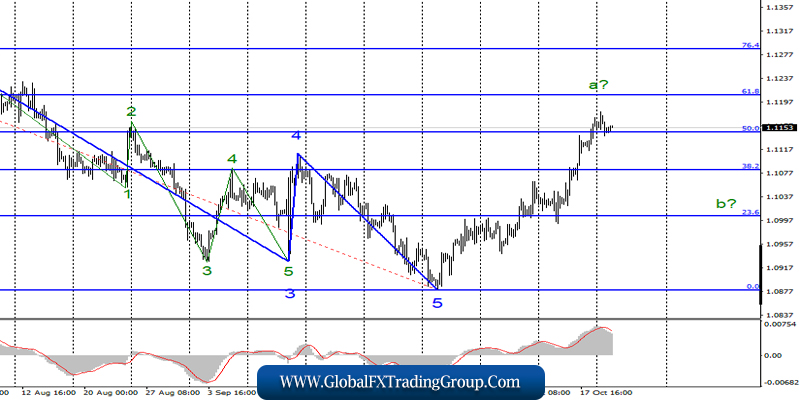

EUR / USD

Monday, October 21, ended for the pair EUR / USD with a decrease of 40 basis points. There are new reasons to assume the completion of the construction of the alleged first wave as part of a new upward trend section.

If this assumption is true, then the instrument will begin to decline from current positions with targets located near the 23.6% Fibonacci level.

Fundamental component:

The news background for the EUR / USD pair remains weak and ambiguous. On the one hand, the latest Brexit news was supported along with the pound and the euro, but on the other hand, Brexit is more important for the UK, and not for the EU.

Thus, an increase in the Euro currency can be regarded as a reaction of the currency market to a whole set of factors, including Brexit, a double reduction of the Fed’s key rate, and worsening economic statistics in America.

However, this Thursday, the news background may put pressure on the currency of the European Union, as it is difficult to expect actions from the ECB in the current environment aimed at tightening monetary policy. Thus, this moment can coincide with the construction of the correctional wave b.

Until Thursday, the market may be completely calm, as the economic calendar news calendar is completely devoid of.

Purchase goals:

1.1208 – 61.8% Fibonacci

1.1286 – 76.4% Fibonacci

Sales goals:

1.0879 – 0.0% Fibonacci

General conclusions and recommendations:

The euro-dollar pair continues to build a new upward set of waves and is supposedly ready to complete wave a, despite a successful attempt to break through the 50.0% Fibonacci level. The breakdown of the level of 50.0% in the opposite direction will indicate the readiness of the instrument to build the wave b.

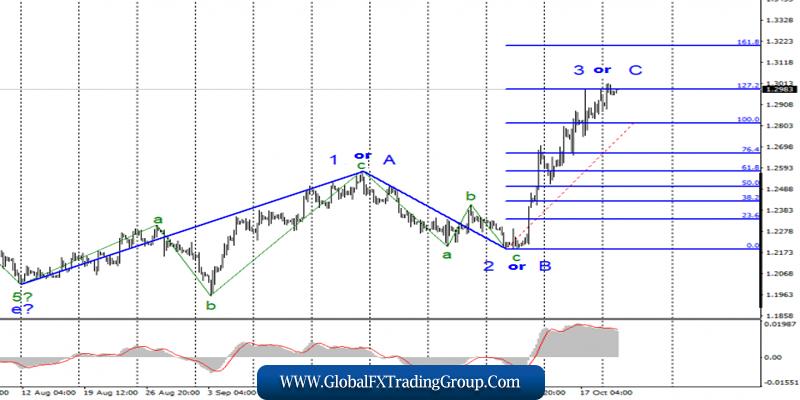

GBP / USD

On October 21, the GBP / USD pair gained several basis points, which keeps the current wave marking intact. The proposed wave 3 or C continues its construction, but also has a high chance of completion near the level of 127.2% Fibonacci.

At the same time, the news background continues to force the markets to buy exactly the pound, although it would be hard to believe a few months ago. It is the news background that can continue to have a beneficial effect not on the pound-dollar instrument.

A successful attempt to break through the level of 127.2% will lead to a new increase in the pair with targets near the Fibonacci level of 161.8%.

Fundamental component:

The news background for the pound-dollar pair continues to remain favorable, since the prospect of a tough Brexit looming on the horizon for a long time is slowly disappearing.

Yesterday, the British Parliament inflicted another defeat on Boris Johnson, without even considering considering his option of an agreement with the European Union.

According to the Speaker of the House of Commons, Bercow, the deputies “already said everything on Saturday,” so it makes no sense to hold a second vote, essentially on the same issue.

Thus, it turns out that the markets will now wait for Brussels to respond to Boris Johnson’s request to postpone Brexit to January 2020. Most likely, the EU will approve the request, and it’s even hard to imagine what will happen next.

There may be re-elections to Parliament, if the deputies themselves agree with this proposal of Johnson, a second referendum is also possible as well as a vote of no confidence in Johnson. There are a lot of options.

For the pound, only one point matters – the further Brexit without a deal, the more British currency is in demand.

Sales goals:

1.2191 – 0.0% Fibonacci

Purchase goals:

1.2986 – 127.2% Fibonacci

1.3202 – 161.8% Fibonacci

General conclusions and recommendations:

The pound / dollar instrument continues to build an upward trend. However, an unsuccessful attempt to break the level of 1.2986 indicates that the instrument is ready to decline. Since the news background is now at its most importance, the continuation or completion of the construction of wave 3 or B will depend on it.

On the contrary, a breakdown of the level of 1.2986 can be regarded as a signal to buy.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom