EUR / USD

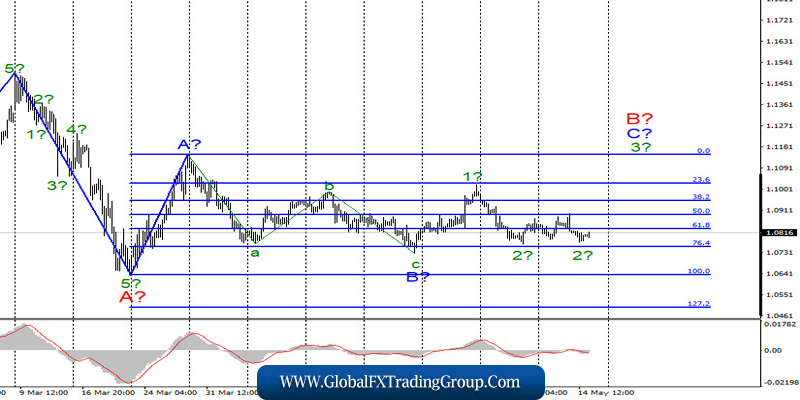

On May 14, the EUR/USD pair lost about 20 basis points, but could not reach the minimum of the expected wave 2 in C to B, stopping at a distance of several points from it. Thus, wave 2 in C in B can take on a pronounced three-wave form and, in any case, has already complicated its internal structure. The markets are clearly experiencing problems with the construction of an upward wave 3. And if the moment of its construction continues to be delayed, the entire wave picture may require adjustments and additions.

Fundamental component:

The entire information background on Thursday was reduced to a report on applications for unemployment benefits in the United States. Another week brought America another 3 million primary applications for benefits, and the total number of secondary applications (from people who have not been able to find work for some time) is already almost 23 million. This news is bad for the US economy, however, demand for US currency has not declined.

Thus, the construction of the alleged wave 3 is still delayed due to low demand for the euro. This morning, a report on GDP for the first quarter was already released in Germany, which showed a decrease of 2.3% y / y. Now, it remains to find out how much the GDP of the entire eurozone has decreased. The corresponding report will be released soon. In the afternoon, markets will witness a report on US retail and the University of Michigan consumer confidence index. An April industrial production report will also be released.

These data are unlikely to support the demand for the US currency, so, the quotes for the instrument may begin to rise in the afternoon. Moreover, the determination of China’s guilt and the list of possible punishments for it by the White House are also taking place in America. At least, such conclusions can be drawn from recent interviews with Donald Trump and people as close to him as possible. Thus, the world may very well need to prepare for a new conflict between Beijing and Washington.

General conclusions and recommendations:

The euro/dollar pair presumably continues to build the upward wave C in B. Thus, I recommend buying the instrument with targets located, as before, around 1.1148, which equates to Fibonacci 0.0%, or near the peak of wave A on a new MACD signal “up”. At the same time, a successful attempt to break through the minimum of wave B will require corrections and additions to the current wave marking.

GBP / USD

On May 14, GBP/USD pair lost a few basis points and continues to decrease with great difficulty, thus resuming the construction of the expected wave C in 2 or B. A successful attempt to break the 38.2% Fibonacci level will further complicate this wave. At the same time, the entire wave 2 or B can take on a more elongated, 5-wave horizontal appearance. On the other hand, an unsuccessful attempt to break through the level of 1.2170 will indicate that the markets are not ready for further sales of the British pound and the transition to building an upward wave.

Fundamental component:

The Bank of England Chairman, Andrew Bailey, delivered a speech in the UK yesterday. The country’s chief economist said that the Central Bank is not considering the option of introducing negative rates in the near future, but “everything is possible, especially in the current pandemic.” Thus, the markets were able to exhale, however, strictly speaking, no one expected that the Bank of England would continue to lower rates, as the ECB did at the time. No economic reports are expected from the UK today.

General conclusions and recommendations:

The pound/dollar instrument is nearing completion of the construction of the second wave of a new upward trend section. Thus, I now recommend buying the pound with targets around the 26th figure, counting on building a wave of 3 or C or d in 2 or B on a new MACD signal “up” or in case of an unsuccessful attempt to break through the level of 1.2170. At the same time, a successful attempt to break the level of 1.2645 will allow you to buy the pound more confidently.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom