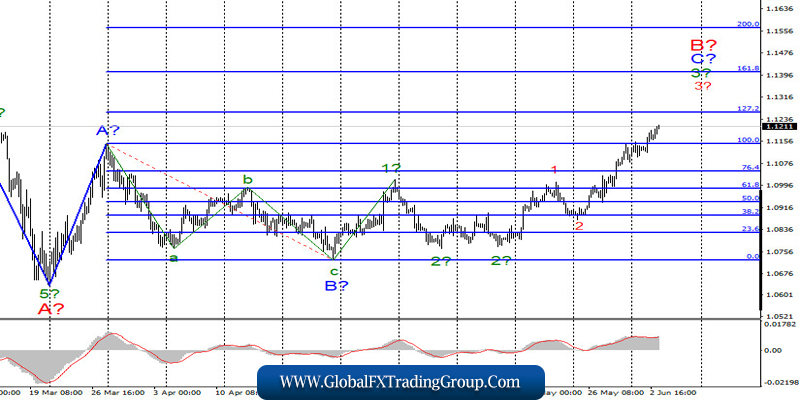

EUR / USD

On June 2, the EUR/USD pair gained about 30 more basis points and continues to build the expected wave 3 in 3 in C in B of the upward trend section. If the current wave markup is correct, then the increase in quotes will continue with targets located near the 127.2% and 161.8% Fibonacci levels. On the other hand, an unsuccessful attempt to break through any of these levels may lead to a departure of quotes from the reached highs and, possibly, the construction of a corrective wave 4.

Fundamental component:

On Tuesday, the EUR/USD instrument continued to increase due to all the events taking place in America. Economic news and reports faded into the background. There were, in fact, not so many of them during the first two days of the week. But the national revolt in the United States is gaining impulse and the government of the country does not seem to fully understand how to deal with it.

Let me remind you that the riots began after the murder of African-American George Floyd by the police of one of the states. At this time, rallies and protests, accompanied by riots and looting, are held in more than 40 American cities. Donald Trump is indignant about this, accuses the governors of all states of inaction and calls for resorting to the US Army to suppress the riot.

However, his statements only worsened the situation. If in a country like the USA, where the last riot of comparable scale was about 50 years ago, people take to the streets, which means they are really unhappy with something. And instead of listening to the Americans, whom Trump considers “the best in the world,” the president is going to resort to the help of a regular army.

The media believes that this is not only about racism. Americans are very difficult to endure the economic crisis, tired of quarantine, exhausted to the limit with coronavirus. Many lost their jobs. Thus, the rallies express, rather, a general dissatisfaction with what is happening in the country in recent months, and the murder of George Floyd was just the last straw to all of these.

General conclusions and recommendations:

The euro/dollar pair supposedly continues to build the rising wave C to B. Therefore, I recommend buying the instrument with targets located near the calculated levels 1.1260 and 1.1406, which equates to 127.2% and 161.8% Fibonacci for each new signal “up” MACD.

GBP / USD

On June 2, GBP/USD pair gained about 60 basis points and, thus, continues to build upward wave, supposedly 3 or C. I expect continued growth of quotes of the instrument with targets located near the level of 0.0% Fibonacci and above. A successful attempt to break through the 0.0% level will indicate the readiness of the markets for further purchases of the instrument and confirm the completion of the construction of wave 2 or B, which can still take a more complex and extended form at the moment.

Fundamental component:

There was still no news background in the UK on Tuesday. Markets continue to monitor the situation around the riots in the United States, as well as the negotiations between the UK and the European Union, which resumed this week. There is a lot of unconfirmed information, little official information.

Rumors say that both Brussels and London can make certain concessions, but no one knows which ones and whether they will be enough to reach an agreement. Today, an important ADP report will be released in America that will show the change in the number of workers in the US in the private sector. -9 million is expected. However, the US currency is not in demand now, so this report is unlikely to give the instrument an additional upward impulse.

General conclusions and recommendations:

The pound/dollar pair supposedly completed the construction of the second wave of a new upward trend section. Thus, I now recommend buying a pound with goals located around the 26th and 27th figures, based on the construction of wave 3 or C or wave d in 2 or B (if the wave becomes more complicated) for each new MACD signal “up”. Now, a successful attempt to break through the level of 1.2645 will allow you to buy the pound more confidently.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom