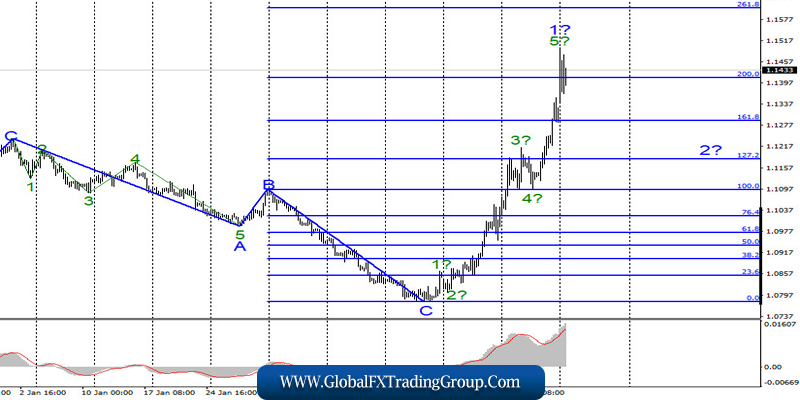

EUR / USD

On March 6, the EUR/USD pair gained just 40 base points. However, Monday opened with a gap of another 70 points up and during the first day of the week, the euro has already managed to gain about 70 points. Thus, the uncontrolled increase in the euro-dollar instrument continues, and now, it is very difficult to imagine when it will end and what can stop it.

I think no one doubts that the reasons for such a strong increase in the quotes of the instrument do not lie in the plane of economic news or reports or wave analysis. The new COVID-2019 virus, which throws all markets into shock and panic without exception, is to blame. Thus, the alleged wave 1 of the new upward trend section can take on a theoretically arbitrarily extended form, like its internal wave 5.

Fundamental component:

The news background for the EUR / USD instrument on March 6 was very important and interesting. However, it was completely ignored. The markets did not pay attention either to the US unemployment rate, which returned to many-year lows, to Nonfarm Payrolls. The number of which exceeded all market expectations, or to the wage level, which increased by 3%. That is, with such a news background, one could only expect a decline in the quotes of the instrument.

Nevertheless, the markets continued to panic on Friday, and continue to panic today. Moreover, both currency markets, stock markets, and commodity markets – all this leaves the prospects of any currency, any commodity, or any stock index in complete uncertainty. At the same time, the Coronavirus can cause truly full-scale quarantines in many countries, which will lower business activity to negative values.

Thus, the world economy will slow down, and the economies of the EU and many other countries of the world will slide into recession. So, what will happen to the oil, gas and stock markets is even hard to imagine. Thus, at this time, all economic news can be ignored, paying attention only to the actions of central banks and news about the coronavirus and the fight against it.

General conclusions and recommendations:

The euro/dollar pair is supposedly continuing the construction of a new ascending section. Based on the current wave marking, wave 1 continues its construction. Thus, I still recommend waiting for the completion of the construction of wave 2 and buying the instrument only later, when the construction of wave 3 begins. At the same time, any transactions are now extremely dangerous due to panic and complete uncertainty prevailing in the market.

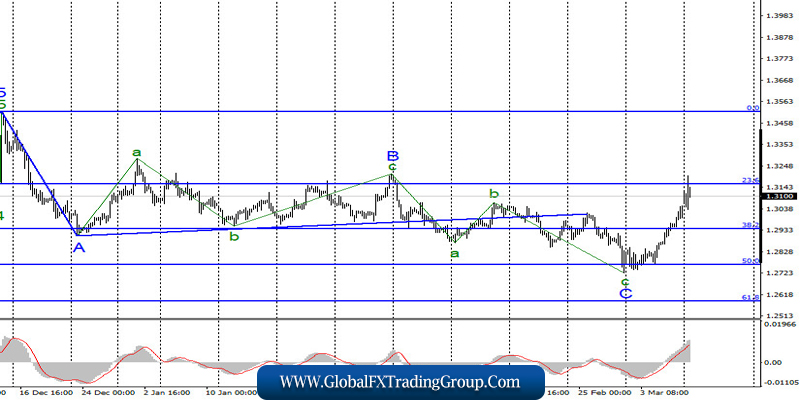

GBP / USD

On March 6, the GBP/USD pair gained about 90 base points. Thus, the current wave counting required corrections and additions once again. Now, the entire trend section, which dates back to December 13, is considered completed and has taken a three-wave form and form. If this is true, then a new upward trend section has begun to be built, which is completely unclear what form it will take and how long it will be. The current news background allows for completely different build options.

Fundamental component:

The news background for the GBP / USD instrument on Friday was in the same economic reports from America that were ignored by the markets with the same degree of ease. The same reasons that pushed the euro-dollar instrument upward, pounded in the same direction and the Pound-Dollar.

Thus, pushed the pound-dollar in the same direction. Thus, it doesn’t even make sense to look at economic news, analyze reports, or wait for information about negotiations on a trade deal with the European Union. All this does not matter now. The only thing that matters is the news from the central banks of the UK, USA, EU, as well as news about the spread of the coronavirus and the fight against it.

General conclusions and recommendations:

The pound/dollar instrument has complicated the current wave count. Thus, I do not recommend trading now, as the situation in the markets is very unstable and frankly shocking.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom