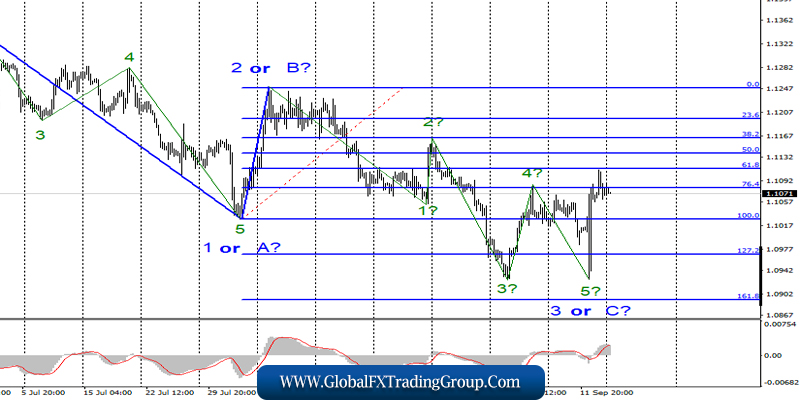

EUR / USD

Friday, September 13, ended for the EUR / USD pair with an increase of 10 base points. Thus, the current wave marking still assumes completion of the construction of the bearish trend section. If this assumption is true, then from current positions, immediately or after building the correctional wave down, the increase in quotations will continue within the framework of a new upward trend section.

Fundamental component: On the EUR / USD instrument, the markets “retreated” from the events of Thursday on Friday. In the morning, euro purchases resumed, but after a few hours, they stopped. All economic reports of the day were planned for the American session, so the dollar added a little in price after lunch.

The report on retail sales for August showed an increase of 0.4%, which is higher than market expectations, and excluding car sales – 0%, which is slightly worse than forecasts. A little later came the consumer confidence index, amounting to 92.0. Since the significance of these reports was not the highest, the US currency received only indirect support.

On Monday, the news calendar is completely empty. Not a single report. Based on this, we can expect the construction of a corrective downward wave today. On Wednesday, the results of the Fed meeting will be announced, which will greatly affect the dynamics of the EUR / USD pair, as markets expect changes in the US monetary policy.

Until Wednesday, there may be a “trick”, as it was last week before the ECB meeting.

Purchase goals:

1.1248 – 0.0% Fibonacci

Sales goals:

1.0893 – 161.8% Fibonacci

1.0807 – 200.0% Fibonacci

General conclusions and recommendations:

The euro/dollar pair supposedly completed the construction of the bearish wave 3 or C. If this is true, then the pair expects the construction of an upward set of waves. I recommend buying a pair with targets located about 12 figures, but so far in small volumes. Now, it is possible to build a correctional wave, so I recommend buying a pair again using the MACD up signal.

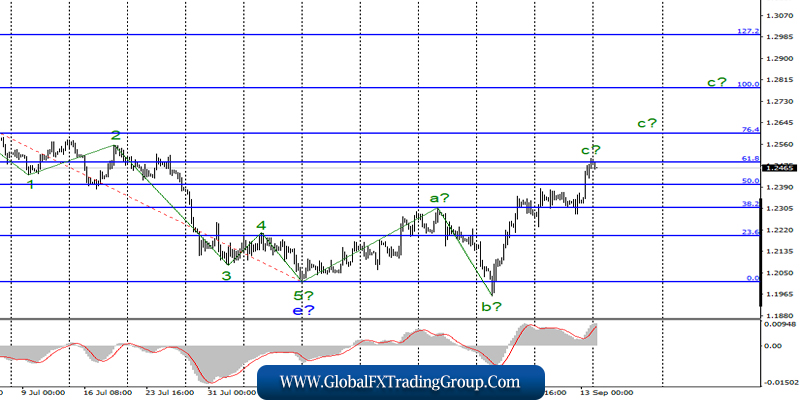

GBP / USD

On September 13, the GBP / USD pair gained 170 base points and, thus, continued to build the alleged wave c as part of the upward trend section. Despite the fact that the news background on Friday and generally in recent days has ceased to be encouraging for the pound, the markets are still buying the British currency.

The latest news suggests that there are no changes in the UK. In the truest sense of the word, the British Parliament remains on forced leave. Boris Johnson, in turn, remains in his opinion regarding the exit from the EU until October 31. The question of the Northern Ireland border and the “Backstop” mechanism also continues to be unresolved.

Brussels and London are far from signing the Brexit agreement. I believe that optimistic markets may soon come to naught. Given the fact that we saw three waves up and this is the minimum wave structure, which can be considered fully completed, then we may well become witnesses of the resumption of the construction of a bearish trend section in the near future. To date, the pound-dollar pair has made an unsuccessful attempt to break through the 61.8% Fibonacci level and may begin to move quotes from the highs reached.

Fundamental component: On Monday, the GBP / USD pair will be inclined to build a correctional wave. The news background will not be available today only if Boris Johnson or the EU representatives with new information on Brexit do not go on the air. The markets, starting from the current day, will more closely monitor the events around Brexit, as the euphoria about its possible transfer has already passed and now it is time to get confirmation of the positive news on which the pound has been growing recently.

However, confirmation may just be a problem, because Boris Johnson is trying to find workarounds and still get out of the EU in the previously scheduled time. And for the pound, the tough Brexit is deadly.

Sales goals:

1.2016 – 0.0% Fibonacci

Purchase goals:

1.2489 – 61.8% Fibonacci

1.2602 – 76.4% Fibonacci

General conclusions and recommendations:

The downward trend section is still considered completed. Thus, now, it is expected to continue the construction of the rising wave with targets located near the calculated levels of 1.2489 and 1.2602, which corresponds to 61.8% and 76.4% of Fibonacci. Wave C may complete its construction in the near future.

Thus, I recommend buying a pair in case of a successful attempt to break through the 61.8% Fibonacci level or after receiving a MACD “up” signal (in this case, you need to look how far the price will go down).

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom