EUR / USD

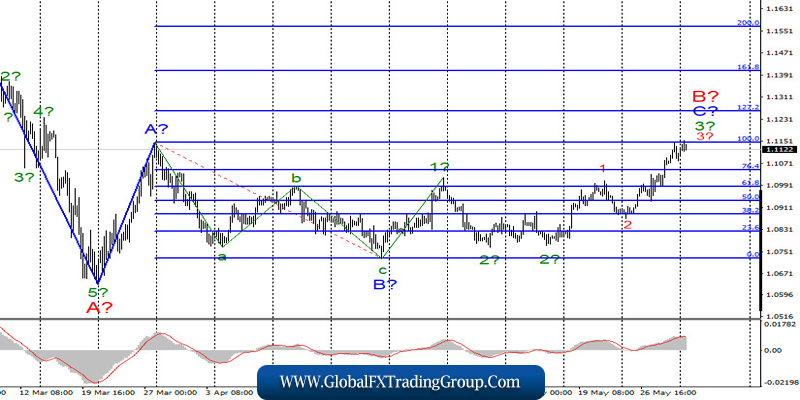

On May 29, the EUR/USD pair gained about 20 more basis points and, thus, continues to build the estimated wave 3 in 3 in C in B of the upward trend section. If this is true, then the increase in quotes will continue with targets located near the levels of 127.2% and 161.8% Fibonacci. On the other hand, an unsuccessful attempt to break through the 100.0% level may lead to a departure of quotes from the reached highs and, possibly, the construction of a correctional wave 4.

Fundamental component:

On Friday, the EUR/USD instrument continued to rise, although, at first glance, there were no special reasons for this. Economic statistics in Europe and America turned out to be rather weak again. In the European Union, the consumer price index is steadily approaching 0.0%, that is, deflation. In America, citizen spending declined more than 10% in April. And although incomes have increased, if we correlate this report with unemployment indicators, it becomes clear that for the economy, there is no positive result from an increase in incomes of 10.5%.

But last week, there were riots that were growing in America, which turned into almost an open riot over the weekend. The reason is the murder of a young African American man by a white policeman. In addition, Fed Chairman Jerome Powell spoke on Friday, who said during a lecture at Princeton University, that the Central Bank did everything it could. Let me remind you that the Fed lowered rates almost to zero, expanded the program of quantitative easing to virtually unlimited proportions.

According to Jerome Powell, the Fed is in no hurry to continue to cut rates, considering this an inappropriate step. In addition, he fears the second wave of the pandemic and, as a result, the introduction of a new quarantine in the country. According to Powell, the economy may not be able to cope with the second wave and recovery will take even longer. In general, disappointing news is coming from the United States, so the dollar is not in demand at all.

General conclusions and recommendations:

The euro/dollar pair supposedly continues to build the rising wave C to B. Therefore, I recommend buying the instrument with targets located near the calculated levels 1.1260 and 1.1406, which equates to 127.2% and 161.8% Fibonacci for each new signal “up” MACD. The peak of wave 1 has been updated, and a successful attempt to break through the level of 1.1149 will help the euro continue to increase, and an unsuccessful one will lead the quotes to move away from the highs reached.

GBP / USD

On May 28, the GBP/USD pair gained about 20 basis points and, thus, continues to build upward wave, supposedly 3 or C. If this is true, then the increase in quotes of the instrument will continue with targets located near the level of 0.0% Fibonacci and above. There also remains the option in which wave 2 or B will take on a more complex form. In this case, the construction of wave d in 2 or B is now continuing, with targets also located near the 0.0% Fibonacci level. Fundamental component: There was still no news background in the UK on Friday. Therefore, the attention of the markets was still drawn to events in the United States. The pound also continues to grow on news and events from America, but not as quick as the euro. Today, there was an index of business activity in the manufacturing sector in the UK, which almost completely coincided with market expectations. The same thing was published in the European Union. These reports are not very significant right now. On the other hand, a report on business activity will also be released today in America, to which markets will also not pay attention. General conclusions and recommendations: The pound/dollar pair supposedly completed the construction of the second wave of a new upward trend section. Thus, I now recommend buying a pound with goals located around 26th and 27th figures, based on the construction of wave 3 or C or wave d in 2 or B (if the wave becomes more complicated) for each new MACD signal “up”. A successful attempt to break through the level of 1.2645 will allow you to buy the pound more confidently.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom