EUR / USD

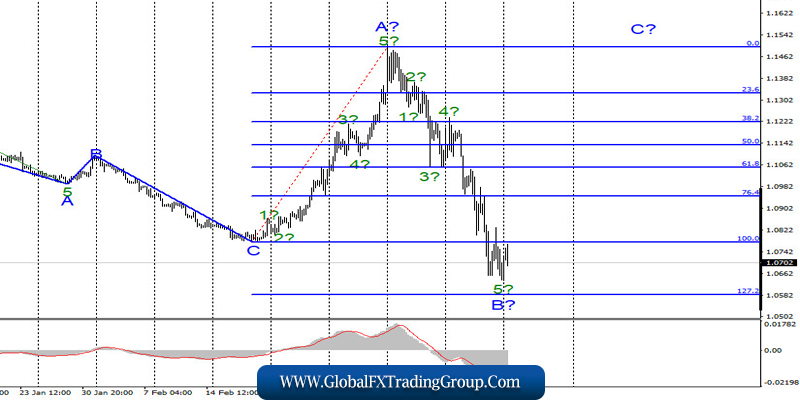

On March 20, the EUR / USD pair gained about 30 base points, although it reached the level of 1.0830 during the day. Nevertheless, Friday ended near the level of 1.0700, and trading on Monday is around it. At the moment, wave marking does not look that difficult, but ambiguous. The estimated wave B in the horizontal trend section is supposedly completed.

If this is true, then the increase in prices will continue with the current levels in the direction of 15th figures within wave C. However, the main problem lies precisely in the fact that the news background has a strong influence on the markets, so the drop in the quotes of the instrument can easily continue.

Fundamental component:

There was no news background for the EUR / USD instrument on March 20. There were no economic reports from America and the European Union. However, they have now little influence on the currency market since much more markets are interested in the extent of the spread of coronavirus on our planet.

In the past two weeks, the US dollar has been in high demand in the market, since the epidemic in America was weak, and the status of the dollar (the currency that has always been and always will be) was almost the only reason for the high demand for the US currency. However, the dollar has stopped growing in the past few days.

Either due to the fact that everyone who wanted to convert their assets into American currency already did this, or because the epidemic began to gain momentum in America. If the second reason is relevant, then the demand for the US currency may now decline. After a long decline in both instruments, corrective waves are needed. The more cases there are in America, the more the American economy will shrink.

Moreover, the markets have long ignored the falling US stock market, the US oil companies that are experiencing serious problems due to low oil prices. Perhaps, it’s now time to pay attention to the fact that faith in the dollar is not supported by anything and the economic situation is no better than European or British.

General conclusions and recommendations:

The euro-dollar pair presumably completed the construction of the downward wave B. The entire trend section, starting on February 20, can have very strong correction waves, which will be equated to almost 100% of the pulsed ones. So far, the main option for the development of events is the construction of an ascending wave C. You can carefully buy an instrument using the MACD signal “up”.

GBP / USD

On March 20, GBP / USD added 180 basis points, which in the current conditions is not a big figure for the pound. Last Friday, the quotes of the instrument reached the level of 1.1930, but closed the week near the level of 1.1650. Around which, trading took place on Monday.

The current wave marking involves the completion of the construction of wave E, as well as the entire downward trend section, which began on December 13. At the same time, given the current state of the markets, it is possible that the wave pattern will require adjustments and additions.

Fundamental component:

There was no news economic background for the GBP / USD instrument on Friday either. The governments of Great Britain and the United States continue to take all necessary measures to stop the spread of the COVID-2019 epidemic, as well as mitigate its impact on the economy. Unfortunately, it is not possible to stop the epidemic so far. In this regard, US President Donald Trump gave his permission to introduce the National Guard to the states most affected by the epidemic – New York, California and Washington.

Meanwhile, full quarantine has been introduced with the maximum level of restrictions in the UK. According to official information, the number of infected in the US is already 40,000, and in Britain – 5,000. However, these figures are unlikely to reflect the actual volume of infection, only approximate.

General conclusions and recommendations:

The pound / dollar instrument continues to complicate the current wave count. Thus, I still do not recommend trading, as the situation in the markets is very unstable. Perhaps wave E is completed, which indicates the willingness of the markets to buy the pound, but the trading amplitude was 500 points on Friday. Traders must decide for themselves whether the current risks are acceptable to them.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom