EUR / USD

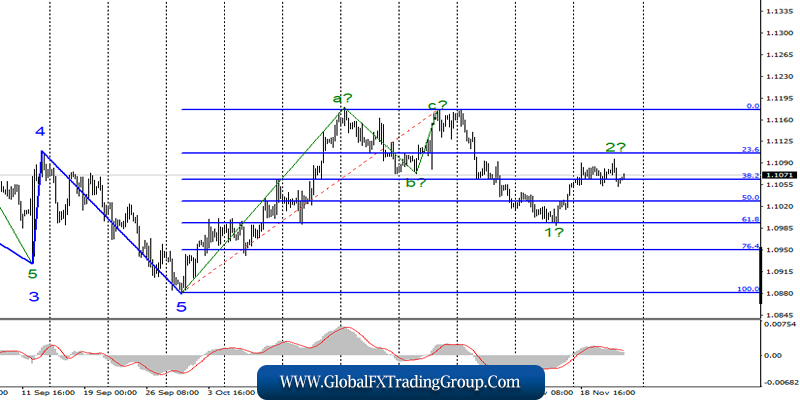

November 21, ended for the EUR/USD pair with the loss of 15 basis points. Thus, the alleged wave 2 still shows signs of its completion, and the readiness of the instrument for a new decline, within the framework of wave 3. If the current wave counting is correct, then the decline in quotes will resume today with targets located below the 10th figure.

The only question is whether the news background will help the execution of developing this version. This week, no economic reports have been released either in America or in the European Union. Today, the market will witness a fairly large package of economic data.

Fundamental component:

On Thursday, the news background for the euro-dollar instrument was reduced only to the minutes from the last ECB meeting, which caused even less attention and interest than the Fed’s minutes the day before.

According to the European Central Bank, low interest rates will support the economy of the European Union, however, it will take more time to fully appreciate the effect of lowering the deposit rate by 0.1% and launching a new phase of the QE program.

Moreover, the ECB also warns in its release that due to the excessive “cheapness” of money, many investment entities have begun to bet on riskier assets. As a result, investment and pension funds, as well as insurance companies, assume undue risks.

An economic downward turn can force investors to turn down excessively risky assets, which will trigger a crash in the stock market and intensify the economic downward turn. Now, what remains is finding out what opinion the ECB’s chairman Christine Lagarde holds, who will speak in Frankfurt in Germany in a few hours.

Any “dovish” notes in her speech can “help” the euro-dollar instrument to continue building the bearish part of the trend, as the demand for the euro can decrease. Also, today, data on business activity in the areas of production and services will be released in the European Union and America.

Judging by the expectations of the market, a strong increase in business activity in the EU should not be expected, while in America, indicators will remain in the “safe zone” – above 50.0. General conclusions and recommendations: The euro-dollar pair allegedly completed the construction of the proposed wave 2.

Thus, I now recommend selling the instrument with targets located near the calculated levels of 1.0993 and 1.0951, which equates to 61.8% and 76.4 Fibonacci. Meanwhile, the signal of the MACD indicator “down” indicated the readiness of the markets for the sale of the instrument. Thus, a protective order can be placed above the 23.6% Fibonacci level.

GBP / USD

On November 21, the GBP/USD pair lost about 15 basis points. Thus, an unsuccessful attempt to break through the Fibonacci level of 127.2% indicates the completion of the construction of the alleged wave d and the transition of the pound-dollar instrument to the construction of the bearish wave e.

If this is true, then the decline in quotations will continue from current positions with targets located near the low of the wave from (1.2770), or slightly lower. On the other hand, a successful attempt to break the level of 1.2987 will indicate that the market is ready to complicate the upward trend of the trend, which currently looks complete.

Fundamental component:

On Thursday, the news background for the GBP/USD instrument was completely absent again. There are still occasional reports from a party about the course of the election campaign, but they do not contain any important information on the merits.

Therefore, pound sterling continues to remain within the horizontal section of the trend. Today, quite important business activity indices in the services and production sectors will come out in the UK with forecasts of 50.0 and 49.0, which will be seasoned several hours later with the same indices for America.

This is all that markets can turn their attention to today. Are they ready to react to economic reports again? As we can recall last week, markets missed much more important and serious information on British GDP, inflation and wages.

Regarding today’s reports, one thing is certain, if British business activity in the manufacturing sector slows down compared to October 49.6, then the demand for the pound may decline. However, if business activity in America does not go below 50.0, then demand for the dollar may increase. General conclusions and recommendations:

The pound / dollar instrument supposedly completed the construction of the upward trend section. Thus, only a successful attempt to break through the level of 1.2986 can complicate this part of the trend and become the basis for new purchases of the instrument with targets located near the calculated level of 1.3199, which equates to 161.8% Fibonacci. The working option provides a decline to the level of 1.2770.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom