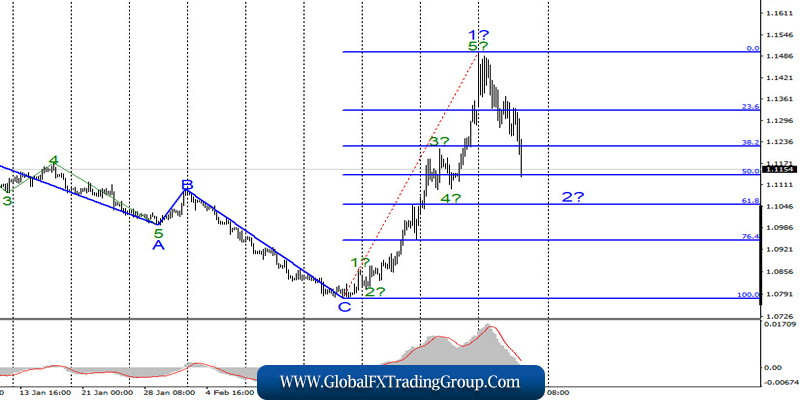

EUR/USD

On March 11, the EUR/USD pair lost about 30 more base points, and during today – another 100. Thus, based on the wave analysis, the instrument moved to the construction of a descending wave 2 as part of the upward trend section. If this is true, then the decline in quotes will continue with targets located near the level of 50.0% and 61.8% for Fibonacci. The entire wave 2 can be very long, up to 100% of wave 1. The markets continue to be in a state of absolute shock.

Fundamental component:

The news background for the EUR/USD instrument on March 11 was very interesting, but the most interesting events occurred today and the markets were waiting for them. The European Central Bank held a meeting, the last of the world’s largest central banks, and left the key interest rate unchanged (deposit and credit). On the one hand, the deposit rate is already negative in the EU, and on the other, it seems that many central banks of the world are aiming for a period of low or even negative rates.

In addition, the markets were concerned about the question of how the ECB is going to stimulate the economy in times of raging coronavirus? The ECB responded by expanding its corporate bond repurchase program by 120 billion euros by the end of the year. According to ECB representatives, these measures will help support favorable financial conditions for the economy. The ECB also believes that the QE program will continue for as long as necessary. It will end only when the rate increase period begins. Thus, the ECB still began to stimulate the economy, which caused a new decline in demand for the euro.

And yesterday, the European Union released a very weak report on industrial production, which did not add optimism to the markets, but in the US, a fairly strong report on inflation was released. Thus, the decline in the instrument’s quotes in the last two days fully corresponds to the nature of the news background. The US dollar has already recovered 50% of its losses. Will it continue to recover?

General conclusions and recommendations:

The euro/dollar pair presumably continues to build an ascending section. Based on the current wave layout, wave 1 has completed its construction. Thus, I still recommend waiting for the completion of wave 2 construction and buying the tool only after the construction of wave 3 begins. At the same time, it is unlikely that wave 3 will be as strong as wave 1, and the entire section of the trend that originates on February 20 may again take a three-wave form, as well as a rather non-standard form.

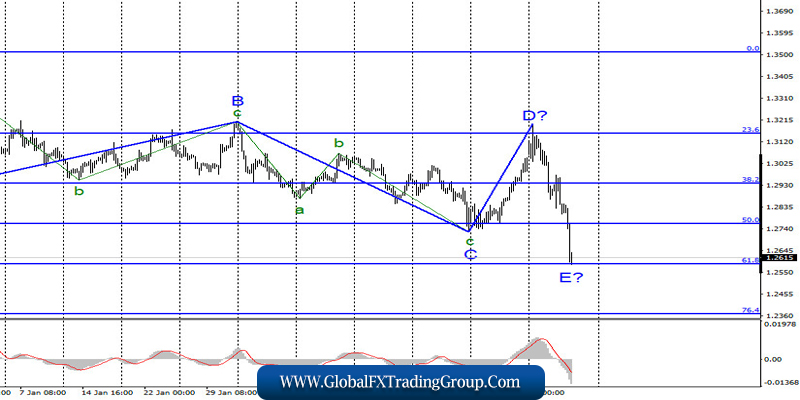

GBP/USD

The GBP/USD pair lost about 75 basis points on March 11. Thus, the minimum of wave C was updated, which led to the refinement of the entire wave markup. However, I warned that the markets are still in a state of shock, the news background is very strong, so the amplitude of movements of each instrument is very high. Thus, now the entire section of the trend, which originates on December 13, takes the form of a 5-wave structure. And if this is true, then wave E may already be complete. But now the “ruler” is by no means a wave analysis, but a news background. Thus, the wave markup can continue to become more complex and become more extended.

Fundamental component:

The news background for the GBP/USD instrument was very strong on Wednesday. First, the Bank of England cut the key rate immediately by 0.5%. Second, reports on GDP and industrial production in the UK were extremely weak. Third, inflation in America exceeded market expectations. Thus, all factors were in favor of the dollar and demand for it increased reasonably. Along with the rise in the dollar, stock markets in the United States and oil prices collapsed again today.

The coronavirus continues to have a devastating impact on the world economy. All measures to stimulate it may be in vain or insignificant. It is unlikely that the world economy will stop paying attention to the epidemic thanks to them. Today, for example, it became known about the quarantine in America, according to which Europeans will not be able to get into the country in the next 30 days.

General conclusions and recommendations:

The pound/dollar tool has complicated the current wave markup once again. Thus, I still do not recommend trading now, as the situation in the markets is very unstable and frankly shocking. After completing the construction of wave E, using the MACD “up” signal, it will be possible to consider the possibilities of buying the instrument, however, this is only based on the current wave marking, which involves completing the construction of a downward set of waves, the latter in which E.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom