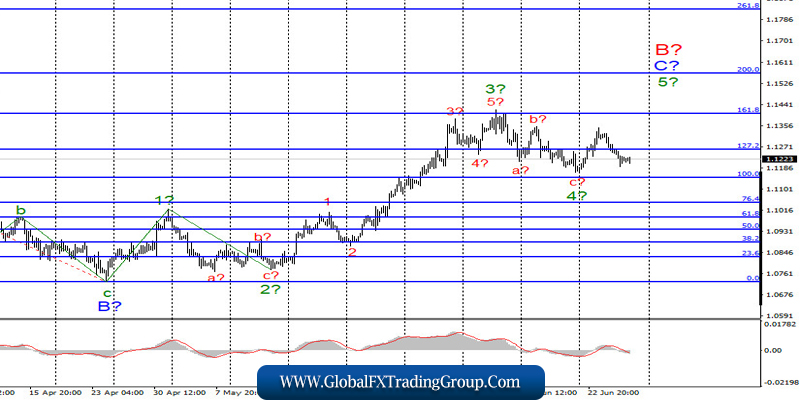

EUR / USD

On June 25, the EUR/USD pair has lost around 40 basis points, but has not violated the current wave counting, which involves the construction of an upward wave of 5 in C in B. Until a successful attempt to break through the minimum of wave 4, the current one will remain unchanged. In the case of a successful attempt to break through, wave 4 will first be considered complicated, and waves e and d can also be constructed inside it. If its construction is not completed after that, then the entire wave markup will require adjustments and additions.

Fundamental component:

On Thursday, the informational background for the euro/dollar pair was quite interesting, but I’m completely not sure that the markets worked it out. Over the past day, the demand for the US dollar continued to remain high, which contradicts the current wave counting. Thus, either the wave counting will have to be clarified, or the demand for the US currency should sharply decline in the next day or two. A report on GDP was released in America yesterday, which showed a 5% reduction, as expected by the markets, a report on applications for unemployment benefits, which in general also did not surprise anyone, and a report on orders for durable goods, which turned out to be much better than expected markets.

Thus, in general, the entire news package can be described as neutral. Nevertheless, the markets found motivation for new purchases of the dollar. But will they continue today when no important news is expected from America? Christine Lagarde, who delivered a speech this morning, could adjust the mood of the markets. The ECB chairman said that “Europe has probably gone through the most difficult phase of the crisis caused by the coronavirus epidemic.”

However, at the same time, the head of the ECB also called on the authorities of the EU countries to prepare for a possible second wave, which, given what is happening in the US, may well begin in Europe. Moreover, she said that the economy of the European Union in the second quarter may decline by 13%. The markets do not expect any more news from the European Union today.

General conclusions and recommendations:

The euro/dollar pair presumably continues to build the rising wave C to B. Thus, I recommend buying the instrument with targets located near the calculated levels of 1.1406 and 1.1570, which equates to 161.8% and 200.0% Fibonacci for each signal “up” MACD calculated on the construction of wave 5 in C in B.

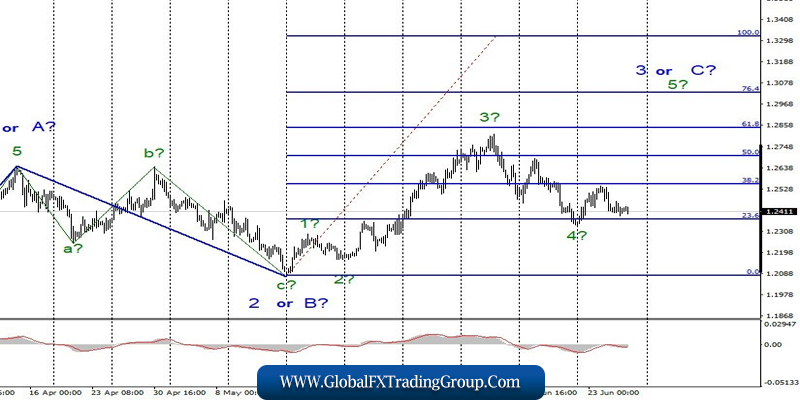

GBP / USD

On June 25, the GBP/USD pair lost only a few basic points, and thus, the current wave markings have not suffered any changes. As before, wave 4 is considered completed, and if this is true, then the increase in quotes of the instrument will resume in the near future within the framework of wave 5 to 3 or C with targets located about 29 figures and above. So far, wave 4 has taken on a pronounced three-wave form, so wave 5 can turn out to be very extended.

Fundamental component:

There was nothing interesting again In the UK on Thursday and the markets excellently played this absent news background, having spent the whole day in a range with an amplitude of no more than 30 points. Today, the news background for the pound will remain the same, since nothing interesting is expected from Britain again. Thus, all attention is paid to the US, where the coronavirus sets new records in the number of infections. I believe that it will be difficult for the US currency to rise due to a new outbreak in America.

General conclusions and recommendations:

The pound/dollar pair supposedly continues to build the rising wave 3 or C. Thus, buy deals remain valid with targets located near the calculated levels of 1.2844 and 1.3030, which corresponds to 61.8% and 76.4% Fibonacci. I recommend buying the pound for each MACD signal “up”, calculated on the construction of a rising wave 5 to 3 or C.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom