EUR / USD

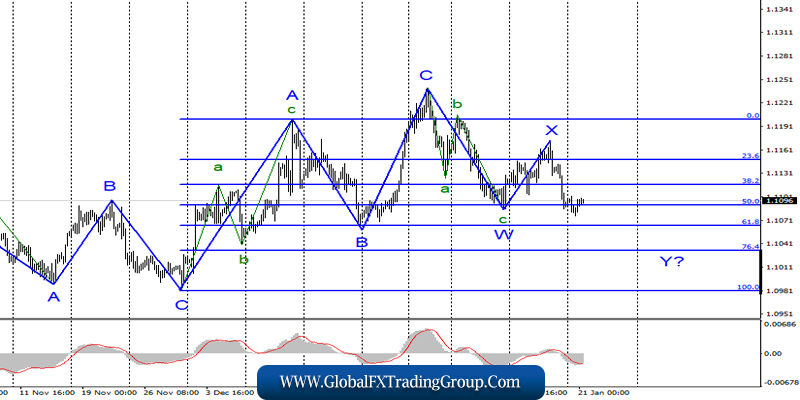

On January 20, the EUR / USD pair gained several basis points, however, such a small increase in the instrument did not in any way affect the current wave marking. Thus, the euro / dollar instrument remains in the framework of creating a downward 3-wave structure, in the wake of the Y.

If this assumption is correct, then the decline in quotes will continue with targets located near the levels of 76.4% and 100.0% Fibonacci. At the same time, I drew my attention once again to the fact that the instrument continues to move mainly with three-wave structures, which, in essence, means the absence of a trend.

Fundamental component:

There was no news background for the instrument on Monday. No economic reports came out, but there was plenty of political news. I do not pay too much attention to the political area, since, of course, the economy is more important for the currency exchange market.

Nevertheless, the United States is now an unprecedented event, which in the entire history of the country, the impeachment of the president of the country only happened twice, and the president was never forcibly removed from his post. As a result, Donald Trump has a ghostly chance of becoming the first.

The accusations of Democratic politicians are that Donald Trump violated the principles on which the Constitution and Democracy are based. He put his interests above state interests, obstructed the work of Congress, and also tried to intervene in the 2020 presidential election, trying to eliminate his main rival, Joe Biden, who just belongs to the Democratic Party.

Thus, the consideration of the case in the Senate will begin today, where 53 of the 100 seats are occupied by Republicans, and 67 votes are required to approve impeachment. That is why I call the entire consideration of the case – meaningless. The Senate will not approve the removal of Donald Trump.

The US President himself understands this, and in a very simple manner “asks” the Senate to quickly justify it and close the case. So now, you can observe this process since no economic reports are listed on the calendar for the coming days.

General conclusions and recommendations:

The euro-dollar pair is supposedly continuing to build a downward set of waves. Thus, I would recommend continuing to sell the instrument with targets located near the levels of 1.1034 and 1.0982, which corresponds to 76.4% and 100.0% Fibonacci, on the new MACD signal “down”.

GBP / USD

On January 20, the GBP / USD pair gained several basis points, but the activity of the markets was too low for the movement to affect the wave markings. The proposed wave 3 or c continues to become more complicated and takes on a very long form.

Moreover, it can not be considered completed at the moment neither as wave 3, nor as wave c. To continue its construction, a successful attempt to break through the 38.2% Fibonacci level is necessary.

Fundamental component:

There was no news background for the GBP / USD instrument on Monday either. The country, along with its government, continues to prepare for Brexit on January 31, for the transition period, and for negotiations with EU leaders regarding further existence.

Meanwhile, markets are receiving more and more evidence that the British economy, if not in distress, is in a recessionary state. Each year, the country’s economy loses $ 70 billion and will continue to lose this money during 2020.

Moreover, the Bank of England warns markets that it is ready to lower its key rate, and economic reports continue to come out weak. Today, we are waiting for data on unemployment, applications for unemployment benefits and changes in wage levels in the UK.

Market expectations are fairly neutral and therefore, real values and their relationship with expectations will be of great importance. Thus, we are waiting for news and are working to lower if we successfully break through the 38.2% Fibonacci level.

General conclusions and recommendations:

The pound / dollar instrument continues to build a new downward trend. I recommend selling this instrument again with targets near the level of 1.2764, which corresponds to the Fibonacci level of 50.0%. At the same time, a successful attempt to break through the 38.2% level will indicate the willingness of markets to continue selling British currency.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom