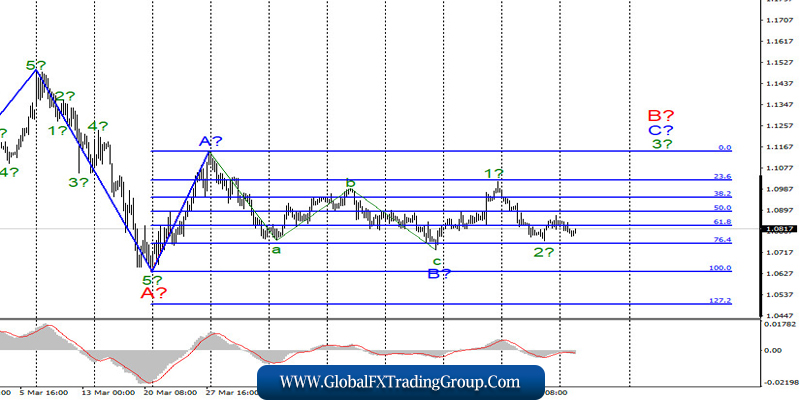

EUR / USD

On May 11, the EUR/USD pair lost a total of 25 basis points, but this was enough to cast doubt on the construction of the expected wave 3 in C in B. The fact is that the wave pattern continues to become more complex, and if the low of wave 2 is updated, adjustments and additions may be required. For example, wave B may take a longer horizontal view. One way or another, the markets can not continue building an upward wave, which is justified by the current wave markup.

Fundamental component:

The news background for the EUR/USD pair on Monday was extremely weak. There was no economic news from the EU and America. Thus, the low activity of the markets for the euro-dollar instrument was due to. However, recently, markets are increasingly turning their attention to global topics that may affect not only the economy. One of these topics is the conflict between the German Constitutional court and a similar court of the European Union.

Although it would be more correct to say a conflict between Germany and the EU, since the court is just a tool. So, the German constitutional court questioned the legality of the program of buying bonds by the German Central Bank, which operates under the leadership of the ECB. The court considers that such a program is contrary to German law, which loses legitimacy in the matter of the Central Bank’s activities.

At the same time, the European Commission says that the program is absolutely legal, and the ECB can only submit to the European court of justice. Thus, Germany shows its doubts about the expediency of participating in this program, and the Central Bank of Germany will not buy back securities for the next three months. By and large, this is called disobedience to a higher authority.

Any Central Bank can act in the same way, stating that the ECB program contradicts the laws of its country. Then the Eurozone will simply fall apart, and it will fall apart very quickly. So far, I believe that the conflict between Germany and the EU leadership may negatively affect the demand for the European currency.

General conclusions and recommendations:

The euro/dollar pair presumably continues to build the upward wave C in B. Thus, I recommend buying the instrument with targets located, as before, that is around 1.1148, which equates to Fibonacci 0.0%, or near the peak of wave A on a new MACD signal “up”. At the same time, a successful attempt to break through the minimum of wave B will require corrections and additions to the current wave marking.

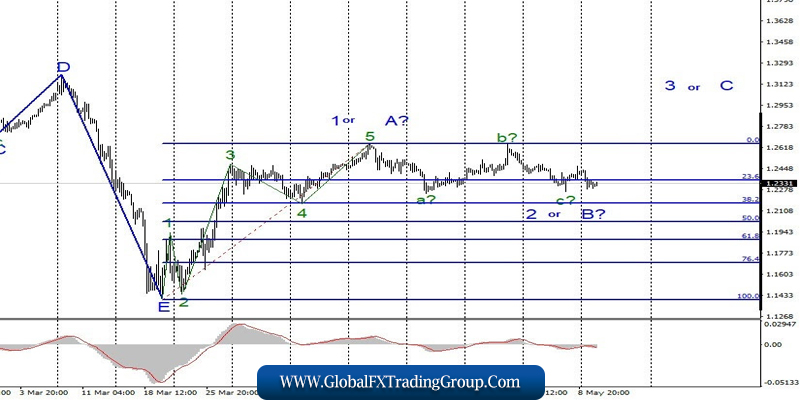

GBP / USD

On May 11, the GBP/USD pair lost about 70 basis points. The assumed wave C in 2 or B is completed, and if this is true, then the current positions will resume raising quotes with goals located above the peak of wave 1 or A within wave 3 or C. At the same time, wave 2 or b can take a more complex and extended form. Thus, only after a successful attempt to break through the peak of wave 1 or A, it will be possible to conclude that the markets are ready for new purchases of the British currency.

Fundamental component:

The news background for the GBP/USD pair on May 11 was also very weak. There have been no news or economic reports from the UK. Most news is still on the coronavirus pandemic. The UK recently overtook Italy in the number of pandemic cases, and the total number of deaths from it exceeded 32 thousand. Moreover, Boris Johnson, who announced the relaxation of quarantine from May 13, also extended the general effect of quarantine until June 1. The Prime Minister also believes that the spread of the pandemic has been slowed, and therefore, quarantine is weakening. In general, there is still little positive news.

General conclusions and recommendations:

The pound/dollar pair supposedly completed the construction of the second wave of a new upward trend section. Thus, I now recommend buying the pound with targets located around the 26th figure, counting on building a wave of 3 or C or d in 2 or B on a new MACD signal “up”. At the same time, a successful attempt to break through the level of 1.2645 will allow us to buy the pound more confidently.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom