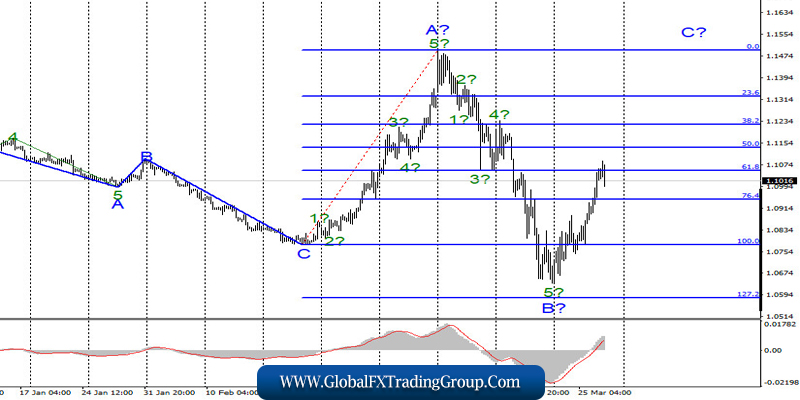

EUR / USD

On March 26, the EUR / USD pair gained about 150 more basis points and continues to build the proposed wave C with targets located near the 15th figure. If the current wave marking is correct, then the increase in quotes will continue for the designated purpose. However, it is possible that wave C will take the classic five-wave form, so the impulse movement will be interrupted from time to time by the corrective one. On the other hand, an unsuccessful attempt to break the 61.8% Fibonacci level warns about the readiness of the markets to move away from the highs reached.

Fundamental component:

The news background for the EUR / USD instrument on March 26 was quite important. From economic reports, I can only note data on applications for unemployment benefits for the third week of March, which immediately showed an increase of 3.3 million. Now, almost no one has any doubt that the unemployment rate in the US will grow enormously in March. Thus, the forecast of James Bullard begins to come true, although, probably, all representatives of the Fed would like the head of the Federal Reserve Bank of St. Louis to be mistaken.

However, unemployment will most likely reach 10-15% in the near future. I also regret to note that the news regarding the spread of the epidemic is in the first place in the world. Over the past day, America came out on top in the number of diseases, ahead of China with its population of 1.5 billion people. In this way, it is the United States that can now be considered the global focus of coronavirus. And the more people are sick of the United States, the less likely it is that the US economy will not suffer much or begin to recover in the coming months.

So far, weighted average forecasts suggest that recovery should be expected no earlier than the second half of the year provided that the epidemic can be curbed before the summer. In the meantime, there are 86,000 COVID-2019 cases and 1300 deaths from the disease in America. Italy is not far behind with 81,000 cases and 8,000 deaths. And then, provided that the epidemic can be curbed before the summer. In the meantime, there are 86,000 COVID-2019 cases and 1,300 deaths from the disease in America. In turn, Italy is not far behind with 81,000 cases and 8,000 deaths.

General conclusions and recommendations:

The euro-dollar pair presumably continues to build the rising wave C. The entire trend segment, which begins on February 20, takes a horizontal view, and the A-B-C waves can be approximately equal in size. So far, the main option for the development of events is to build an ascending wave C. Thus, you can carefully buy an instrument with Stop Loss orders under the low of wave B. Here, the final goal is 1.1500.

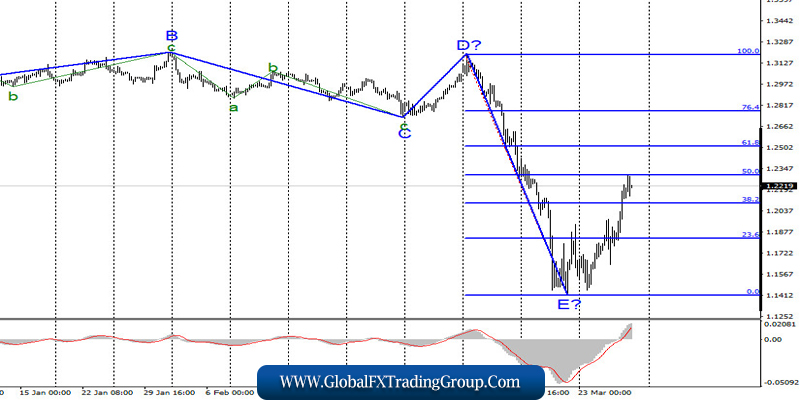

GBP / USD

On March 25, GBP / USD gained around 270 basis points. Thus, the construction of a new rising wave, presumably as part of a new upward trend section, continues. If this assumption is correct, then the increase in quotes will continue, but the entire trend section, which begins on March 20, should get at least a 3-waveform. Thus, an unsuccessful attempt to break through the 50.0% Fibonacci level may lead to a departure of quotes from the highs reached and the construction of a correctional wave. Meanwhile, a successful attempt will show a willingness to further increase the instrument.

Fundamental component:

The economic news background for the GBP / USD instrument on Thursday came down again to general news about the spread of the COVID-2019 virus and measures taken by governments of all countries of the world. Of course, I, like you, are more interested in news from America, the European Union and the UK, as it is they that can affect the movement of the euro / dollar and pound / dollar instruments.

In the UK, the virus continues to spread as easily as in other countries, despite the “hard” quarantine. It’s just that it came to Britain a little later, so the number of cases here is not too large. At the same time, this is already 12,000. Scientists also note that there can be many more cases in reality. And this applies not only to Britain, but also to the whole world.

General conclusions and recommendations:

The pound-dollar instrument has also supposedly completed the construction of the downward set of waves and the last wave E. Thus, now, you can buy the pound sterling based on the construction of a new upward set of waves with targets located near the 25th figure and with Stop Loss orders under the low of wave E. The instrument can also begin to build a correctional wave already today or Monday.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom