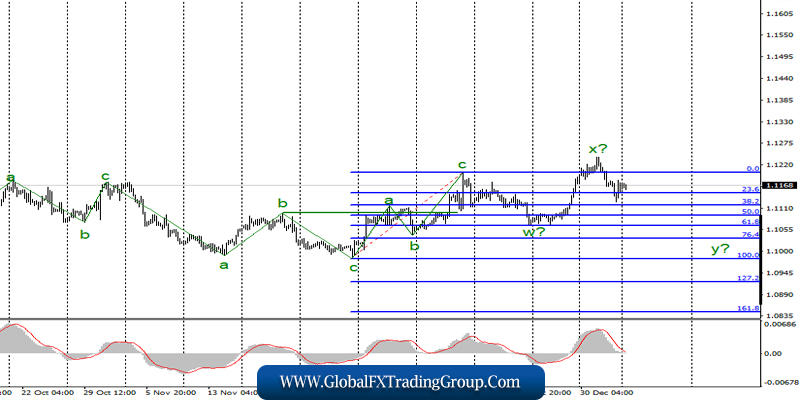

EUR / USD

On January 3, the EUR / USD pair lost another 10 basis points as part of building a bearish wave, presumably y. If this assumption is correct, then the decline in quotations will continue with targets located near the 10th figure and below.

The wave pattern now has a rather complicated appearance, and the instrument continues to move mainly with three wave structures. An alternative scenario suggests a successful attempt to break through the maximum of wave x.

Fundamental component:

The news background for the euro-dollar instrument was unfavorable for the US currency on Friday. Firstly, the ISM services business activity index turned out to be very weak, which amounted to only 47.2, which means its deterioration compared to November.

At the same time, Markit business activity indices (including those for the service sector) remain above 50.0, which is such a mismatch. Secondly, America attacked a military base near Baghdad in Iraq, and as a result of which a senior military official, Colonel Soleimani, was killed.

According to the assurance of the American side, which considers the organization headed by Soleimani to be terrorists, the colonel was preparing attacks on US embassies in the Middle East. To prevent these attacks, President Donald Trump decided to strike first. Iraq has already promised to “brutally take revenge” and Trump promised to attack 52 targets in Iraq if Baghdad tries to harm the Americans.

This story means increased geopolitical risks. Today, a number of composite indices of business activity and indices for the service sector in the EU countries, in particular Germany, Spain, Italy, France, and Great Britain, will be released and almost all of them are expected by the markets without much change.

Only the German composite index can stay below 50.0. Now, exactly the same two indices will come out after dinner in America, and exactly with the same market expectations. Moreover, forecasts and previous values completely coincide for both Markit – 52.2 indices. Thus, I believe that the markets will show a very restrained reaction to these economic reports.

General conclusions and recommendations:

The euro-dollar pair allegedly completed the construction of the upward trend section. Thus, I would recommend continuing to sell the instrument with targets located around the levels of 1.1034 and 1.0982, which corresponds to 76.4% and 100.0% Fibonacci, since there is now a high probability of building a bearish wave.

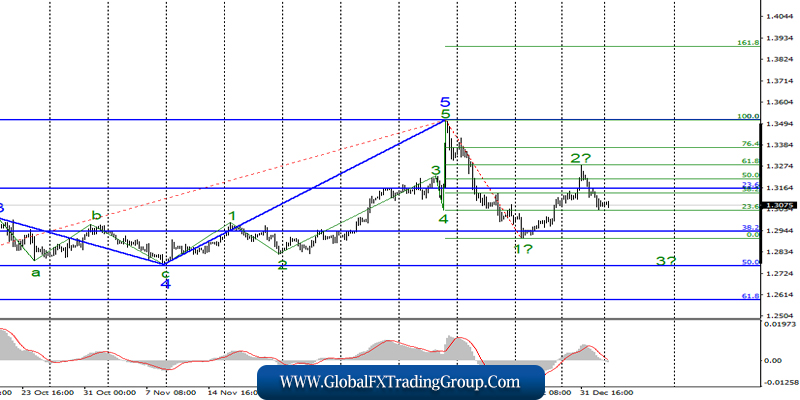

GBP / USD

On January 3, the GBP / USD pair fell by 55 basis points and, therefore, continues to build a downward wave 3 as part of a new bearish trend section with targets much lower than the 29th figure.

The entire downward trend section that forms after December 12 may take a three-wave form, but I believe that there is more chance of building a full-fledged 5-wave structure, given the news background, which remains not very favorable and optimistic for the pound.

On the contrary, an unsuccessful attempt to break through the level of 1.3281, which equates to 61.8% Fibonacci, indicates that the markets are ready for new strong pound sales.

Fundamental component:

The news background for the GBP / USD instrument on Friday was exactly the same as for the EUR / USD instrument. However, if the euro was able to slightly improve its position in the afternoon, the pound will then only stopped in its decline near the level of 1.3050.

Now, quotes can move away from the lows reached, after which I am waiting for the resumption of the construction of the downward trend section. Today, index of business activity in the service sector for December will be released in the UK.

Therefore, markets are waiting for a value of about 49.2 and will be sincerely happy if the forecast is exceeded. At the same time, a single positive economic report from Britain will clearly not be enough to break the desire of the markets to continue large sales of the British currency.

Let me remind you that the main concerns of the markets are connected with the same Brexit, or rather, with the possible failure of negotiations with Brussels regarding a trade agreement, which will nullify all the efforts of Parliament to prevent Brexit without a deal.

Thus, the pound-dollar instrument may fall back slightly from local lows today, but it is unlikely to be very high.

General conclusions and recommendations:

The pound / dollar instrument continues to build a new downward trend. I recommend continuing to sell the instrument with targets near the level of 1.2764, which corresponds to the 50.0% Fibonacci level, as wave 2 or b is supposedly completed, as indicated by an unsuccessful attempt to break through the 61.8% Fibonacci level.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom