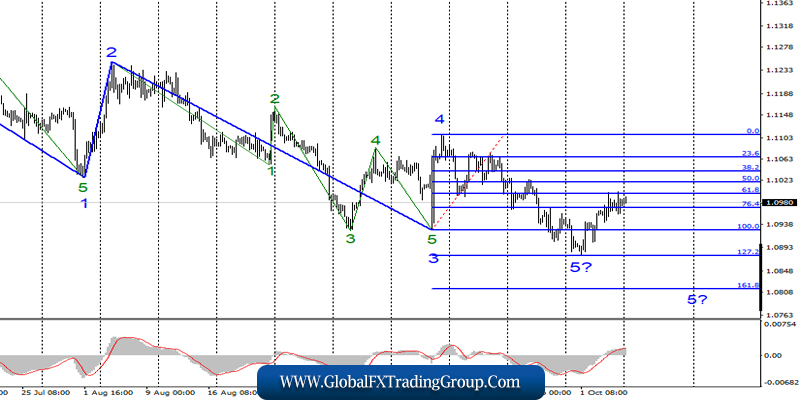

EUR / USD

Friday, October 4, ended for the EUR / USD pair with an increase of 15 basis points. Although, frankly, the markets were set for more serious movements, given the strength of the news background that day.

However, most of the economic reports left conflicting feelings. Nonfarm Payrolls showed the creation of new 136,000 jobs, the unemployment rate declined to 3.5% in September, and the average hourly wage did not increase compared to the previous month.

Market expectations were somewhere better, and somewhere worse. In general, the euro-dollar pair continued to move away from previously reached lows and build the proposed first wave as part of a new upward trend section.

Fundamental component:

The last day ended with a speech by Jerome Powell, which can be characterized exactly as well as previous economic reports. Powell did not report anything new and interesting to the markets.

Therefore, the question of the Fed’s intentions to change monetary policy at the next meeting remains open. Today, October 7, the entire news background of the EUR / USD pair will be reduced again to a speech by Jerome Powell.

The markets are now worried by the following point: if the Fed goes for the third time in a row to lower the key rate, then the buyers of the US dollar will noticeably decrease.

Thus, in this case, the downward part of the trend can actually end near the lows of October 1. I also note that the instrument made two unsuccessful attempts to close above the 61.8% Fibonacci level, which indirectly indicates a possible departure of quotes from the highs reached.

However, the current type of wave marking is more inclined to build at least a three-wave uplift structure.

Purchase goals:

1.1109 – 0.0% Fibonacci

Sales goals:

1.0876 – 127.2% Fibonacci

1.0814 – 161.8% Fibonacci

General conclusions and recommendations:

The euro-dollar pair has allegedly completed the construction of a downward set of waves. At the same time, until a successful attempt to break through the Fibonacci level of 61.8%, certain chances remain to complicate wave 5 of the downward trend section with targets located around 1.0876 and 1.0814.

Therefore, with instrument purchases, I recommend being careful now.

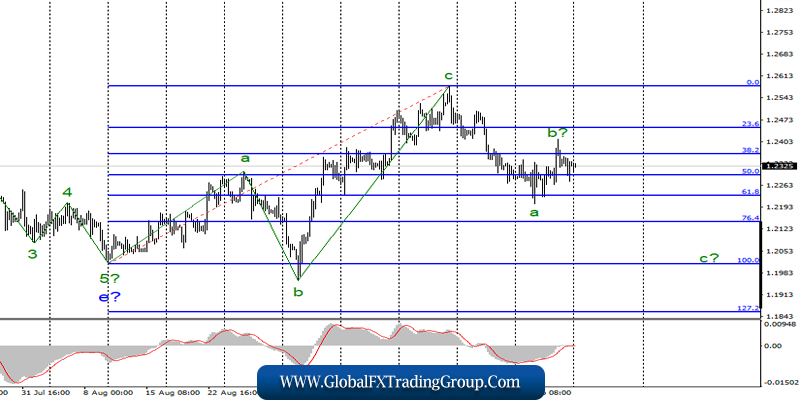

GBP / USD

The pair GBP / USD on October 4 added just a few base points. Thus, such a weak change in course leaves the current wave marking unchanged. As before, I assume the completion of the construction of wave b as part of a descending set of waves, originating on September 20.

If this is true, then the decline of the instrument will continue from its current position with targets under 22 pieces. Moreover, news background from the UK still does not support the British pound. The confusion with Brexit remains. Information on this topic is constantly conflicting.

In addition, economic reports from the UK leave much to be desired and also do not cause markets to want to buy the pound.

Fundamental component:

There were no economic reports in the UK on Friday. On Monday, the markets will remain on a “dry ration” again, only an evening performance by Jerome Powell will be able to wake the market. This week, the markets will closely monitor any information from the British Parliament again.

According to the latest data, Boris Johnson made a new proposal to the EU under the terms of the Brexit agreement. There is little hope that this proposal will convince the European Parliament to sign an agreement.

However, the British pound and the UK are now counting on any chance. By the way, the European Union has already expressed skepticism regarding Boris Johnson’s previous proposal, as his plan does not solve, in the EU’s opinion, the main problems in connection with which the deal has not yet been signed.

Sales goals:

1.2229 – 61.8% Fibonacci

1.2147 – 76.4% Fibonacci

Purchase goals:

1.2582 – 0.0% Fibonacci

General conclusions and recommendations:

The pound / dollar instrument supposedly continues to build a new bearish trend section. Thus, now, I expect the completion of the construction of the correctional wave b and the resumption of the decline of the instrument in the direction of the levels of 61.8% and 76.4% Fibonacci as part of the construction of wave 3 or c.

The MACD signal “down” may indicate a transition to the construction of a new bearish wave.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom