EUR / USD

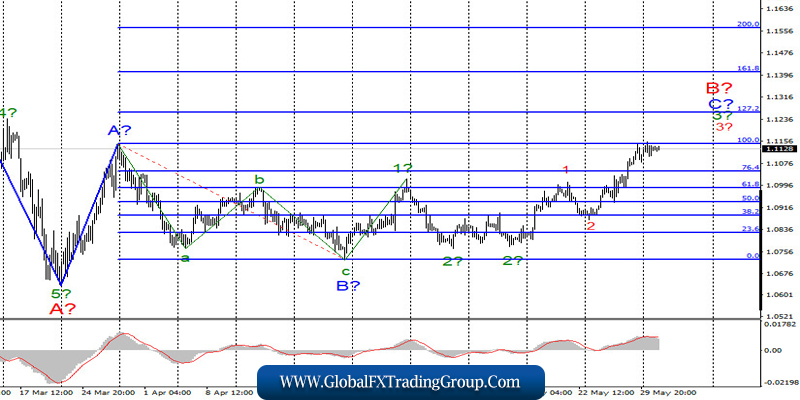

On June 1, the EUR/USD pair gained about 30 more basis points and, although this is not much, continues to build the estimated wave 3 in 3 in C to B of the upward trend section. If the current wave counting is correct, then the increase in quotes will continue with targets located near the levels of 127.2% and 161.8% Fibonacci. An unsuccessful attempt to break through the 100.0% level may lead to a departure of quotes from the reached highs and, possibly, the construction of a correctional wave 4.

Fundamental component:

On Monday, the EUR/USD continued to rise thanks to all the events taking place now in America. In the midst of the financial crisis caused by the pandemic and subsequent quarantine worldwide, the number one precedent was the killing of a black guy by a white policeman in the United States. After this resonant event, the whole country was covered with rallies and protests threatening to develop into a nationwide rebellion. And it’s rather difficult to say what exactly the protesters demand.

The policeman who killed George Floyd has already been detained and is in custody. However, riots are mounting, and so even US President Donald Trump had to go down to the bunker, as the protesters got to the White House. Trump has already stated that he is ready to use military force in order to stop the riots throughout the country. However, it is not so easy to send troops into one’s own country; approval by Congress and the basis for such actions are required.

In general, the United States is now in complete chaos. Instead of working to restore a crumbling economy, the country is involved in rallies and riots. Of course, the demand for US currency in the currency market is only declining because of this. It is unlikely that Donald Trump is very upset due to the fall of the US dollar, since he intended to make the dollar as cheap as possible from the very beginning of his presidential term. However, what is happening in the country in 2020 reduces his chances of being re-elected in November of that year.

General conclusions and recommendations:

The euro/dollar pair presumably continues to build the upward wave C in B. Thus, I recommend buying the instrument with targets located near the calculated levels of 1.1260 and 1.1406, which equates to 127.2% and 161.8% Fibonacci for each new signal “up” MACD. The peak of wave 1 has been updated, and a successful attempt to break through the level of 1.1149 will help the euro continue to increase, while an unsuccessful one will lead the quotes to move away from the highs reached.

GBP / USD

On June 1, the GBP/USD pair gained about 150 basis points and thus, continues to build an upward wave, presumably 3 or C. I expect continued growth of quotes of the instrument with targets located near the level of 0.0% Fibonacci and above. There also remains the option in which wave 2 or B will take on a more complex form. In this case, the construction of wave d in 2 or B is now continuing, with targets also located near the 0.0% Fibonacci level.

Fundamental component:

There was still no news background in the UK on Monday. There was one single report on business activity in the manufacturing sector, which did not interest the markets. The same report came out in the USA and the market reaction was the same. There are topics in the world that are much more attracting the attention of markets than business activity. There will be no reports again in the UK on Tuesday, however, markets may be interested in the negotiations between Brussels and London that began the day before. This round will most likely also end in nothing. Thus, the British may also soon lose some of the demand of the markets.

General conclusions and recommendations:

The pound / dollar pair supposedly completed the construction of the second wave of a new upward trend section. Thus, I now recommend buying the pound with goals located around the 26th and 27th figures, based on the construction of wave 3 or C or wave d in 2 or B (if the wave becomes more complicated) for each new MACD signal “up”. At the same time, a successful attempt to break through the level of 1.2645 will allow you to buy the pound more confidently.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom