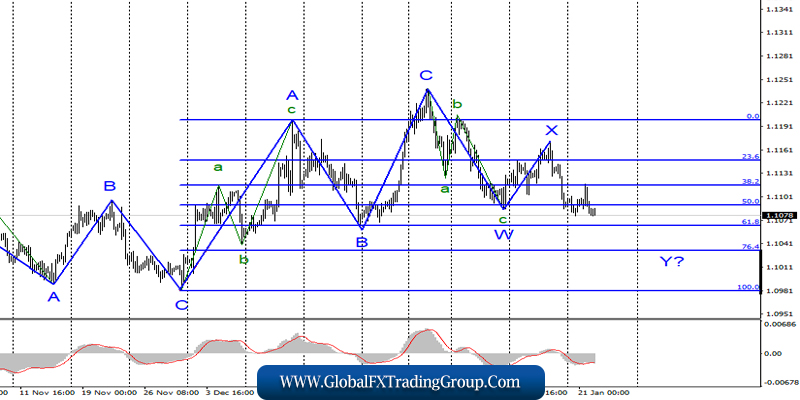

EUR / USD

On January 21, the EUR / USD pair lost about 15 basis points and made an unsuccessful attempt to break through the 38.2% Fibonacci level. Thus, the instrument remained within the framework of constructing the proposed wave Y as part of the downward trend section, which currently assumes a 3-waveform.

If this assumption is correct, then the decline in quotes will continue with targets located around the 10th figure. The whole wave pattern does not look completely unambiguous and the movements of the instrument are mainly due to the construction of correction structures.

Fundamental component:

There was no news background for the instrument on Tuesday. However, this applies only to economic reports. As often happens, the President of the United States Donald Trump made a devastating speech, who stated that he was ready to introduce 20% duties on cars from the European Union, thus starting a trade war if the European Union did not remove all trade barriers for American companies, which, according to Trump, lead to unfair competition.

This problem has matured for a long time. A possible US-EU trade war has been discussed throughout the past year, but Trump already had one trade war with China at that time, and attention to the European Union was weakened.

Now, the American president decided to return to the European Union after signing the first stage of a future trade agreement with China. Donald Trump wants to sign a trade agreement with Europeans and, certainly on terms that favors America.

It has not yet been announced when the US will impose duties on European cars and whether any negotiations are currently underway on this issue. One thing is for sure – the trade war with America for the European Union will be a crushing blow to the economy, which is already going through far from the best of times.

The news background on Wednesday will also be absent for the euro / dollar instrument. However, I would recommend to carefully monitor Trump’s new speeches regarding a possible trade war with Europe.

General conclusions and recommendations:

The euro-dollar pair is supposedly continuing to build a downward set of waves. Thus, I would recommend continuing to sell the instrument with targets located near the levels of 1.1034 and 1.0982, which corresponds to 76.4% and 100.0% Fibonacci.

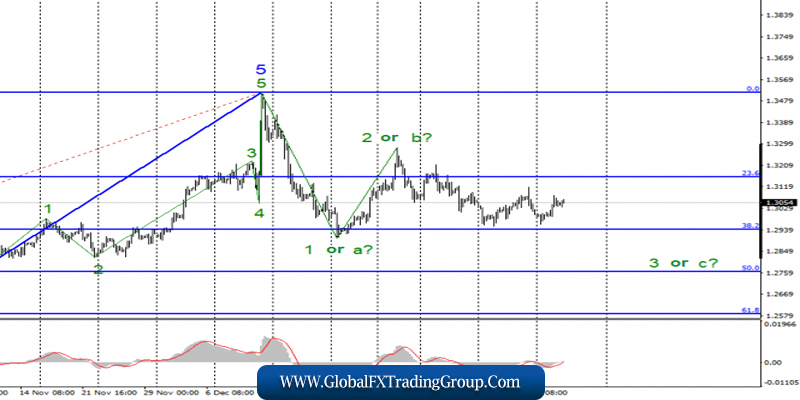

GBP / USD

On January 21, the GBP / USD pair gained about 40 basis points and continues to remain inside the alleged wave of 3 or c, which takes on a rather complex and extended form. This wave, no matter whether it will be with or 3, should continue its construction at the 38.2% Fibonacci level, however, the complexity of the current layout allows for certain adjustments. Thus, I recommend selling the pound / dollar instrument after a successful attempt to break through the 38.2% Fibonacci level.

Fundamental component:

A news background for the GBP / USD instrument was present on Tuesday. Several reports came out in the UK, and, surprisingly, they turned out to be positive. The November unemployment rate was 3.8%, which was what the markets expected to see, the average wage rose by 3.2% and 3.4% (with and without bonuses), which is even slightly better than expected, and the number of unemployment claims turned out to be significantly lower than the forecast of 22.9K.

Thus, the demand for the pound increased during the morning trading yesterday, but so far, there is no feeling that the construction of the downward trend section has been completed. Moreover, there are too many problems in the UK right now, and even more may come up after January 31, when the transition period officially begins, during which trade negotiations with the European Union are to be held.

General conclusions and recommendations:

The pound / dollar instrument continues to build a new downward trend. I recommend selling the instrument again with targets near the level of 1.2764, which corresponds to the Fibonacci level of 50.0%. On the other hand, a successful attempt to break through the 38.2% level will indicate the willingness of markets to continue selling British currency.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom