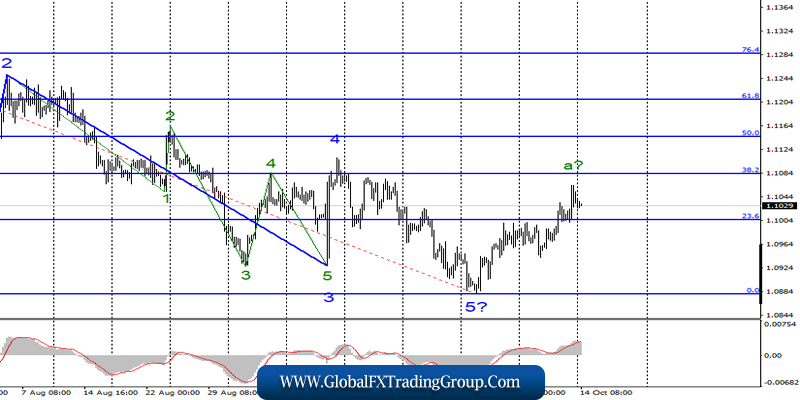

EUR / USD

Friday, October 11, ended for the EUR / USD pair with an increase of 30 basis points. Thus, the downward trend section is still considered completed.

Moreover, the instrument is supposedly located within the framework of building the first wave as part of a new upward trend section. If this assumption is correct, then the increase in quotations will continue within the framework of the expected wave a with targets located near the level of 38.2% Fibonacci.

Fundamental component:

The fundamental background for the EUR / USD pair remains rather uncertain now.

On the one hand, there are no positive economic reports from the Eurozone, on the other hand, not everything is good right now in America, starting from the Congress investigation into Trump’s activities, which could lead to impeachment or, at least, cast a shadow over the US president, who doesn’t allow himself to win the race against Joe Biden in 2020, ending with a trade war with China, which, although slowly moving towards the signing of a trade agreement, is still very far from this moment.

On Monday, the European Union will release a report on industrial production and markets expect to see a figure of -2.5% y / y, which will indicate a serious decline in the industry. Although, given the weakest indicators of business activity in the manufacturing sector of the Eurozone, such a reduction in industrial production is not surprising. Thus, today, the wave a can complete its construction.

Purchase goals:

1.1083 – 38.2% Fibonacci

1.1145 – 50.0% Fibonacci

Sales goals:

1.0879 – 0.0% Fibonacci

General conclusions and recommendations:

The euro-dollar pair is supposedly continuing to build a new upward set of waves. At the same time, the news background can “turn” the instrument down at any time, but for now, I still expect a moderate increase in quotes with targets located near the levels of 1.1083 and 1.1145.

An unsuccessful attempt to break the level of 1.1083 may lead to a departure of quotes from the reached highs and the construction of wave b.

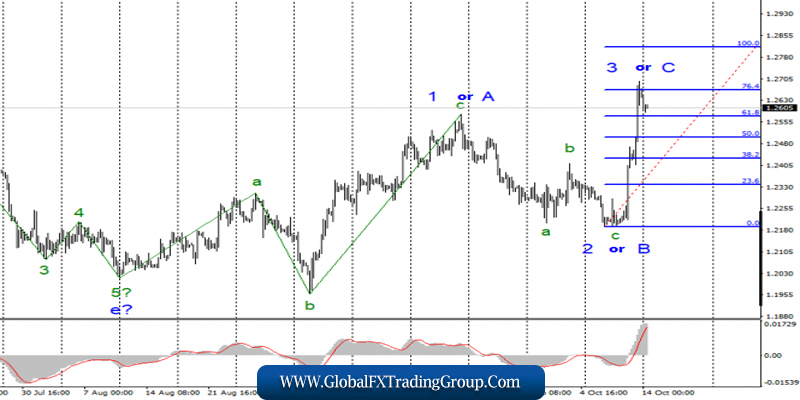

GBP / USD

On October 11, the GBP / USD pair gained another 205 basis points, thus, transforming the existing wave markings. At the moment, the wave pattern involves the construction of a 3-wave plot of the trend, which can already be completed, given the too fast growth of the pound over the past two days.

Thus, the proposed wave C will either get too long or shortened. A lot in this matter will depend on the news background, as there will be plenty of events this week that will affect the dynamics and direction of the pound-dollar instrument.

Fundamental component:

While the pound has beaten volatility records, markets continue to think about how the EU summit will end this week. At the end of last week, against the background of information that seems to increase the likelihood of a deal between London and Brussels, the British currency has grown very much.

Now, the progress issued to it must be confirmed. Boris Johnson will have to confirm them, since he is the main distributor of information about the positive outcome of negotiations between the EU and Britain. This week, either something that, perhaps, no one has long believed in, will be confirmed.

The parties will come to an agreement, or something will happen, the probability of which is 90%, is Brexit’s next transfer. By the way, even if Johnson makes an agreement with the European Union, it’s necessary that the UK Parliament approves the deal later, and we all know how much the British deputies are picky and like to reject the proposals of the Prime Ministers.

If the deal fails, and Brexit is rescheduled, such a news background will be favorable for the US currency and the construction of a new bearish section of the trend. Hard Brexit – also opens the way for the instrument to go down.

Sales goals:

1.2191 – 0.0% Fibonacci

Purchase goals:

1.2666 – 76.4% Fibonacci

1.2817 – 100.0% Fibonacci

General conclusions and recommendations:

The pound / dollar instrument has transformed the wave markings. Thus, now, I can recommend new purchases of the instrument in case of a successful attempt to break through the 76.4% Fibonacci level, which will indicate the readiness of the markets for a new pound increase.

However, I also indicate that the current levels are very high for the pound, and if Brexit does not decide in favor of the UK this week, then there is a high probability of building a new downward trend. Accordingly, current levels look very attractive for sales.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom