EUR / USD

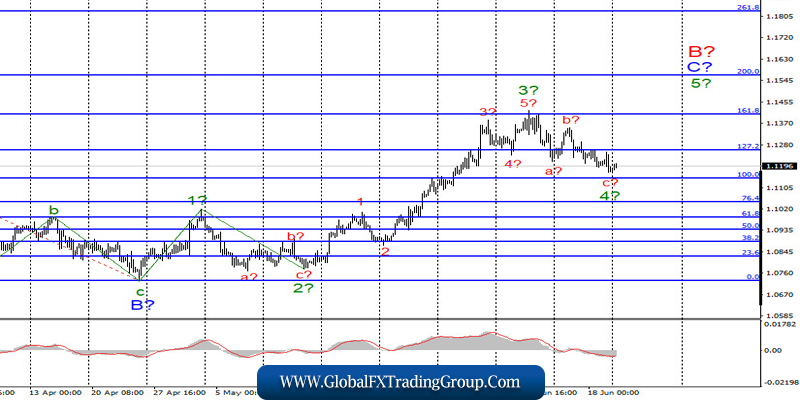

On June 19, the EUR/USD pair lost about 25 basis points and, thus, continued to build the expected wave C in 4 in C in B. If the current wave markup is correct, then the decline in quotes will continue with targets located near the 100.0% Fibonacci level. An unsuccessful attempt to break this level will indicate that the markets are not ready for further sales of the Euro. After the completion of wave 4 in C in B, I expect a resumption of the increase in the quotes of the instrument with targets above the 161.8% Fibonacci level, within the framework of wave 5 in C in B.

Fundamental component:

On Friday, there were few interesting events in America and the European Union.The most interesting thing that cannot be ignored is the results of the video of the EU summit, during which many pressing issues were discussed. However, the most important thing is that representatives of the 27 EU countries discussed the creation of the economic recovery Fund and decided to discuss everything in more detail in a personal meeting in July. Thus, no important decisions were made on this issue, and all discussions and negotiations will be delayed for at least another month.

Therefore, the European economy will not receive the support it needs for a faster recovery for at least two more months. However, there were similar problems in America. If earlier, the US Congress and Donald Trump almost freely decided on packages of assistance to the economy for several trillion dollars, the adoption of a new package was rejected by the Democrats, who believe that Donald Trump and the Republicans want to raise their own ratings with this package on the eve of the presidential election, while the national debt is growing and is already 26 trillion dollars.

However, the Fed Chairman supports the Republican initiatives and also believes that workers, households and businesses need additional financial assistance. The euro/dollar instrument reacts rather reticently to these messages. Markets are clearly waiting for more important and interesting information, but it will not be available today.

General conclusions and recommendations:

The euro/dollar pair is supposedly continuing to build the upward wave C in B. Thus, I recommend buying the instrument with targets located near the calculated levels of 1.1406 and 1.1570, which equates to 161.8% and 200.0% Fibonacci for new signal MACD “up”, which can announce the completion of construction of a wave 4 in C in B.

GBP / USD

On June 19, the GBP/USD pair lost about 75 basis points. Thus, at the moment, wave 3 or C complicates its internal structure and continues its construction. If the current wave marking is correct, then the increase in quotes will resume after the completion of the construction of wave 4 with targets located above the 29th figure. An unsuccessful attempt to break through the 23.6% Fibonacci level will indicate the possible completion of the construction of wave 4. On the other hand, declining the instrument’s quotes below 23.6% will require adjustments and additions to the current markup.

Fundamental component:

A quite interesting retail sales report for May was released in the UK on Friday. According to its data, retail trade grew by 12% m/m in May and declined by 13.1% y/y. Thus, the numbers were less weak (or stronger) than the markets had expected. However, this did not particularly help the pound, demand for which remained low all day. The main question this week is whether the markets will start buying the pound again, in accordance with the wave markup, or whether certain adjustments will have to be made.

General conclusions and recommendations:

The pound/dollar pair supposedly continues to build the rising wave. Thus, purchases remain valid with targets located near the estimated levels of 1.2844 and 1.3030, which corresponds to 61.8% and 76.4% Fibonacci. I recommend buying the pound on the MACD signal “up”, especially in the case of an unsuccessful attempt to break through the level of 1.2372, in the hope of building a new upward wave.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom