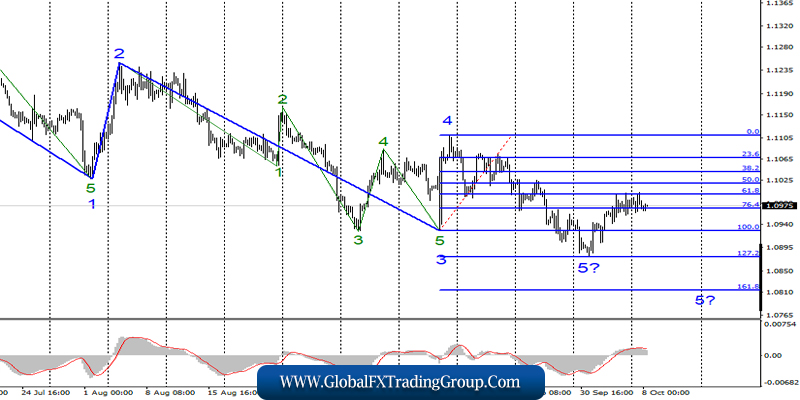

EUR / USD

Monday, October 7, ended for the EUR / USD pair with a decrease of 15 basis points. Thus, the instrument performed the third unsuccessful attempt to break through the 61.8% Fibonacci level.

This factor continues to put pressure on the euro, and the markets may start new sales of the pair in the near future. The news background, which has recently leveled off a bit for the euro-dollar currency pair, still does not provide good reasons for markets to buy large volumes of euros and not close deals in a day.

The current wave marking implies the construction of a new upward trend section, however, an unsuccessful attempt to break through the level of 61.8% associated with a negative news background may lead to the continuation of quotations decline and complexity of the downward trend section.

Fundamental component:

Jerome Powell has frankly disappointed markets lately. Not buyers of the US dollar, but markets, because nothing interesting in his speeches does not tell them. On Friday and Monday, two speeches by Powell took place, from which no conclusions can be drawn.

Markets are most interested in the mood of the Federal Reserve for the third consecutive rate cut since it is the market’s confidence in this that can help the euro break through the 61.8% level, and the instrument can continue to build the rising wave in accordance with the current wave markings.

Meanwhile, Powell is silent as a “partisan in interrogation,” confining himself only to phrases that the markets have heard more than a dozen times. Thus, the probability of a rate cut remains high, but there is no confirmation for it.

Purchase goals:

1.1109 – 0.0% Fibonacci

Sales goals:

1.0876 – 127.2% Fibonacci

1.0814 – 161.8% Fibonacci

General conclusions and recommendations:

The euro-dollar pair has allegedly completed the construction of a downward set of waves. At the same time, until a successful attempt to break through the Fibonacci level of 61.8%, certain chances remain to complicate wave 5 of the downward trend section with targets located around 1.0876 and 1.0814.

Therefore, with instrument purchases, I recommend being careful for now.

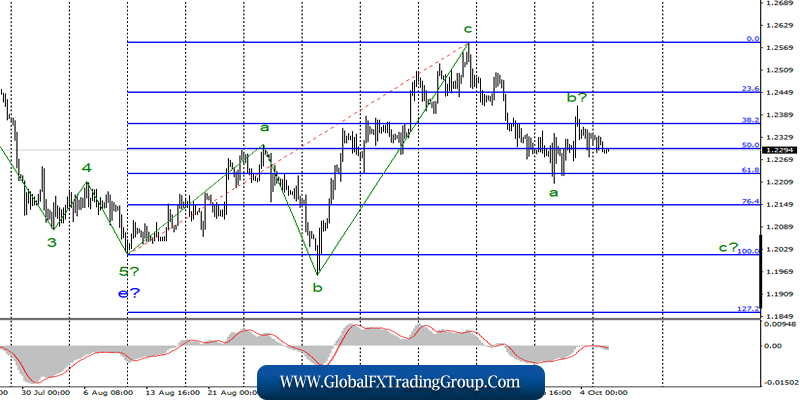

GBP / USD

On October 7, the pair GBP / USD lost 40 basis points and shows its readiness to resume the construction of a downward trend section, namely, wave C. If this assumption is correct, then the decline in quotations will continue with the goals located under the 22nd figure.

Wave b, in turn, currently looks complete. The news background is shifting to the negative side for the currency pair again, and separately for the pound. The European Union and London can’t agree among themselves on the Brexit agreement, and 10 days are left before the EU summit, and 23 days before the next deadline.

This month, we will find out whether there will be a new Brexit date transfer or whether Boris Johnson will somehow remove Great Britain from the EU, despite the Parliament’s ban. In any case, the greater the chance of a tough Brexit, the lower the pound declines.

Fundamental component:

On Tuesday, there will be no economic reports in either America or the UK. However, the third consecutive speech by Fed Chairman Jerome Powell, as well as Mark Carney, will take place.

It is the speech of the Chairman of the Bank of England that I consider the most interesting today. Indeed, on the threshold of a tough Brexit, which can greatly affect the financial and banking systems of the United Kingdom, financial stability will depend on Mark Carney and the members of the monetary committee.

In addition, Carney has already noted that Britain is ready for any shocks in the financial sector, banks are ready for the most negative scenarios, but he cannot guarantee that markets can handle the shocks. Thus, in any case, one needs to be prepared for the crisis scenario, and the Central Bank to uncover the instruments of monetary policy for a possible sharp intervention.

Sales goals:

1.2229 – 61.8% Fibonacci

1.2147 – 76.4% Fibonacci

Purchase goals:

1.2582 – 0.0% Fibonacci

General conclusions and recommendations:

The pound / dollar instrument supposedly continues to build a new bearish trend section. Thus, now, I expect the continuation of the decline of the instrument in the direction of the levels of 61.8% and 76.4% Fibonacci as part of the construction of wave 3 or C.

The MACD signal “down” indicated the transition to the construction of a new bearish wave.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom