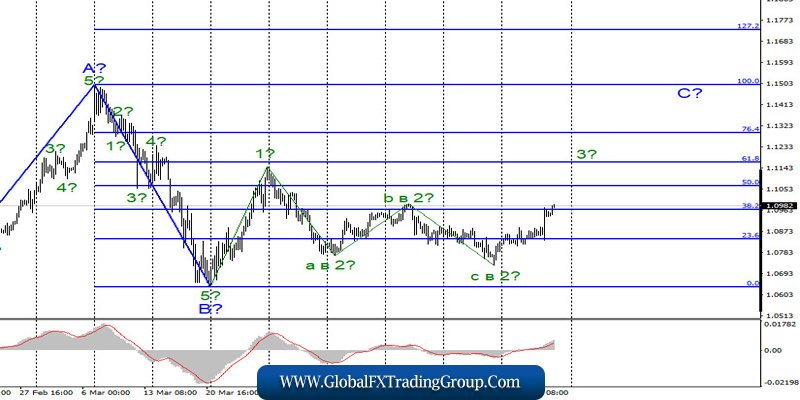

EUR / USD

On April 30, the EUR/USD pair gained about 75 basis points and, thus, continued building the expected wave 3 in C. If the current wave marking is correct, then the increase in quotes of the instrument will continue with targets located about the 11th figure. On the other hand, the alleged wave 2 has taken on a three-wave form and is currently fully completed. A successful attempt to break the maximum of wave b into 2 will indirectly indicate the readiness of markets for further purchases.

Fundamental component:

The news background for the EUR / USD pair on Thursday was quite strong. The economic reports published in the European Union all showed the worsening current economic situation. The unemployment rate is rising, inflation is falling, and GDP growth has become negative. And although most analysts and market participants believed that the deterioration in the eurozone could be even stronger, I believe that “it is not yet evening.” Indeed, for the time being, only March-April or the first quarter data continue to arrive. That is, when the coronavirus pandemic was just beginning in Europe.

Thus, the decline in the EU economy may be much stronger in the second quarter. ECB chairman Christine Lagarde also spoke about this after the meeting. She noted that the economic shock experienced by Europe is very strong, and the uncertainty associated with the spread of COVID-19 and its opposition, does not allow more or less accurately assess the extent of possible losses and the timing of economic recovery.

Moreover, Christine Lagarde expects a reduction in the European economy by 5-12% in 2020. This means that the head of the European Central Bank expects a reduction in the third and fourth quarters unlike the leaders of the United States. At the current meeting of the ECB, decisions were made on additional measures to stimulate the economy and expand lending programs.

It was these steps that the markets were waiting for from the ECB, which was one of the few that did not lower rates since the pandemic began. At the same time, the number of initial applications In America increased by almost 4 million yesterday, and the total number of repeat applications reached 18 million. All these are unemployed people who need to pay benefits and who do not bring any benefit to the economy.

General conclusions and recommendations:

The euro/dollar pair is supposedly continuing to build the rising wave 3 in C. Thus, I now recommend continuing to buy the instrument with targets located near the levels of 1.1165 and 1.1295, which corresponds to 61.8% and 76.4% Fibonacci. I recommend placing Stop Loss protective orders below the wave with a minimum of 2 and moving them up as the instrument rises.

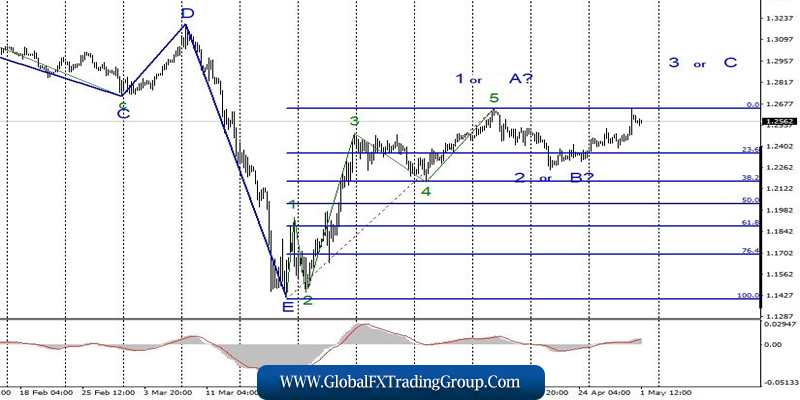

GBP / USD

On April 30, the GBP/USD pair gained 130 basis points, thus continuing to build an upward wave, which may be wave 3 or C or a correction wave of 2 or B, after which the quotes of the instrument will resume to decline with targets located near the 22nd figure. This is the main issue of the current wave counting. On the other hand, a successful attempt to break the maximum wave 1 or A indicates the willingness of markets to buy the British currency as part of construction is wave 3 or C. However, at the moment, an attempt to break through the level of 1.2649 is unsuccessful.

Fundamental component:

The news background for the GBP / USD pair on April 30 was weaker. Nevertheless, weak reports on applications for US benefits and personal income and expenses of US citizens have also had a positive effect on the British currency. It became known In the UK today that the index of business activity in the manufacturing sector in April fell to 32.6, which is even worse than the previous preliminary value. However, there is nothing surprising in this. Business activity is falling at a record pace in all countries of the world.

General conclusions and recommendations:

The pound/dollar pair supposedly completed the construction of the first wave of a new upward trend section. Thus, I now recommend selling the pound with targets located around 22 and 21 figures, based on the construction of correction wave 2 or B using the new MACD signal down, or waiting for the completion of this wave, and then buying the instrument at the beginning of upward wave 3 or C.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom