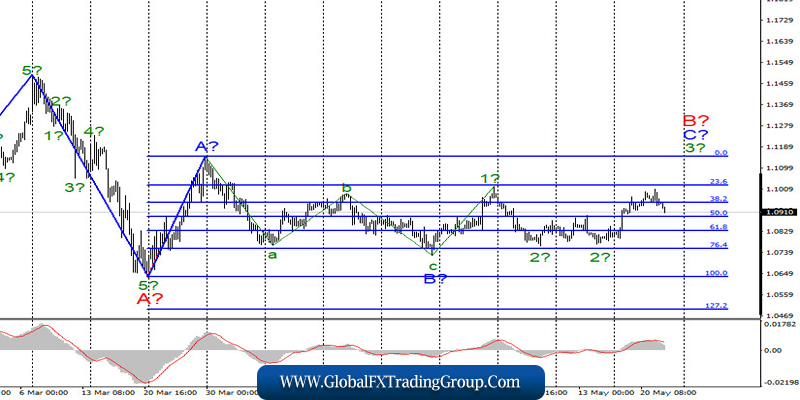

EUR / USD

On May 21, the EUR/USD pair lost about 30 basis points, and on Friday morning trading another 45. However, such losses do not yet violate the existing wave markup, which assumes the construction of a wave 3 in C in B. At the same time, the instrument has not yet made a successful attempt to break the maximum of wave 1, which would indicate serious intentions of the markets for further purchases of the Euro currency. Thus, the current wave 3 may become more complex, and the entire wave pattern may require adjustments and additions.

Fundamental component:

On Thursday, the European Union released business activity reports for May. The values are not final, but they can be trusted. Thus, business activity in services and production began to accelerate in Germany and the European Union, which means the beginning of economic recovery. At the same time, the values of business activity are still so small that they do not allow us to conclude that the service and production sectors themselves are accelerating. Let me remind you that any value of business activity below 50 is considered negative and indicates a reduction in the field itself.

Thus, it would be more correct to say that the economy has not begun to recover, but is slowing down its decline, which is also a positive fact in the current conditions. The same index of business activity came out in the United States, and they also showed a slowdown in the fall of the economy, starting to recover. In addition, unemployment claims in the US are also starting to slow down. If 5-6 million new unemployed were registered every week at the very beginning of the crisis, then yesterday’s report showed “just” 2.4 million new applications.

The total number of secondary applications on May 8 is 25 million. Jerome Powell’s evening speech did not arouse any interest in the markets. At the same time, the White House does not support the possibility of a new reduction in the key rate. This was stated by Larry Kudlow, head of the White House National Economic Council, on Thursday. He believes that the policy of negative rates has never worked in the countries where it was introduced, and does not support the desire of Donald Trump to continue to soften the monetary policy.

General conclusions and recommendations:

The euro/dollar pair presumably continues to build the rising wave C to B. Thus, I recommend buying the instrument with targets located, as before, around 1.1148, which equates to Fibonacci 0.0% on the new up signal MACD The low of wave B has not been updated, so the current wave markup retains its integrity.

GBP / USD

On May 21, The GBP/USD pair lost another 12 basis points. The changes in recent days are so small that they do not affect the current wave markup. Thus, the expected wave 3 or from the upward section of the trend, which begins on March 19, continues its construction. Price increases can resume with targets located near the peak of wave 1 or A and higher. At the same time, the alternative assumes a significant complication of wave 2 or B, which can take a 5-wave form. However, in this case, I also expect an increase in quotes with targets located around the 26th figures within the internal wave of 2 or B.

Fundamental component:

The indexes of business activity was also released in the United Kingdom yesterday. In the service sector, business activity increased to 27.8, and to 40.6 in the manufacturing sector. In general, the news background did not support the pound. Despite the fact that similar reports came out in America, the markets started selling British currency again.

General conclusions and recommendations:

The pound/dollar pair supposedly completed the construction of the second wave of a new upward trend section. Thus, I now recommend buying the pound with goals located around the 26th and 27th figures, based on the construction of wave 3 or C or d in 2 or B (if the wave becomes more complicated) for each new MACD signal “up”. On the other hand, a successful attempt to break through the level of 1.2645 will allow you to buy the pound more confidently.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom