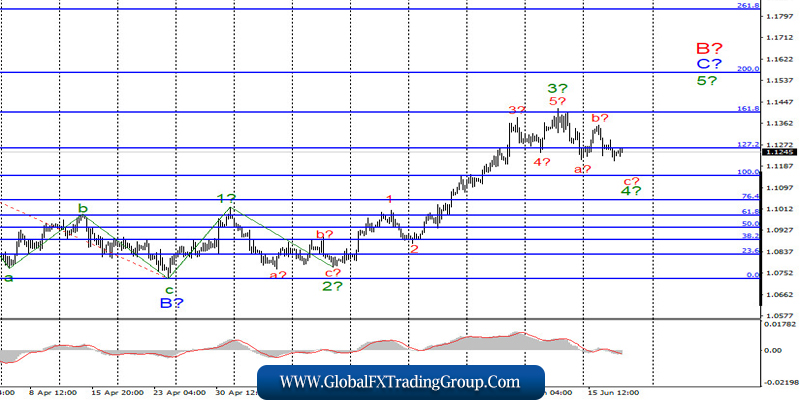

EUR / USD

On June 17, the EUR/USD pair lost about 20 basis points and thus, continued to build the expected wave C in 4 in C in B. If this is true, then the decline in quotes will continue with targets located near the 100.0% and 76.4% Fibonacci levels. After completing the construction of the current wave, I expect to resume the increase in the quotes of the instrument with goals that are above the 161.8% Fibonacci level, within wave 5 to C to B.

Fundamental component:

On Wednesday, there were few interesting events in America and the European Union. In general, there are only one or two topics that are hot. One of these topics is the coordination of the 750 billion package of assistance to the European economy. Let me remind you that earlier proposals that were somewhat similar in nature were rejected, since the southern countries cannot come to a common opinion with the northern countries.

And since the decision to form a recovery fund, as well as its sources and methods of debt repayment, requires that all EU member States vote unanimously, the most affected by the epidemic, Italy, Spain, Portugal, and Greece have not received any assistance yet and can wait for it for a very long time. The EU Summit will be held tomorrow, and all these issues will be discussed at it. The main problem is how to provide assistance to the most affected countries.

After all, everyone will have to “chip in” the Fund, which means that all EU countries will also have to give loans. If, at the same time, Italy or Spain receive several tens of billions of euros free of charge, it will not be entirely honest with those countries that do not need such serious assistance and, moreover, will have to pay for this assistance. It is not surprising that Austria, the Netherlands, Finland, Sweden and Denmark oppose such an initiative of the European Commission.

And at the next summit, they will either need to be persuaded, or there will be no recovery fund at all. This is a very serious issue for the Eurozone, as well as for the Euro currency, which is still doing well and, according to the current wave markup, has even a good chance of continuing to increase.

General conclusions and recommendations:

The euro/dollar pair is supposedly continuing to build the rising wave C to B. Therefore, I recommend buying the instrument with targets located near the calculated levels of 1.1406 and 1.1570, which equates to 161.8% and 200.0% Fibonacci for new signal «up» MACD, which can announce the completion of construction of a wave 4 in C in B.

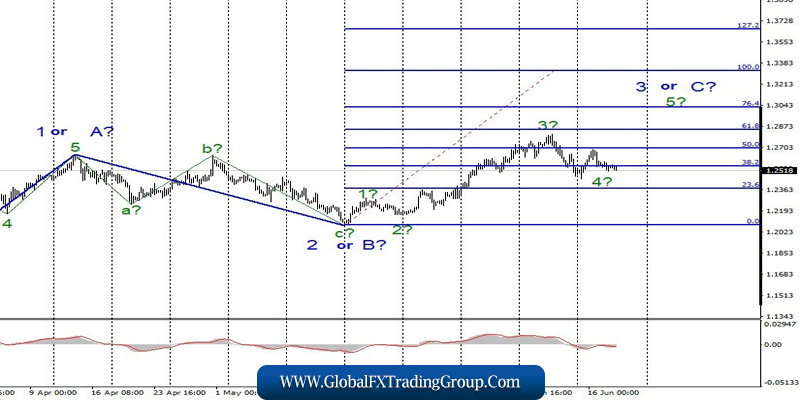

GBP / USD

On June 17, the GBP/USD lost another 30 basis points. Thus, at the moment, the internal correctional wave of 3 or C presumably continues its construction. The current wave count is ambiguous and suggests the type and possible completion of construction of wave 3 or C, and the resumption of increase within wave 5 to 3 or C. In general, the whole wave 3 or C can turn out to be very long and complex.

Fundamental component:

The consumer price index was released in the UK on Wednesday, which declined compared to the previous month to 0.5% y / y. Of course, this report did not cause an increase in demand for the pound. Today, just an hour ago, the results of the meeting of the Bank of England became known. The key refinancing rate remained unchanged at 0.1%, and the asset repurchase program was expanded by £ 100 billion. On this news, the pound is likely to continue to decline along with the US currency.

General conclusions and recommendations:

The pound/dollar pair supposedly continues to build the rising wave. Thus, purchases remain valid with targets located near the estimated levels of 1.2844 and 1.3030, which corresponds to 61.8% and 76.4% Fibonacci. I recommend buying the pound for each MACD signal “up”, at the same time be on the lookout, as the instrument may unexpectedly complete the construction of the upward trend section.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom