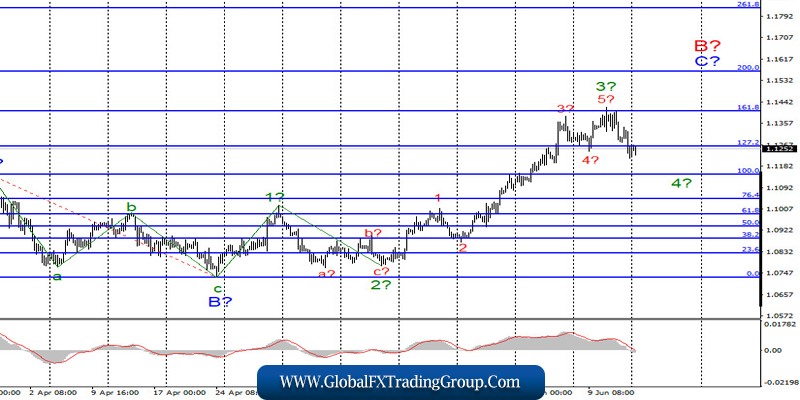

EUR/USD

On June 12, the EUR/USD pair lost around 40 basis points and continued building the expected wave 4 in C in B. If this is true, then the decline in the instrument’s quotes will continue in the direction of the 100.0% and 76.4% Fibonacci levels. However, the upward section of the trend does not yet look fully completed and completed. Thus, after completing the construction of the correction wave, the formation of a wave 5 in C in B is expected.

Fundamental component:

There were practically no economic reports and news in the world last Friday. Markets could only pay attention to the report on industrial production in the European Union, which, without any surprises, turned out to be extremely weak. Therefore, we can conclude that this particular report served as the reason for a new decline in demand for the euro, however, I believe that it has nothing to do with it.

The Euro currency has been growing for about two weeks in a row, and it seems that this growth was far from always based on some optimism from Europe rather, the negative from the United States. However, in general, markets continue to be nervous from time to time, since the coronavirus could not be defeated, the economies of many countries of the world are restarted, but it will take a long time to fully recover.

In America, the growth of coronavirus diseases has already been recorded, the country is in a political depression, and President Donald Trump is more concerned about his low political ratings than the strikes and protests surrounding the racist scandal and the COVID 2019 epidemic. In general, 2020 can definitely be called “black”. It is not surprising that there are such movements in the markets from time to time that are difficult to explain.

It is often necessary to rely only on wave analysis (or other types of technical analysis), because the fundamental analysis now does not allow us to make a conclusion about the future movements of instruments. No news is expected from Europe or the US on Monday.

General conclusions and recommendations:

The euro/dollar pair is supposedly continuing to build the rising wave C to B. Therefore, I recommend buying the instrument with targets located near the calculated levels 1.1406 and 1.1570, which equates to 161.8% and 200.0% Fibonacci for each new signal “up” MACD. At this time, the instrument is in the process of constructing a correctional wave 4 in C to B, so the instrument may decline for some time.

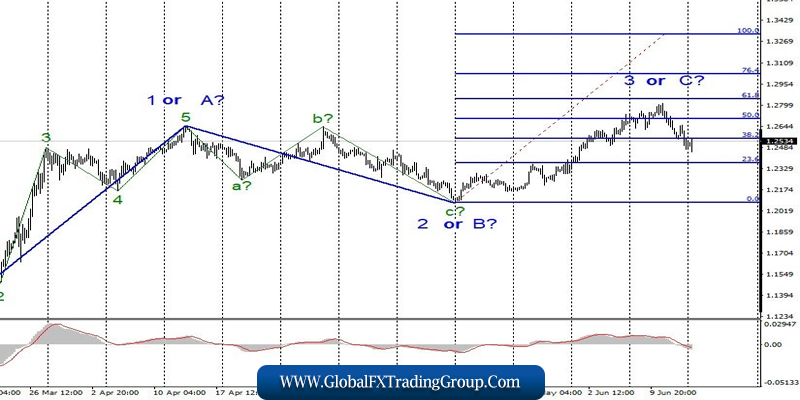

GBP/USD

On June 12, the GBP/USD pair lost about 70 basis points. Thus, at the moment, the construction of an internal correctional wave of 3 or C, which does not look fully completed yet, is supposedly continuing. If this is true, then the increase in quotes will resume in the near future, and the whole wave 3 or C may take a very long form. At the same time, the news background from the UK does not at all suggest a further increase of the pound.

Fundamental component:

The GDP in April and industrial production reports was released in the UK last Friday. And these data turned out to be extremely weak, even worse than the negative expectations of the markets. Industrial production declined by 20.3%, and GDP by 20.4%. Thus, the demand for the British has declined again and is likely to continue to decline. However, I would like to note that the British economy will suffer from coronavirus more than the economies of many European countries or even the American one.

For Britain, Brexit continues to be in first place, which has already inflicted severe damage to the economy and continues to do so. Most likely, its negative impact will be noticeable even when the country officially leaves the European Union, that is, in 2021 and subsequent years.

General conclusions and recommendations:

The pound/dollar pair supposedly continues to build an upward wave. Thus, purchases remain valid with targets located near the estimated levels of 1.2844 and 1.3030, which corresponds to 61.8% and 76.4% Fibonacci. I recommend continuing to buy the pound at the new MACD signal “up”, while at the same time being on the alert, as the instrument may unexpectedly complete the construction of an upward trend.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom