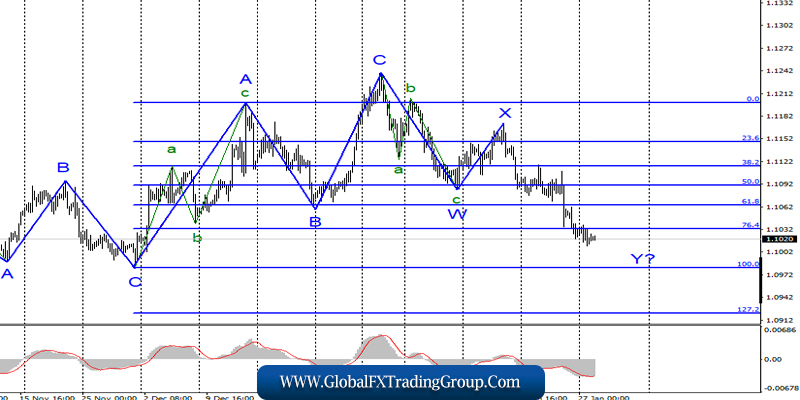

EUR / USD

On January 27, the EUR / USD pair lost about 10 basis points, and continues building a prospective wave Y. A successful attempt to break through the 76.4% Fibonacci level indicates the willingness of the markets to continue and further get rid of the euro currency with goals located near the level of 1.0982, and possibly even lower.

On the contrary, an unsuccessful attempt to break the level of 1.0982 may lead to the completion of the construction of wave Y and the transition of the instrument to the construction of a new upward trend section.

Fundamental component:

There was no news background on Monday. There is a continuation of a sluggish decline in the European currency, which began last week after the ECB meeting and a speech by Christine Lagarde, which, in the general opinion of the market, was excessively “dovish. As I said, there was no important and interesting news yesterday.

The world continues to discuss a new problem in healthcare – a new virus in China, which has already spread to Europe, the United States, and Australia. In America, the US Senate continues to consider the case of Donald Trump exceeding his official duties, as well as obstructing the work of Congress, which theoretically could lead to impeachment. However, this is unlikely to happen.

Despite the fact that new witnesses and new testimonies appeared in the case, few people believe that 10 months before the US election, that is, at a time when it is time to prepare for election campaigns, the Senate, in which the majority of senators are Republicans, will go into direct conflict with the President.

Today, the news background for the instrument will intensify in the afternoon, as a report on orders for durable goods in the US is released. The expectations of the market come down to fairly low numbers, but the main thing is what the real values will be and how much they will exceed forecasts or turn out to be worse than them.

If the data from America is strong enough, then the Fibonacci level of 100.0% can be tested today. A little later, the US consumer confidence index will be released, but it is much weaker than the first report.

General conclusions and recommendations:

The euro-dollar pair is supposedly continuing to build a downward set of waves. Thus, I would recommend continuing to sell the instrument with targets located around 1.0982, which corresponds to 100.0% Fibonacci. On the other hand, an unsuccessful attempt to break through this level will lead to a move away from the lows reached in quotes and possibly the completion of construction of a wave the Y.

GBP / USD

On January 27, GBP / USD pair lost about 20 basis points and continues to decline in the framework of the alleged wave of 3 or c. The trend section, which began its construction after December 23, is very complex and confused in its internal structure and can still transform into wave 2 or b.

At the same time, an unsuccessful attempt to break the level of 1.3162, which equates to 23.6% Fibonacci, indicates the readiness of the pound / dollar instrument to further decrease. Alternatively, a successful attempt to break through the 38.2% Fibonacci level (blue grid) will confirm the continuation of the construction of the downward trend section.

Fundamental component:

There was no news background for the GBP / USD instrument on Monday. Markets have clearly focused on the upcoming meeting of the Bank of England, especially because a decision can be made on Thursday to lower the key rate. However, this event is extremely important even if the Bank of England does not take such a step immediately at the beginning of the year.

Meanwhile, no news is expected from the UK in the first two days of the week. The economic data from America in the afternoon could trigger an increase or decrease in demand for the dollar on Tuesday, January 28. As with the euro, strong data from America support the construction of the downward wave, which I currently expect.

General conclusions and recommendations:

The pound / dollar instrument continues to build a new downward trend. I recommend selling the instrument with targets located near the levels of 1.2941 and 1.2764, which corresponds to 38.2% and 50.0% Fibonacci.

The instrument may complicate wave 2 or b, therefore, the increase may resume to 1.3329 (in case of a successful attempt to break through the 23.6% Fibonacci level), and then it is recommended to consider new sales of the instrument near the level of 1.3329.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom