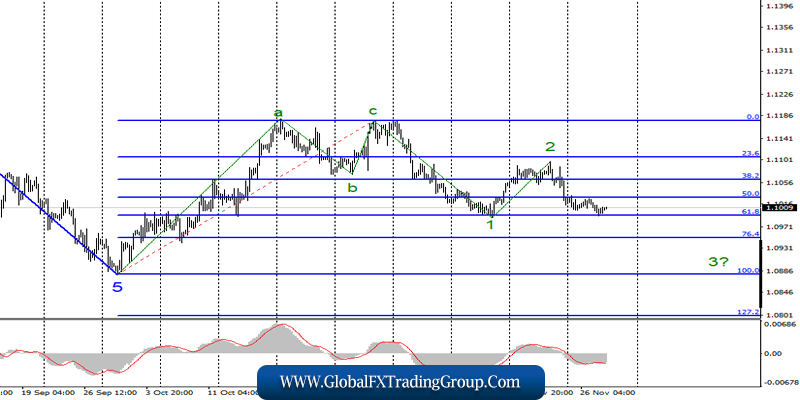

EUR / USD

November 27 ended for the EUR/USD pair with a decrease of 25 basis points and an unsuccessful attempt to break through the Fibonacci level of 61.8%.

Thus, the instrument can now begin to move quotes away from the lows reached, however, the current wave marking still involves the construction of a bearish section of the trend and its wave 3 with targets located below the 10th figure, that is, below the minimum of the expected wave 1.

Thus, a successful attempt to break through the minimum of wave 1 will indicate the readiness of the instrument for further decline.

Fundamental component:

On Wednesday, the news background for the euro-dollar instrument was quite noticeable. In America, several important economic reports were published at once, among which stand out are the orders for durable goods and GDP for the third quarter in a preliminary estimate.

Both reports showed positive dynamics and exceeded market expectations. Now, US GDP in the third quarter is expected to be at least 2.1% y / y, while durable goods orders are up 0.6%. The Chicago PMI index also increased compared to the previous month to 46.3 points.

The level of expenditures of the US population increased by 0.3% while the level of income in October did not change. However, it is clear that US figures could not disappoint sellers of the euro-dollar pair even without the latest report.

From the European Union, no statistical information came on this day. At the same time, there are no data on negotiations between the PRC and the United States in the framework of the trade transaction.

President Donald Trump only continues to regularly and daily remind markets that the parties are at the “finish line” of negotiations and will soon sign an agreement. However, this does not prevent him from signing anti-Chinese laws and interfering in the internal affairs of China. We are talking about the law on human rights in Hong Kong, which Trump signed the day before.

Thus, it is completely possible that Trump will have to impose new duties on imports from China in the near future if Beijing “responds” to the law signed by Trump.

General conclusions and recommendations:

The euro-dollar pair is supposedly continuing to build wave 3. Thus, I now recommend to remain in the sales of the instrument with targets located near the calculated levels of 1.0993 and 1.0951, which is equal to 61.8% and 76.4 for Fibonacci. An unsuccessful attempt to break through the 61.8% Fibonacci level may lead to quotes moving away from the lows reached, but without building an upward wave.

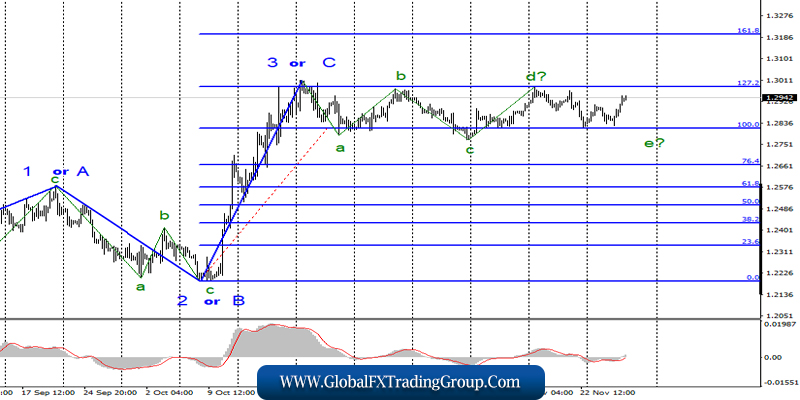

GBP / USD

On November 27, the GBP/USD pair gained about 45 basis points and questioned the further construction of the wave e. An unsuccessful attempt to break through the 100.0% level led to the withdrawal of quotations of the instrument from the lows reached.

But in the case of a successful attempt to break through the 127.2% Fibonacci level, the wave marking will undergo certain changes and will suggest the construction of a new impulse upward wave, possibly 5. However, before breaking through the level of 127.2%, I still do not recommend relying on an increase in the pound.

Fundamental component:

On Wednesday, the news background for the GBP / USD instrument was exactly the same as for the GBP / USD instrument. But if the euro was at least slightly reduced, which corresponds to the economic data released yesterday, then the pound could began to rise, which completely does not correspond to either the news background or the wave markup.

At the same time, markets continue to discuss elections in the UK simply because there is nothing more to discuss. Economic statistics are now completely not interested in the currency exchange market, so only one thing remains.

To calculate the probability of a conservative victory in the elections and, based on this, try to form positions on the instrument. I believe that it makes no sense to try to guess the election results, but, given the fact that the instrument cannot make a breakthrough of either the 100.0% Fibonacci level or 127.2%, I’m not waiting for the construction of a new trend section yet. Trading in the “sideways” is a rather complicated and unrecognized task.

General conclusions and recommendations:

The pound / dollar instrument continues to build a horizontal trend section. Thus, now, I still expect the pair quotes to decline to around 1.2770 after the MACD signal “down”, after which the wave pattern may require adjustments and additions.

It is recommended to buy a pair, not earlier than a successful attempt to break through the 127.2% Fibonacci level, which will indicate the willingness of the markets to build a new impulsive rising wave.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom