EUR / USD

On March 12, the EUR / USD pair lost only 90 basis points. “Just” because the total amplitude of the instrument was almost 300 points over the past day. The instrument declined to the 61.8% Fibonacci level, made an unsuccessful break down attempt and now shows signs of readiness to build a new upward wave. Unfortunately, the panic remains in the minds of all markets, both currency and stock. Thus, the current wave marking may well become more complicated, take a more non-standard look and require corrections and additions.

Fundamental component:

The news background for the EUR / USD instrument on March 12 was very interesting. The ECB decided at a meeting not to lower the deposit rate from the current -0.5% even lower. However, they still decided to continue to flood the economy with money, turning on the printing press at full capacity. The program of repurchase of assets (securities) will be expanded in the European Union by 120 billion euros by the end of 2020.

However, these measures may not be enough to keep the economy afloat given that the COVID-2019 virus continues to spread throughout Europe (as well as around the world). In principle, any measures now will not be enough. In any case, the economy will slow down or even shrink in 2020. The only question is how much? This will depend on the scale of the pandemic, the spread of which cannot be stopped. Meanwhile, the Fed is preparing for a new easing of monetary policy.

In normal times, any decrease in the rate would necessarily cause a weakening of the national currency. However, such a conclusion cannot be drawn now. Markets continue to panic, the US stock market continues to break anti-records, so the movement can be expected in any direction and with any force. The wave analysis speaks in favor of the growth of the euro in the coming week; however, everything will depend only on the mood of traders, investors and other market participants.

General conclusions and recommendations:

The euro-dollar pair is supposedly continuing the construction of the upward section. Based on the current wave marking, waves 1 and 2 have completed their construction. Thus, if it were not for the panic state of the market, I would recommend starting buying Eurocurrencies in the calculation of building wave 3 of the upward trend section with goals located about 15th figure and above. However, I believe that markets should be careful above all in the current environment.

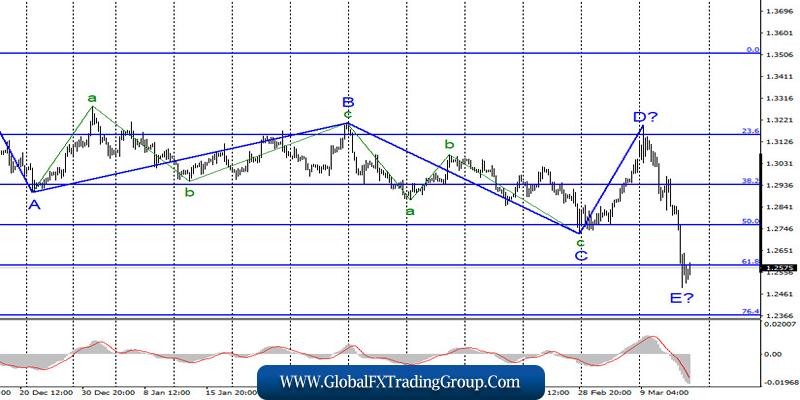

GBP / USD

On March 12, GBP / USD lost about 250 basis points. Thus, the construction of the proposed wave E as part of the non-standard 5-wave structure of the waves continued. Given the strong decline in quotes within the framework of wave E, it may already be completed or is nearing completion. If this is true, then the construction of a new upward trend section may begin in the near future. However, the current state of the market may further complicate the current wave counting.

Fundamental component:

There was no news background for the GBP / USD instrument on Thursday. However, the panic in the market persists. Yesterday, for example, the British pound declined by 250 points. At the same time, the euro declined during the day, the stock markets in the United States, which until recently was called the reason of the decline of the dollar, also closed at a record minus. The Fed lowered the rate by 0.5% and intends to reduce it by another 0.5% or even 0.75% in the near future.

The Bank of England has also softened monetary policy, but, as we see, all these measures are aimed at mitigating the effects of the pandemic on the economy. However, these actions of the Central Banks do not even have much significance now for the currency exchange market. Markets are trying to transfer their funds to the safest assets, therefore, transactions on the market are now carried out not in accordance with our usual logic.

General conclusions and recommendations:

The pound / dollar instrument has complicated the current wave markup again. Thus, I still do not recommend trading, as the situation in the markets is very unstable. After completion of construction of a wave E, MACD signal on the “up”, can be considered a purchasing tool. However, this is only based on the current wave marking, which involves the completion of building a downward set of waves, the last of which is the wave E.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom