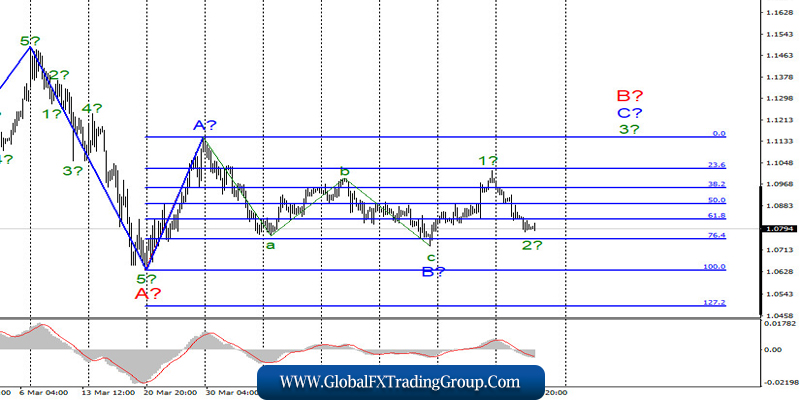

EUR/USD

The news background for the EUR/USD pair on Wednesday consisted of several reports from Europe, a summary of forecasts from the European Commission and a relatively important ADP report on changes in the US employment.

The latest report did not surprise investors.

The markets have long been prepared for the fact that the total number of Americans who lost their jobs amid the economic crisis and the coronavirus lockdown will be at least 20 million. At the same time, I believe that the forecasts of the European Commission did not particularly impress the markets as well. The Commission predicted that the European economy can drop by more than 7%.

However, I believe that these forecasts can be corrected at least every month, depending on how things are going with the coronavirus pandemic. Meanwhile, concerns about future relations between Beijing and Washington are increasing.

Donald Trump urgently needs to find those responsible for the deaths of more than 70 thousand Americans in the United States, as well as more than 1 million infected. Obviously, this will be China. One of the most effective ways of pressuring Beijing is to remind it about trade duties and tariffs.

Most likely, if evidence of China’s guilt is found, new tariffs will be imposed. It is not clear what is going to happen with the previous agreement signed in January. However, the United States do not want to violate it. However, Trump is unlikely to leave China in peace. Thus, the world hopes that there will be no second trade war.

However, the reality is that not only the United States can blame China. If the world’s largest economies begin to feud with each other after or during the Covid-19 pandemic, it will be possible to increase the forecasts of the European Commission twice, as well as similar forecasts of the American economy crash.

General conclusion and recommendations:

The EUR/USD pair is likely to continue the formation of the upward wave C into B. Thus, Iit is preferable to buy the instrument with targets located around 1.1148, which is equal to Fibonacci retracement of 0.0%, or the peak of the wave A. A successful attempt to break through the low of the wave B can indicate that the markets are not ready to buy the euro.

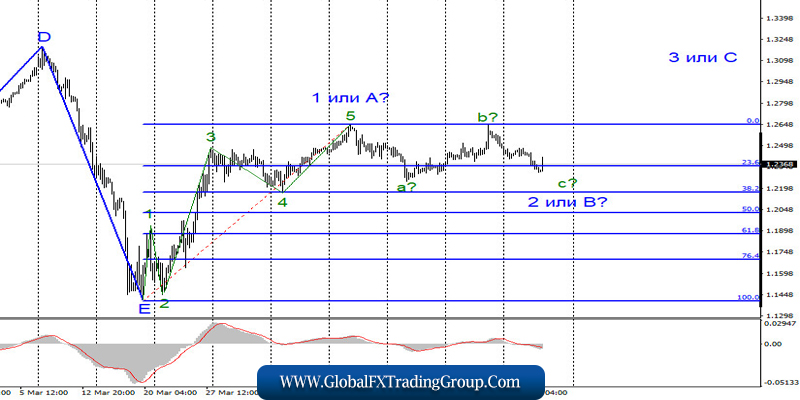

GBP/USD

On May 6, the GBP/USD pair lost 90 basis points and continued the formation of the expected wave C in 2 or B as part of the upward trend section. The pair is expected to fall further with targets located near the minimum of the wave A at 2, or B, or slightly lower. After the wave is formed, I expect the quotes to increase within the framework of the wave 3 or C with targets above the 26th pattern. At the same time, the wave marking can become even more complex, as the markets remain in a state of anxiety and instability due to the COVID-19 epidemic.

Fundamental component:

The news background for the GBP/USD pair on May 6 was extremely poor. However, the results of the meeting of the Bank of England, which left the key rate unchanged at a minimum level of 0.1%, have been released today. Also, the volume of asset purchases under the quantitative incentive program remained unchanged – 645 billion pounds.

As for the interest rate, all 9 members of the monetary committee voted against its change, while only two members of the committee voted in favor of expansion of the QE program. However, two votes were not enough to make a decision. Today, Governor Andrew Bailey will make a statement, which can also spark interest. Elsewhere, a report on claims for unemployment benefits in the US will be released today.

General conclusions and recommendations:

The GBP/USD pair supposedly completed the formation of the first wave of a new upward trend section. Thus, it is preferable to sell the British pound with targets located around the 22nd pattern, with an eye to the formation of a correctional wave 2 or B. After the completion of this wave, it is better to buy the instrument with targets located above the 26th pattern, and expect the formation of wave 3 or C.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom