EUR / USD

Wednesday, September 18, ended for the EUR / USD pair with a decrease of 40 basis points. Thus, the general conclusions on wave marking remain the same. Wave 3 or C is completed. The first two waves in the new upward trend section or wave 4 are also completed. In any case, I expect the construction of another rising wave 3 or with goals located above the 11th figure.

On the other hand, great expectations of the forex market were associated with the news background on Wednesday. At first, the release of an important report on inflation in the European Union was expected, but the report’s values frankly disappointing.

No, inflation in the EU did not slow down even more, just predicted and real values coincided, which did not give grounds for the markets to somehow “react” to the report. Well, in the evening, the results of the two afternoon Fed meeting were expected, which, if they did not disappoint, did not fully satisfy the market’s expectations.

The Fed lowered its base rate by 25 basis points, and Jerome Powell did not say anything interesting at a press conference. Absolutely “passing” meeting of the Fed. Fundamental component: For the euro-dollar pair, Thursday will be much more boring than Wednesday.

The news background on September 19 will be practically “zero”. Thus, I do not expect major changes and high amplitudes today. The wave pattern still involves the construction of an upward trend section. At a minimum, 100 points up the tool should master. This is exactly what I expect in the coming days, even if the news background remains “zero”.

A successful attempt to break through the minimum of the alleged wave 2 or b will force us to take a different look at the wave pattern, which will require changes and adjustments.

Purchase goals:

1.1128 – 61.8% Fibonacci

1.1175 – 76.4% Fibonacci

Sales goals:

1.0927 – 0.0% Fibonacci

General conclusions and recommendations:

The euro-dollar pair allegedly completed the construction of a bearish wave 3 or C, as well as wave 2 or b as part of a new trend section, which originates on September 12. If this is true, then the pair expects a continued increase in quotations.

I recommend buying a pair with goals near the calculated levels of 1.1128 and 1.1175. Also, I still expect the construction of the third upward wave. A breakthrough of the minimum of September 17 will cancel the execution of this option.

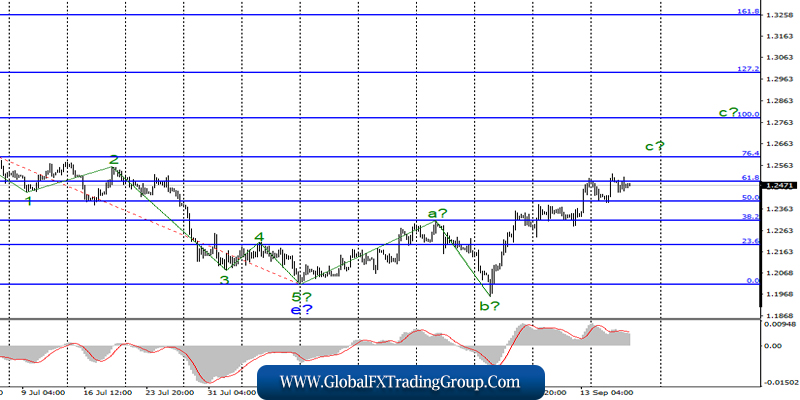

GBP / USD

On September 18, the GBP / USD pair lost 30 basis points but generally continues to build the upward trend section within the framework of the expected wave c .

The consumer price index in the UK in August unexpectedly for many decline to 1.7% y / y, but this report did not cause a wave of sales of the British currency. The markets showed amazing resistance to negativity from Britain, showing that Brexit is now more important, which already resembles a Mexican or Argentine series.

Thus, we can say that the news background for the pound remains moderately positive and wave c has real chances to continue building. However, not everything is so simple, and the prospects for the pound remain fragile and precarious.

Fundamental component:

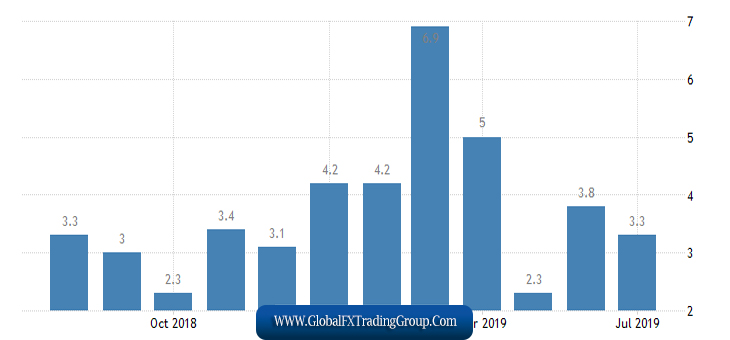

On Thursday, October 19, the GBP / USD pair will pay attention to the economic report on retail sales in the UK in August.

In recent months, retail sales have shown very good dynamics, increasing by 4-5% compared with the values a year earlier. However, in August, a slight decline could occur, and the value may be 2.8% y / y, which is not critical.

The pound-dollar instrument may not even notice this report, just as it did not notice much lower inflation yesterday. Well, you can not ignore the meeting of the Bank of England, The results of which will become known this afternoon.

Although no major changes in the monetary policy of the country, which has been unable to leave the EU for three years, are expected by the markets; nevertheless, the accompanying statement may contain interesting information.

For example, about economic forecasts.

Sales goals:

1.2016 – 0.0% Fibonacci

Purchase goals:

1.2489 – 61.8% Fibonacci

1.2602 – 76.4% Fibonacci

General conclusions and recommendations:

The upward trend section continues its construction. Thus, quotes are now expected to increase with targets located near the estimated levels of 1.2489 and 1.2602, which corresponds to 61.8% and 76.4% Fibonacci. Wave c can still complete its construction in the near future, even today, if the news background contributes to this.

Thus, I recommend buying a pair in case of a successful attempt to break through the 61.8% Fibonacci level, which is not yet available.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom