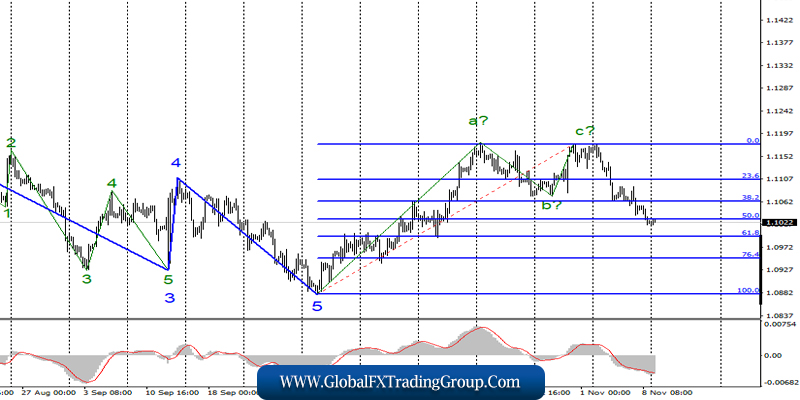

EUR / USD

November 8 ended for the pair EUR / USD with a decrease of another 30 basis points. Thus, the construction of the first wave of the new downward trend section is supposedly continuing, as the trend section between October 1 and October 31 took a completed three-wave form.

If this is true, then the decline in quotations of the instrument will continue with targets located about 9 figures and below. That is, with a greater degree of probability, this means the continuation of a long bearish trend for the euro-dollar pair.

Fundamental component:

On Friday, the news background for the euro-dollar instrument remained extremely weak. Throughout the day, there was only one economic report in America. The University of Michigan consumer confidence index, and even its preliminary significance.

Thus, the markets on Friday simply continued to “bend their line”, adhering to the previously selected trading strategy, which, based on the wave pattern, is to build a downward trend section. On Monday, the news background will remain extremely weak, or rather will be completely absent.

A successful attempt to break through the 50.0% Fibonacci level indirectly indicates that the instrument is ready to continue lowering, thus, by the end of the day, it may drop to 1.0994.

Purchase goals:

1.1175 – 0.0% Fibonacci

Sales goals:

1.0993 – 61.8% Fibonacci

1.0951 – 76.4% Fibonacci

General conclusions and recommendations:

The euro-dollar pair allegedly completed the construction of the upward trend correction section. Since the attempt to break through the minimum of wave b turned out to be successful,

I now recommend selling the instrument with targets located near the calculated levels of 1.0993 and 1.0951, which equates to 61.8% and 76.4 Fibonacci.

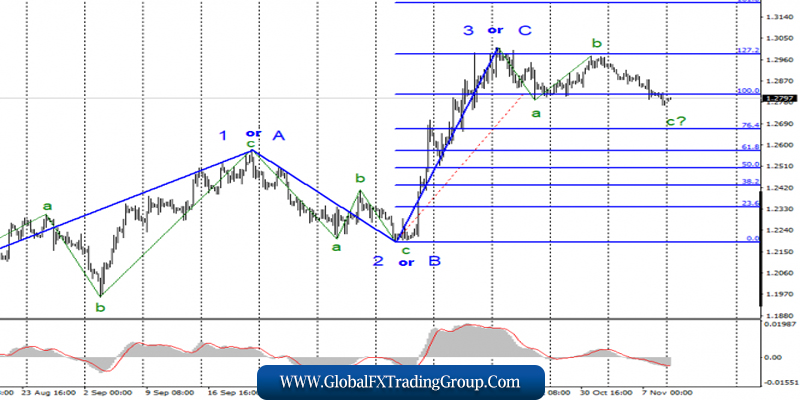

GBP / USD

On November 8, the GBP / USD pair lost about 40 basis points, which still fits perfectly with the current wave marking, and which suggests the construction of a bearish trend section within wave c.

If this is true, then the decline will continue with targets located on the way to 76.4% Fibonacci level. At the same time, the question continues regarding the interpretation of the trend section after October 21. Therefore, it can still be considered both as wave 4 as part of an upward trend that is not completed, and as wave 1 as part of a new downward trend.

However, much will depend on the news background in December. It is in December, when the results of the parliamentary elections will become known.

Fundamental component:

After it became known that the British Central Bank’s decision not to change the key rate, the pound could grow a little, which would contradict the current wave markup. However, traders drew attention to two members of the Central Bank Board of Directors, who voted in favor of lowering the rate.

This factor gives reason to expect that there will be three or four of them at the next meeting. And as soon as there are 5 or more votes, the Central Bank will lower the key rate. However, the mere fact that the two members of the board vote “for” the easing of monetary policy does not speak in favor of the pound, as it means that the central bankers are concerned about the state of things in the UK economy.

Today and tomorrow, several important reports will be released at once, which can just confirm or refute the negative attitude of the members of the Board of the Bank of England. Also today, we are waiting for data on GDP and industrial production, tomorrow – on unemployment and wages. In case most of this data is weak, the pound will continue to build a downward wave c.

Sales goals:

1.2667 – 76.4% Fibonacci

Purchase goals:

1.2986 – 127.2% Fibonacci

1.3202 – 161.8% Fibonacci

General conclusions and recommendations:

The pound / dollar instrument supposedly completed the construction of an upward trend. Thus, only a successful attempt to break through the level of 1.2986 can be regarded as a complication of the upward trend section and become the basis for new purchases of the instrument.

Since a successful attempt was made to break through the 100.0% level, I now recommend looking in the direction of sales with targets located around 1.2667, which equates to 76.4% Fibonacci.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom