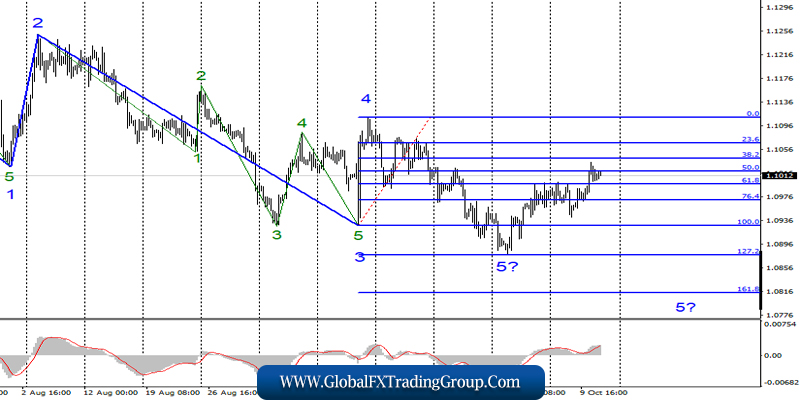

EUR / USD

Thursday, October 10, ended for the EUR / USD pair with an increase of 40 basis points. Thus, the instrument made a successful attempt to break through the level of 61.8% and indicated its desire to continue to increase.

The chances that the downward section of the trend is really completed are growing, and the doubt remains only because of the news background, which is still not in favor of the European currency. However, the current wave marking involves the construction of precisely an ascending set of waves, at least correctional.

Fundamental component:

Yesterday, the report on inflation in America was the only interesting for the EUR / USD pair. The markets expected the consumer price index to rise slightly, to 1.8% yoy, but in reality, inflation remained unchanged at the end of September – 1.7% yoy.

Thus, the US dollar did not receive support from the news background. Moreover, the worse economic reports in America come out, the more chances there are for a new cut in the Fed’s key rate at the end of the month, although many players have no doubt about this.

Today, we can also find out about the plans of Mario Draghi for the next meeting, which will be the last for him at the head of the European Central Bank.

Thus, markets do not expect encouraging information from the president of the ECB, so, at best, his rhetoric will not trigger new sales of the euro. Any hints of a possible new reduction in the deposit or credit rate can lead to a complication of the downward trend.

Purchase goals:

1.1109 – 0.0% Fibonacci

Sales goals:

1.0876 – 127.2% Fibonacci

1.0814 – 161.8% Fibonacci

General conclusions and recommendations:

The euro-dollar pair is supposedly continuing to build a rising set of waves. At the same time, the news background retains certain chances for the complication of wave 5 of the downward trend section with targets located around the levels of 1.0876 and 1.0814.

Therefore, with instrument purchases, I recommend that you should be careful for now.

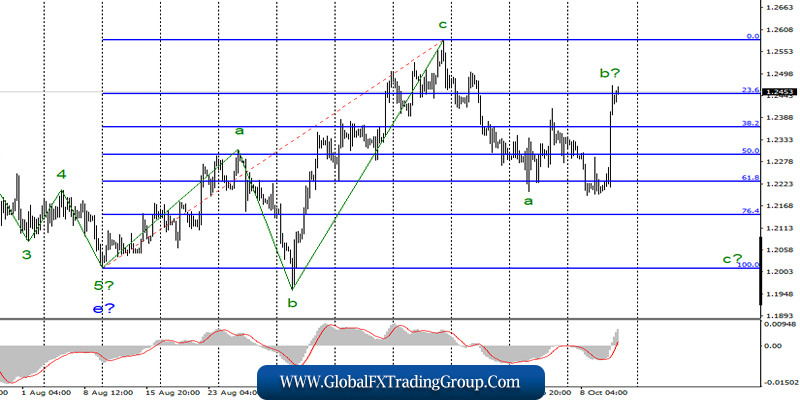

GBP / USD

On October 10, the GBP / USD pair gained as many as 235 base points. Thus, greatly complicating the estimated wave b as part of the downward correction set of waves. If the current wave count is correct, the price decline will resume in the framework of the construction of a future wave today with the goals placed under 22 the figure.

At the same time, such a strong increase in the pound-dollar pair may lead to a change in sentiment in the foreign exchange market to an upward one. An unsuccessful attempt to break through the 23.6% Fibonacci level could mark the resumption of quotes decline.

Fundamental component:

Yesterday, the news background for the pound-dollar pair was reduced to reports on GDP and industrial production in the UK, as well as the US consumer price index. Both GDP and production showed negative dynamics, being significantly worse than market expectations.

However, inflation in the US did not add a positive sentiment to the markets. In general, we can say that the pound simply ignored all these three important reports, but more than worked out the information that Boris Johnson and Irish Prime Minister Leo Varadkar made progress in negotiations on the border between Ireland and Northern Ireland.

It is not known exactly which agreements are in question, since both parties chose not to reveal their cards. However, Varadkar said that the latest proposal by the British Prime Minister could become the basis for a future agreement on Brexit.

What the EU thinks about it, also unknown. More precisely, according to the latest information, the European Union is just skeptical, and Angela Merkel completely openly rejected Johnson’s proposal. However, the pound, as is often the case in recent years, reacted to frank rumors.

The markets “thought up” the information received and concluded that a deal is still possible until October 19, although there is only one week left.

Sales goals:

1.2147 – 76.4% Fibonacci

1.2013 – 100.0% Fibonacci

Purchase goals:

1.2582 – 0.0% Fibonacci

General conclusions and recommendations:

The pound / dollar instrument supposedly continues to build a new bearish trend section, despite a strong increase on the eve. Thus, now, I expect the decline of the instrument to resume in the direction of the levels 1.2147 and 1.2013, which corresponds to 76.4% and 100.0%

Fibonacci as part of the construction of wave 3 or c by the MACD signal “down”.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom