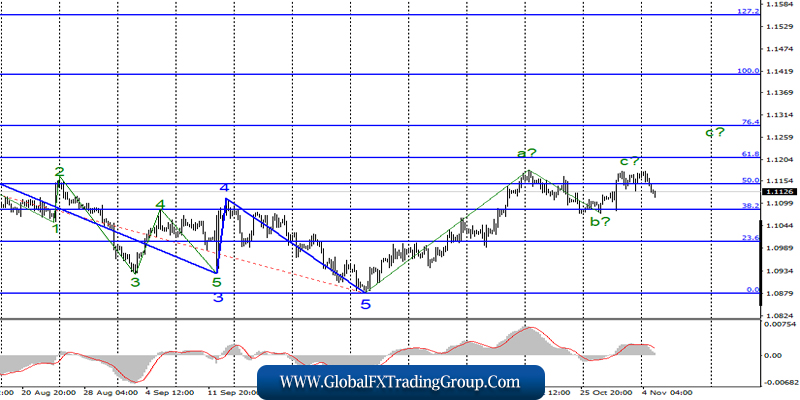

EUR / USD

November 4 ended for the pair EUR / USD with a decrease of 45 basis points. Such a large decrease in the instrument (compared to wavelength c) can be interpreted as an attempt to complete the construction of an ascending set of waves.

If the quotes of the pair go beyond the minimum of the expected wave b, then the three-wave upward trend section can officially be considered completed. On the other hand, the attempt to break the maximum of wave a was unsuccessful, and the markets failed to bring the pair even to the nearest level of 61.8% Fibonacci.

Fundamental component:

The news background on Monday was medium in strength. On the one hand, several economic reports were published immediately concerning business activity in the EU countries. On the other hand, no major changes in these indicators have occurred.

The situation with business activity in the manufacturing sector of the Eurozone remains very deplorable, although judging by yesterday’s reports, there are even some signs of improvement. In the evening, Christine Lagarde spoke, but her speech was more welcoming and ceremonial.

At least monetary policy issues were not addressed. Everything was done with general phrases calling on the European Union to show courage and overcome the economic crisis in which the Alliance has found itself in recent months. What actions is Christine Lagarde herself ready to take to facilitate the EU’s struggle with the crisis, was yet to be announced.

Today is the second day of business activity indexes for markets. On Tuesday, they will enter the US services sector, and experts do not expect any deterioration in this area of the economy.

Purchase goals:

1.1208 – 61.8% Fibonacci

1.1286 – 76.4% Fibonacci

Sales goals:

1.0879 – 0.0% Fibonacci

General conclusions and recommendations:

The euro-dollar pair continues to build a new upward wave set, but wave c could be completed yesterday. I do not recommend buying an instrument now, as an attempt to break through the maximum of wave a turned out to be unsuccessful.

But I recommend selling the instrument in case of a successful attempt to break through the minimum of wave b, which almost coincides with the 38.2% Fibonacci level.

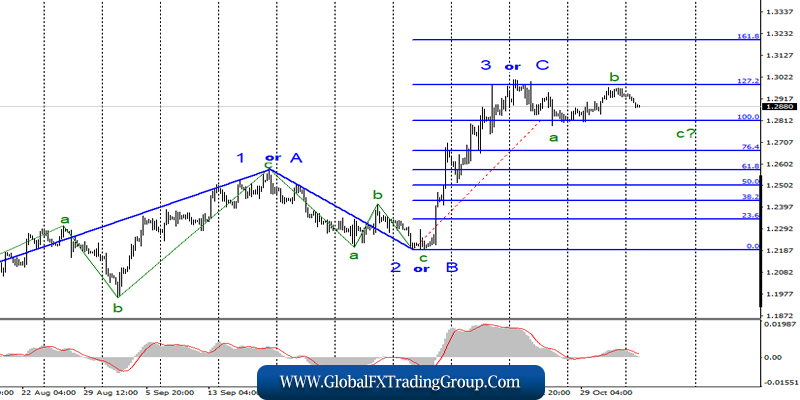

GBP / USD

On November 4, the GBP / USD pair lost 50 basis points, thus confirming the intention to proceed with the construction of a bearish wave, which in the current wave counting is interpreted as wave C. If this assumption is correct, then the decline in quotations will continue to a minimum to the level of 100.0% Fibonacci.

A successful attempt to break through the 100.0% level will indicate the willingness of the markets to further reduce the pound. The assumed wave 3 or C is considered complete, and with it, possibly, the entire upward trend section. However, everything will depend on the news background.

Fundamental component:

The news background on Monday remained neutral. Business activity in the UK construction sector did not surprise the markets at all, staying near the minimum values of 44.2. Thus, a decline is observed both in the field of industry and in the construction sector, and today, the service sector may also be there.

With such a news background, the pound can calmly continue to decline. Given the ongoing confusion with Brexit, which is now moving into a new phase – the phase of parliamentary elections – it will be difficult for the British currency to expect an increase in the coming days.

Perhaps, the pound will be lucky, and business activity in America will also subside, but hopes for this are not very great. By the way, this week will be a debriefing of the meeting of the Bank of England. Rumors that the regulator is preparing to lower the key rate, go for a long time.

Maybe not at this time, but it will happen at the next meeting. So far, the distribution of votes among the members of the Board of the Bank of England has remained unchanged – all 9 economists are in favor of maintaining the rate unchanged. But worsening economic reports cannot be left without attention of the Central Bank for a long time.

Sales goals:

1.2191 – 0.0% Fibonacci

Purchase goals:

1.2986 – 127.2% Fibonacci

1.3202 – 161.8% Fibonacci

General conclusions and recommendations:

The pound / dollar instrument supposedly completed the construction of the upward trend section. Thus, only a successful attempt to break through the level of 1.2986 can be regarded as a complication of the alleged wave 3 or C and become the basis for new purchases of the instrument.

I recommend looking in the direction of sales after a successful attempt to break through the level of 1.2812 (100.0% Fibonacci).

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom