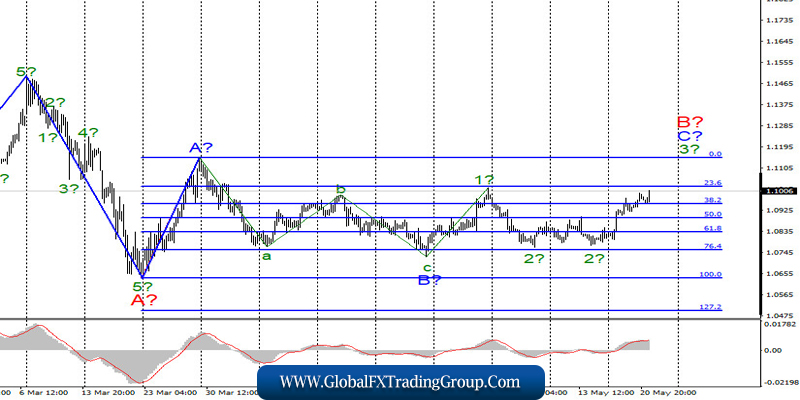

EUR / USD

On May 20, the EUR / USD pair gained about 50bp and thus continued construction supposed wave 3 in C in B. If the current wave marking is correct, then the increase in quotes will continue with targets located around 11 and 12 figures. And then a successful attempt to break the wave A maximum will confirm the intentions of the markets for further purchases of the Euro currency. In the near future, it is necessary to perform a successful attempt to break through the peak of wave 1 in C in B.

Fundamental component:

On Wednesday, the European Union released a report on the consumer price index for April which showed figures that are not very pleasing in the market. This is due to a large number of diverse news background at present, particularly inflation. The consumer price index, as expected, continued to decline and reached the level of 0.3% per annum. The core consumer price index fell to 0.7% y / y.

However, in the evening a more important and significant event took place, which is the minutes of the last meeting of the Fed monetary policy committee. Markets are always interested in these kinds of events since the Central Bank can indicate which direction the economy will look in the next few months or years. And on May 20, it became known that the American economy will look towards zero interest rates in the next few years. The outcome of the meeting said that rates will remain unprecedentedly low until the US economy begins to recover.

Moreover, this is not about minimal recovery after an obvious crisis. The economy should gain pre-crisis growth rates, only, in this case, we will talk about its tightening. Let me remind you that before the crisis caused by the pandemic, the key rate in the US was at 1.75%, and Jerome Powell and his colleagues did not increase, as the GDP growth slowed in recent years due to the trade war with China. But still, they amounted to about 2% per year. Thus, it can be assumed that until the US economy reaches a stable 2%-3%, the Fed will not tighten rates.

Also in the final statement, it was noted that the tension in the stock markets slightly subsided, and the markets themselves partially recovered. There are also excellent results from the banking sector, which was able to meet (not without the help of Congress and the fed) credit demand and generate the necessary reserves.

General conclusions and recommendations:

The EUR/USD pair is supposedly continuing to build the rising wave C from B. Thus, I recommend buying the instrument with targets located, as before, around 1.1148, which equates to Fibonacci 0.0%. The low of wave B has not been updated, so the current wave marking remains intact.

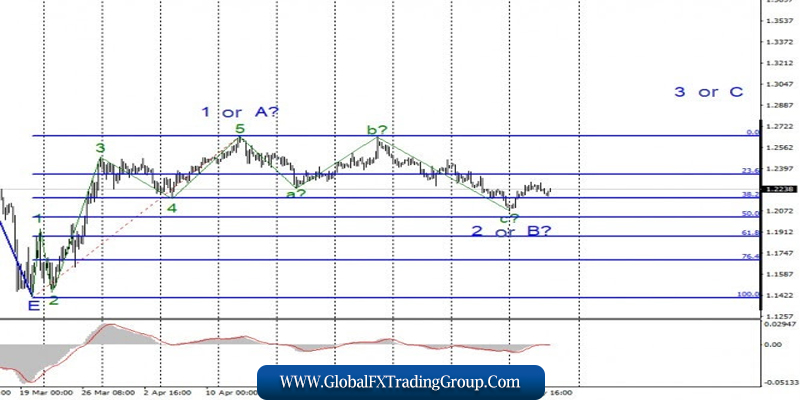

GBP / USD

On May 20, the GBP / USD pair lost only a dozen base points, however, this change is so small that it did not affect the current wave counting. Thus, the proposed wave 3 or C of the upward trend section, which originates on March 19, continues its construction. The increase in quotes may continue with targets located near the peak of wave 1 or A and above. At the same time, an alternative option involves a significant complication of wave 2 or B, which can take a 5-wave form. However, in this case, I also expect an increase in quotes with targets located about 26 of the figure within the internal wave of 2 or B.

Fundamental component:

Bank of England Governor Andrew Bailey spoke in the UK yesterday, which allowed the possibility of lowering the key rate in the negative area in the coming months. This can be done in order to further stimulate the economy, although until recently, the Central Bank stated that it was not considering negative rates. An inflation report was also released in the UK yesterday, which showed a decline to 0.8% per annum from the last 1.5%. The pound sterling during yesterday and today is more reduced, unlike the euro. Markets turn to different factors when trading these instruments.

General conclusions and recommendations:

The GBP/USD tool supposedly completed the construction of the second wave of a new upward trend section. Thus, now I recommend buying a pound with goals located around 26 and 27 figures, based on the construction of wave 3 or C or d in 2 or B (if the wave becomes more complicated). A successful attempt to break the 1.2645 mark will allow you to buy the pound more confidently.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom