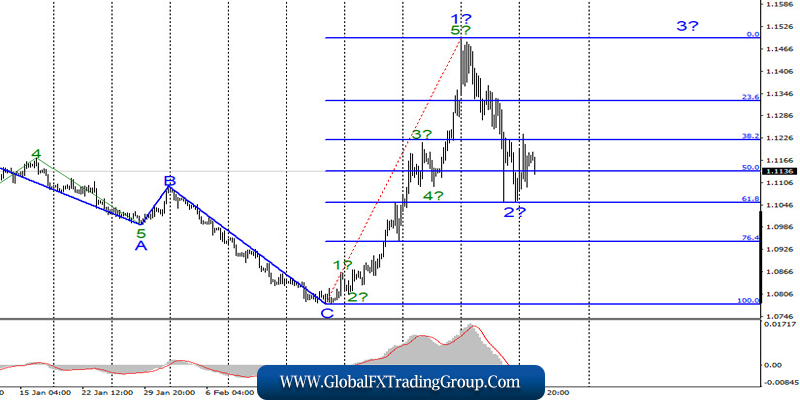

EUR/USD

On March 16, the EUR/USD pair gained 65 basis points after an unsuccessful attempt to break the 61.8% Fibonacci level. Thus, there is more and more reason to complete the construction of wave 2. If this is true, then the increase in the quotes of the instrument will continue with the goals located near the 15th figure and higher.

But a successful attempt to break through the 61.8% Fibonacci level will indicate that the markets are ready for further sales of the instrument, which, accordingly, will lead to a complication of wave 2 and the entire section of the trend that begins on February 20.

Fundamental component:

There was no news background for the EUR/USD instrument on March 16. Nevertheless, another batch of news about the spread of coronavirus around the world led to the fact that stock indices in America continued to collapse, oil prices continued to collapse, and even more countries in the world resorted to measures of full and total quarantine, closing borders. All this, of course, does not help calm the markets at all.

And if the markets do not calm down, then every day we can expect new collapses and falls. Accordingly, the overall situation in the markets does not change. Yesterday, several important reports were also released in China. You may ask: what does China have to do with the EUR/USD and GBP/USD instruments? In fact, the impact is quite weak. However, it was China that showed what to expect from economic reports in the eurozone and America during April and the following months.

Let me remind you that the pandemic began in China and developed there in the first place. So it was the reports from China that were supposed to show how much the infection and subsequent government quarantine measures affected the economy. Industrial production in China fell by 13.5% in February and retail sales – by 20.5%. We can expect approximately the same figures from economic statistics from America and the European Union for the end of March.

This is unlikely to cause additional demand for a particular currency since the decline will be synchronous. However, the decline may be higher in some places and lower in others. So, in any case, you need to prepare for the worst.

General conclusions and recommendations:

The euro/dollar pair presumably continues to build an ascending section. Based on the current wave layout, waves 1 and 2 have completed their construction. Thus, if it were not for the panic state of the market, I would recommend starting buying the euro currency in the expectation of building a wave 3 of the upward trend section with goals located around 15 figures and higher. However, in the current conditions, I believe that first of all, market participants should be careful.

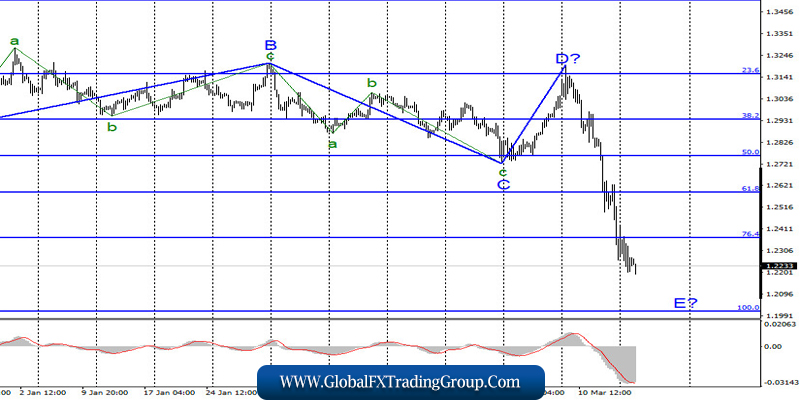

GBP/USD

The GBP/USD pair lost another 25 basis points on March 16, although the trading amplitude was much stronger during the day. Thus, the assumed wave E continues its construction with targets located near the 100.0% level.

If this is true, then an unsuccessful attempt to break this level will lead to the departure of quotes from the reached lows, and, possibly, to the completion of the construction of the entire downward section of the trend. Despite the panic state of the market, which is particularly well manifested in the pound/dollar instrument, the British can’t go down forever.

Fundamental component:

There was no news background for the GBP/USD instrument on Monday. But today in the UK there will be reports on unemployment, applications for unemployment benefits, as well as on changes in the level of average wages. In addition, data on industrial production and retail sales will be released in America.

So, there will be at least 5 fairly important reports during the day. However, all of them can be ignored by the markets. As for the pound, completely different factors are now in the first place. If the euro builds corrective waves from time to time, the British simply falls down. And it is unlikely that this decline will be stopped by far from the most significant news from Britain and the US.

General conclusions and recommendations:

The pound/dollar tool continues to complicate the current wave markup. Thus, I still do not recommend trading now, as the situation in the markets is very unstable. After completing the construction of wave E, using the MACD signal “up”, it will be possible to consider the possibilities of buying the instrument, however, the main problem now is that it will be very difficult to determine the completion of both wave E and the entire downward trend section.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom