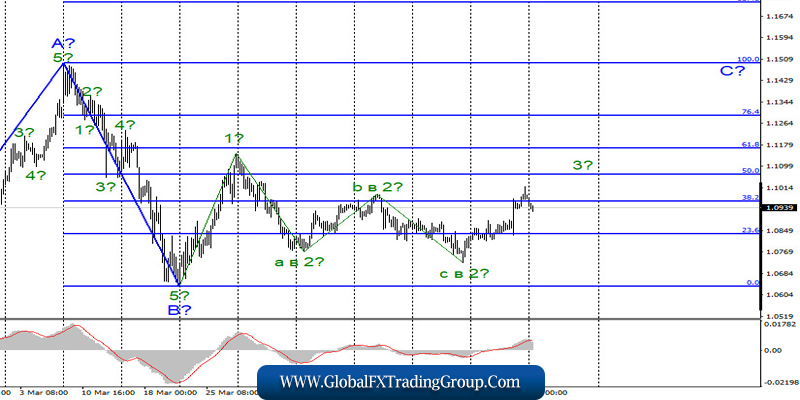

EUR / USD

On May 1, the EUR/USD pair gained about 25 bps and thus continued to build the expected wave 3 in C. If this assumption is correct, then the increase in quotes will resume with the goals located above the 11 figure within the wave C. At the same time, the entire wave pattern may require additions and adjustments, since the situation in the world with coronavirus remains unstable and dangerous. Accordingly, the markets may again fall into a state of shock.

Fundamental component:

The news background for the EUR/USD pair on Friday was quite disappointing. There was only indexes of business activity in the US manufacturing sector, which are now clearly not too interested in the markets. But there is much more news, so to speak, of a general plan. For example, US leader Donald Trump continues to lead the investigation, which is designed to answer the question whether the leak of the coronavirus was not accidental.

America suspects the Chinese authorities that if the leak was completely accidental, then Beijing purposefully hid the true information about the virus from the world, its degree of contagion, as well as the number of people who fell ill and died from it in China. It is incorrect information about this disease that has led to the fact that there are now more than one million cases of the disease in America.

Thus, Washington wants to get evidence of China’s guilt. This is necessary in order for the American President to remove responsibility for the consequences of the coronavirus in the United States, as well as to get a new trump card in negotiations with China. And it is not even so important in which negotiations. America is on the path of a long war with China, and we can not say that China in this history takes the place of the victim and the victimized. It’s just that America’s position is clear and obvious. Trump has stated it many times.

China treats the US unfairly, so the trade balance needs to be equalized. On the contrary, China says much less, and in the case of the COVID-2019 pandemic, no one really knows whether Chinese scientists deliberately released the virus, purposefully withheld information from the entire world. Moreover, the number of diseases and deaths in China is still very difficult to judge.

If there are so few of them, as official statistics say, then it is suspected that China really knew about the virus and its possible consequences from the very beginning, allowed it to leave the laboratory and hit certain areas, and then quickly “rolled” it using pre-prepared tools to prevent its spread throughout the country. If there are many more cases, then it turns out that China is really hiding and withheld important information for the whole world.

General conclusions and recommendations:

The euro/dollar pair is supposedly continuing to build the upward wave 3 in C. Thus, I now recommend continuing to buy the instrument with targets located near the levels of 1.1165 and 1.1295, which corresponds to 61.8% and 76.4% Fibonacci, but the new MACD signal is up. I recommend placing Stop Loss protective orders below the wave with a minimum of 2 and moving them up as the instrument rises.

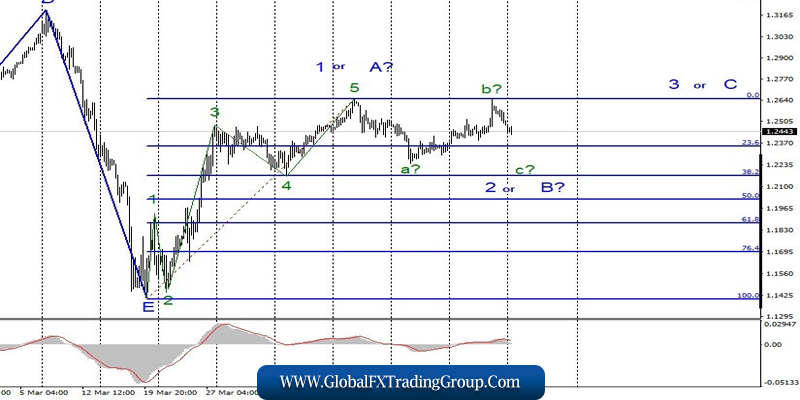

GBP / USD

On May 1, the GBP/USD pair lost 100 basis points, and thus, presumably completed the construction of the expected wave b in 2 or B. If this is true, then this instrument has now moved to building a wave C in 2 or B with targets located around 22 figures. An unsuccessful attempt to break the maximum of wave 1 or A indicated that the markets were not ready for further purchases of the British pound. Meanwhile, an unsuccessful attempt to break through the 38.2% Fibonacci level will indicate the completion of the construction of the expected wave 2 or B.

Fundamental component:

The news background for the GBP / USD pair on May 1 was also weak. Business activity in the manufacturing sectors of the UK and the USA declined simultaneously and approximately the same value. Thus, economic reports did not particularly affect the supply and demand for the instrument. A meeting of the Bank of England is scheduled for this week, which could potentially give the markets a large amount of important information.

General conclusions and recommendations:

The pound/dollar pair supposedly completed the construction of the first wave of a new upward trend section. Thus, I now recommend selling the pound with targets located around 22 and 21 figures per building correction wave 2 or B. After the completion of this wave, I recommend buying this instrument with goals located above the 26th figure in the calculation of building a wave 3 or C.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom