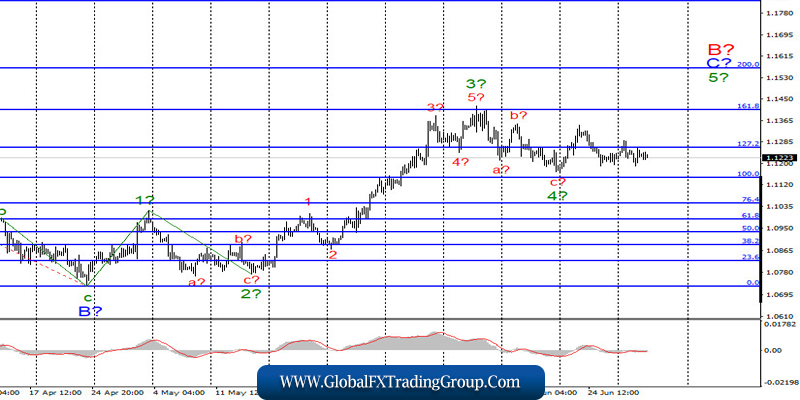

EUR / USD

On June 30, the EUR/USD pair lost only a few basis points, and thus, the current wave counting practically did not suffer any changes. The expected wave 4 in C in B has completed its construction, so now it is still expected to build an upward wave 5 in C in B. A successful attempt to break through the minimum of wave 4 in C in B will complicate the current wave markup and further lower the quotes of the instrument.

Fundamental component:

On Tuesday, the background for the euro/dollar pair was strong enough. However, most of it concerned various statements by senior officials, mainly the United States. For Europe and the United States, key issues are now providing new packages of assistance to the economy. If in Europe, the process of discussion between the finance ministers of all 27 states is paused due to serious disagreements between the northern and southern countries, then in America, only democrats and republicans need to come to an agreement.

Given the fact that Fed Chairman Jerome Powell and Finance Minister Steven Mnuchin have long been urging Congress to allocate additional funds to help the economy begin to recover, the chances of approval of the package are greater in the United States. At the same time, a conflict continues to increase between America and China.

Washington still went into a new confrontation with Beijing, although it is still a very weak option. To begin with, the White House, in response to the Beijing Bill on National Security in Hong Kong, which, according to US officials, can level Hong Kong’s autonomous status, decided to exclude this county from export restrictions and also deprive it of some more preferences.

On the other hand, the European Union consumer price index for June was released yesterday, which turned out to be slightly higher than forecast, but did not cause an increase in demand for the euro. The same applies to today’s reports on unemployment and changes in the number of unemployed in Germany.

The data came out better than market expectations, but this did not lead to an increase in the European currency. Important data on the number of people employed by ADP will be released in the USA in the second half, as well as business activity indexes in the production of ISM and Markit. This will be followed by the minutes of the last meeting of the Fed later in the evening.

General conclusions and recommendations:

The euro/dollar pair presumably continues to build the rising wave C to B. Thus, I recommend buying the instrument with targets located near the calculated levels of 1.1406 and 1.1570, which equates to 161.8% and 200.0% Fibonacci for each signal “up” MACD calculated on the construction of wave 5 in C in B.

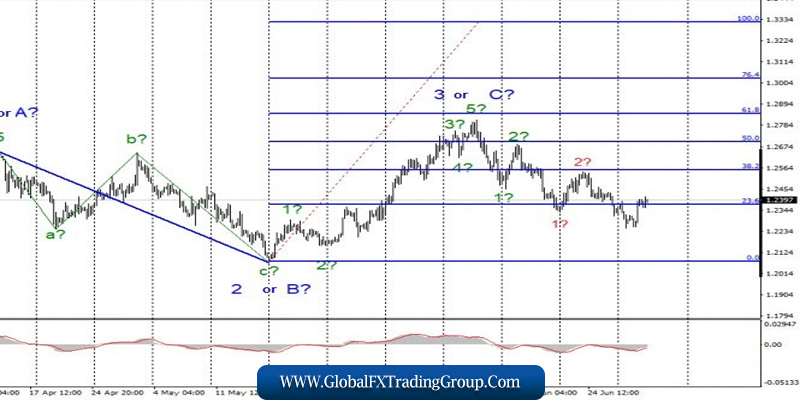

GBP / USD

On June 30, the GBP/USD pair gained 100 basis points, and the entire current wave marking has undergone certain changes and adjustments. Thus, the current wave counting means completion of construction of the rising portion and wave trend 3 or C. If this is true, then the construction of a new bearish set of waves has begun and the construction of wave 3 into 3 is currently ongoing. Thus, it is expected that quotes will resume to decline towards the 0.0% Fibonacci level.

Fundamental component:

Higher GDP for the first quarter, which was worse than market expectations was released in the UK on Tuesday. However, contrary to the logical decline of the pound, this currency began to rise. Today, Britain has a higher index of business activity in the manufacturing sector for June, which amounted to 50.1, which can be considered a positive value. However, in the afternoon,there will be no less important reports on the same business activity and on changes in the number of people employed in the honest sector, which can very much affect the mood of the markets.

General conclusions and recommendations:

The pound/dollar pair has greatly complicated the current wave marking, which now involves the construction of a downward trend section. Thus, at this time, I recommend selling the pound for each MACD signal down in order to build a 3 in 3 wave with targets located near the calculated level of 1.2077, which equates to 0.0% Fibonacci.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom