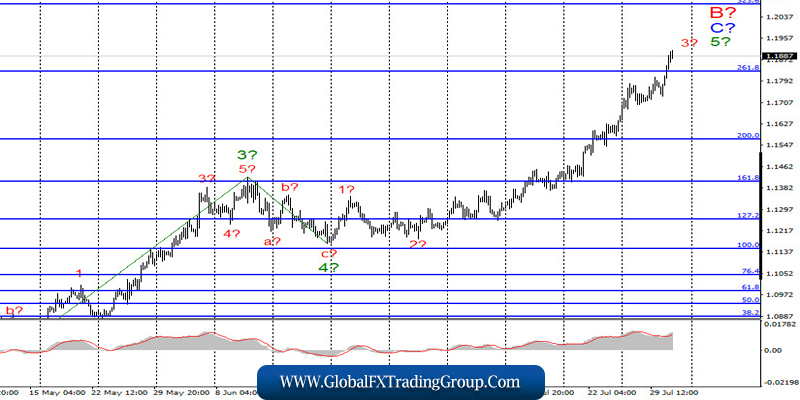

EUR / USD

On July 30, the EUR/USD pair gained about 60 pips and thus, continues to build the supposed wave 3 in 5 in C in B, which takes on a very complex and extended form. But at the same time, there are still no signs of completion of this wave. You should be reminded that after the completion of this wave, a downward pullback and renewal of the rally is expected, as it takes another wave 5 in 5 in C in B to complete the wave structure. Moreover, a successful attempt to break through the 261.8% level indicates that the markets are ready for further purchases of the euro. Thus, the entire wave C to B may end near the 323.6% Fibonacci level.

Fundamental component:

Yesterday was truly a nightmare for the US currency. No, the US dollar did not collapse by 200 or 300 basis points, it continued to trade with the same amplitude with a decline. However, a new news pack from America was a verdict for the US currency. To begin with, GDP in the second quarter declined by almost 33%. No economist in the country can recall such a fall. Historians and political scientists say that if there was such a fall in the economy, it was 100 years ago, during the Great Depression.

Secondly, Donald Trump proposed yesterday to postpone the elections in the country due to the COVID-2019 pandemic. The President of the United States wrote on his Twitter that citizens should be able to vote in person, not by mail, and also safely, which cannot be achieved given the current epidemiological situation in the country. The president’s proposal drew a flurry of criticism from both Democrats and his own party members, Republicans. It should be noted that elections in the United States have never been postponed or canceled, even during the world wars, which, of course, Trump himself could not fail to know.

Thus, Trump’s attempt to buy time and hold elections later, when the situation in the country improves, failed. Well, the third thing I draw your attention to is a new increase in the number of cases per day in the US. Yesterday, the number of new infections was 90 thousand. Thus, the coronavirus continues to infect more and more of the American population, in such conditions it is extremely difficult to demand or at least expect a rapid recovery from the US economy, as Jerome Powell, Fed Chairman, said two days earlier.

Thus, while the “golden time”, what Trump promised is being postponed indefinitely. Today, I recommend paying attention to the inflation and GDP reports for the euro area, which may slightly reduce the demand for the EU currency.

General conclusions and recommendations:

The euro/dollar pair presumably continues to build an upward wave C in B. Thus, I recommend staying in buying the instrument with targets located near the calculated level of 1.2084, which equates to 323.6% Fibonacci.

GBP / USD

The GBP/USD pair gained about 100 pips by the end of the day on July 30 and thus, continues the construction of the expected wave 3 in 5. A successful attempt to break through the 100.0% Fibonacci level led to further growth of the British currency with targets located near the calculated 127.2% Fibonacci level. However, wave 5 still doesn’t look complete. A successful attempt to break through the 127.2% Fibonacci level will indicate that the markets are ready for further purchases of the pound.

Fundamental component:

There was not a single important economic report in the UK this week, nevertheless, there was also little other news. Thus, the markets are still trading this instrument based on US statistics and news from this country. And this news is so bad that the US dollar has no chance to start growing.

General conclusions and recommendations:

The pound/dollar pair continues to build upward wave 5, nothing changes. Therefore, I recommend at this time to continue buying the instrument for each MACD signal “up” with targets located around the level of 1.3183, which equates to 127.2% Fibonacci.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom