EUR / USD

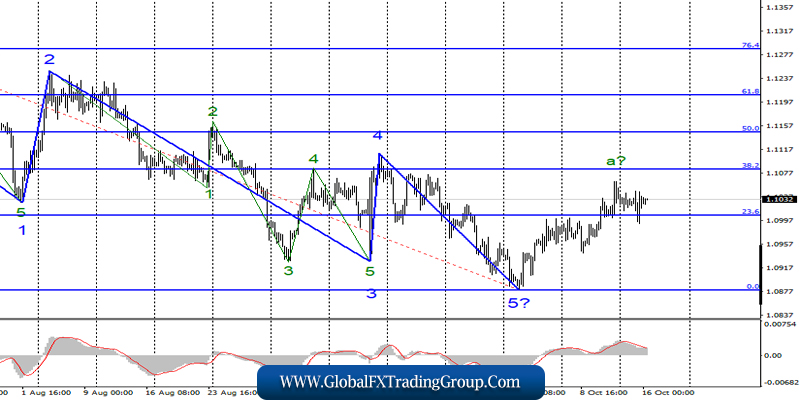

Tuesday, October 15, ended for the EUR / USD pair with an increase of 5 basis points. Thus, the current wave marking has not changed again and, as before, it involves the construction of an upward set of waves.

Now, it’s even difficult to say whether the construction of the correctional wave b has begun, since the departure of the quotes from the reached highs is insignificant. At the same time, an unsuccessful attempt to break through the 23.6% level suggests that the markets are ready to continue raising the instrument.

Fundamental component:

The fundamental background for the EUR / USD pair remains weak and practically does not play a role. On Tuesday, the index of sentiment in the business environment in the European Union came from the ZEW Institute was released, to which few people paid their attention to.

Similar indices were released in Germany, which also did not attract the attention of the markets. Today, the situation will be a little better. On Wednesday, a very important report on inflation in the European Union will be released. If we omit the fact that inflation continues to slow down in the EU, the future actions of the ECB largely depend on the inflation rate. Thus, a new decrease in the consumer price index will mean an increase in the chances of another reduction in the ECB rate.

And in itself, this phenomenon cannot be called positive for the European currency. With this inflation rate, markets may start selling euros again. A value of at least 0.9% yoy could help the euro-dollar pair hold slightly above the 23.6% Fibonacci level.

Purchase goals:

1.1083 – 38.2% Fibonacci

1.1145 – 50.0% Fibonacci

Sales goals:

1.0879 – 0.0% Fibonacci

General conclusions and recommendations:

The euro-dollar pair is supposedly continuing to build a new upward set of waves. At the same time, the news background can “turn” the instrument down at any moment, but I still expect a moderate increase in quotes with targets located near the levels of 1.1083 and 1.1145.

An unsuccessful attempt to break the level of 1.1083 may lead to a departure of quotes from the reached highs and the construction of wave b.

GBP / USD

On October 15, the GBP / USD pair gained 180 more base points and, thus, continued to build the proposed wave 3 or C of a new upward trend section. An unsuccessful attempt to break the level of 100.0% Fibonacci can not only lead to the departure of quotations from the highs, but also to complete the construction of the whole of the third wave, which is already equal to 100.0% of wave size A.

On the other hand, a successful attempt to break the 100.0% level will indicate the readiness of the currency market to new increase on the pound-dollar instrument.

Fundamental component:

The currency market continues to look with hope for the upcoming EU summit on Brexit. Otherwise, it is impossible to explain the increase in the pound by more than 600 basis points in 4 days. The markets are gradually receiving information that the British Prime Minister, Boris Johnson, continues to negotiate with Michel Barnier and the main EU politicians, and there is progress in the negotiations.

Some politicians and experts, in turn, even argue that a deal is possible at the EU summit. It’s hard for me to judge how true this information is, since no details are coming to the market.

And if there are no details, then there is no reason for blind faith in the data on the progress in the negotiations. Everything will be decided tomorrow or the day after tomorrow.

Guessing how it all ends does not make sense since Brexit has already been postponed several times when everyone was waiting for Parliament to approve the deal. This time may not be an exception, especially if one takes into account the negative and openly hostile attitude of the British deputies towards the figure of Boris Johnson.

Today, I also draw attention to the report on inflation in the UK. Although in recent years, economic reports have not influenced the pair too much. Thus, one should not miss the output of the indicator, which is very important for the economy of any country.

Sales goals:

1.2191 – 0.0% Fibonacci

Purchase goals:

1.2817 – 100.0% Fibonacci

1.2986 – 127.2% Fibonacci

General conclusions and recommendations:

The pound / dollar instrument continues to build an upward trend. Thus, I can recommend new purchases of the instrument in case of a successful attempt to break through the Fibonacci level of 100.0%, which is almost reached.

However, I think the current levels are very high for the pound, and if Brexit does not end in favor of the UK this week, then there is a high probability of building a new downward trend.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom