EUR / USD

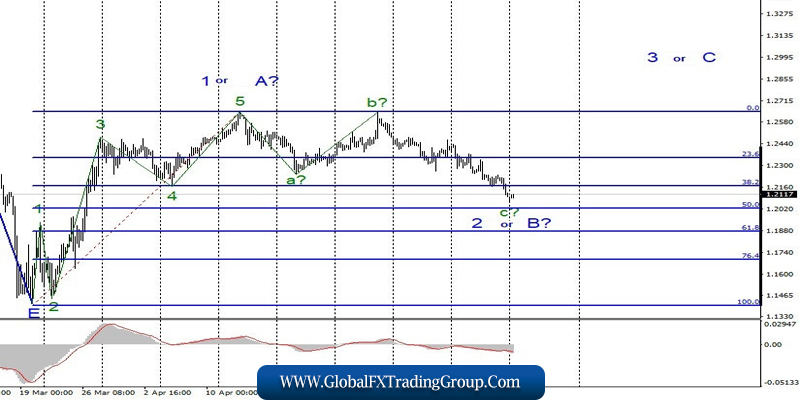

On May 15, the EUR/USD pair gained about 15 basis points, however, such a small price change did not affect the current wave marking. Thus, the instrument is still close to completing the construction of the assumed wave 2 in C in B. If this is true, then the increase in quotes will resume in the near future with targets located near the 11th figure and above. At the same time, the construction of the proposed wave 2 is frankly delayed, which may lead to the need to make additions and adjustments to the current wave markup.

Fundamental component:

The entire Friday background was extremely interesting for the euro-dollar instrument. Eurozone’s GDP in the first quarter of 2020 fell by 3.2% yoy. This value can hardly be called optimistic, but it should be admitted that it could have been worse. At the same time, one should not consider the crisis completed ahead of time. According to many economists, the second quarter will be worse than the first, and the contraction of the economy will continue in America and the European Union.

Also on Friday, record cuts in industrial production and retail sales was released in the United States. The first indicator declined by 11.2% (which is even slightly better than market expectations), and the second – by 16.4%. Thus, an increase in demand for the US currency on Friday afternoon was logical, given the weak economic reports. At the same time, the markets do not want to invest in the euro in a longer term than 1 day. Despite the failed reports and statistics, the US dollar as a whole continues to occupy high positions compared to the euro and the fact of a new conflict between China and the US does not scare the markets.

The new conflict between Beijing and Washington is unlikely to be exclusively verbal. Most likely, it will be a new trade war or even an economic war, with the use of all kinds of prohibitions, sanctions, fines, duties and arrests. Thus, the entire world economy may fall under the “shelling” between China and the United States. It is unlikely that this will positively affect the recovery process.

General conclusions and recommendations:

The euro/dollar pair presumably continues to build the rising wave C to B. Thus, I recommend buying the instrument with targets located, as before, at around 1.1148, which equates to Fibonacci 0.0%, or near the peak of wave A for each new MACD signal “up”. On the other hand, a successful attempt to break through the minimum of wave B will require corrections and additions to the current wave marking.

GBP / USD

On May 15, the GBP/USD pair lost another 125 basis points, and thus, continues to build the expected wave C in 2 or B. The entire wave 2 or B can still greatly complicate its internal structure and take on even a five-wave horizontal appearance. At the same time, given the strong market pressure on the pound and the general unstable state of the markets, the entire wave markup may require additions.

Fundamental component:

The news feed from the UK still contains only negative news. Last Friday, both sides of the negotiation process (Brussels and London) announced that no progress had been made following the results of the second round of negotiations. Both sides, although making concessions, state that an agreement is impossible without them. Therefore, the parties have about a month and a half to come to a common denominator or to admit a complete failure in the negotiations and complete them. On July 1, the parties will officially have to declare the extension of the “transition period” or the rejection of this step.

General conclusions and recommendations:

The pound/dollar instrument is nearing completion of the construction of the second wave of a new upward trend section. Thus, I now recommend buying the pound with targets located around the 26th figure, counting on building a wave of 3 or C or d in 2 or B on a new MACD signal “up”. At the same time, a successful attempt to break through the level of 1.2645 will allow buying the pound more confidently.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom