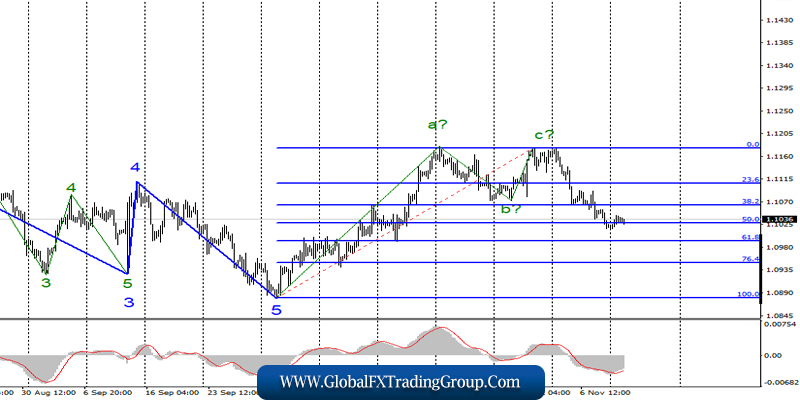

EUR / USD

November 11 ended for the pair EUR / USD with an increase of 10 basis points. However, the increase clearly did not have any effect on the current wave marking. Thus, the construction of the proposed wave c can continue with targets located near the levels of 61.8% and 76.4% Fibonacci.

A successful attempt to break through the level of 50.0% will bring the instrument closer to the execution of this working variant.

Fundamental component:

There was no news background for the euro-dollar instrument on Monday. There were also no interesting events in Europe and America, which explains the low market activity. Today, the news background will remain the same, and thus, one should not expect high activity on the currency exchange market today.

Such days should simply be waited, since working in the 20 or 30 point range is extremely difficult and inconvenient. Moreover, most of the attention of the currency market is shifted to the pound-dollar pair now, and more specifically to the UK, where there are important economic reports and enough news from the political sphere.

Well, the euro-dollar instrument will wait for “its” news, which will also be present this week, but will begin to arrive on the market a little later.

Purchase goals:

1.1175 – 0.0% Fibonacci

Sales goals:

1.0993 – 61.8% Fibonacci

1.0951 – 76.4% Fibonacci

General conclusions and recommendations:

The euro-dollar pair allegedly completed the construction of the upward trend correction section. Since the attempt to break through the minimum of wave b turned out to be successful.

Thus, now, I recommend selling the instrument with targets located near the calculated levels of 1.0993 and 1.0951, which equates to 61.8% and 76.4 Fibonacci.

A new successful attempt to break through the level of 50.0% or a MACD signal down will just give the green light for new sales of the instrument.

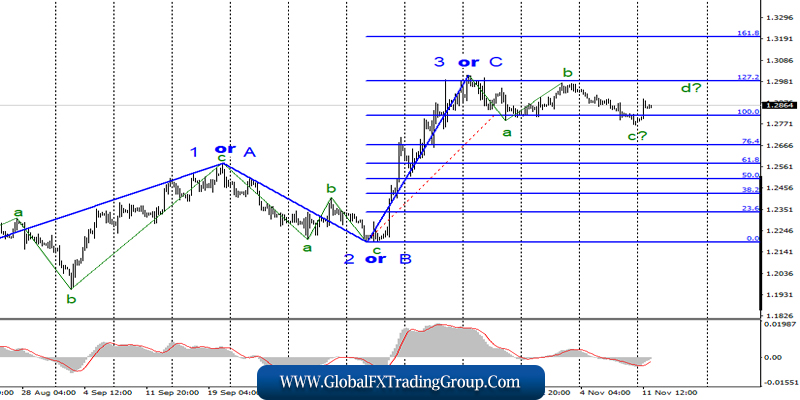

GBP / USD

On November 11, the GBP / USD pair gained about 60 basis points, and the current wave pattern is starting to get a little complicated and confused. This is due to the fact that the trend section, after October 21, turns out to be somehow long and drawn out, which does not fit well with the possible option with the complication of the upward trend section and the construction of wave 5 .

Most likely, the pair will now begin to build a horizontal five-wave segment of the trend, and we will see waves d and e. If this is true, then we should now expect an increase in the instrument to the area of 127.2% Fibonacci, and then decline to the level of 100.0% Fibonacci again.

Fundamental component:

Yesterday’s economic reports from the UK were such that today we would have to see the pound-dollar instrument at about 27 figures or lower. However, instead of selling the pound, the market decided to buy it.

Of course, not just like that, but thanks to Nigel Farage, the head of the Brexit party, who made a very resonant statement that his members of the same party would not be elected in those areas in which the conservative deputies won the 2017 election.

Thus, the market clearly considered that such a message, which means only a slightly greater chance of winning the conservative elections, is much more important than weak GDP, disastrous industrial production in Great Britain. It is not difficult to guess, both reports turned out to be significantly worse than market expectations.

Today, we are waiting for two more reports from the UK, on wages and unemployment. The expectations of the market come down to + 3.8% y / y in terms of wages and taking into account premiums and without taking them into account.

Any value below should cause a decline in “Britain”. In this case, the market should recall yesterday’s reports, which were left ignored. The unemployment rate is expected at around 3.9%.

Sales goals:

1.2667 – 76.4% Fibonacci

Purchase goals:

1.2986 – 127.2% Fibonacci

1.3202 – 161.8% Fibonacci

General conclusions and recommendations:

The pound / dollar instrument supposedly completed the construction of an upward trend. Thus, only a successful attempt to break through the level of 1.2986 can be regarded as a complication of this area and become the basis for new purchases of the instrument.

At the same time, the trend section threatens to go into horizontal form after October 21, so as not to cast doubt on the further lowering of the instrument.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom