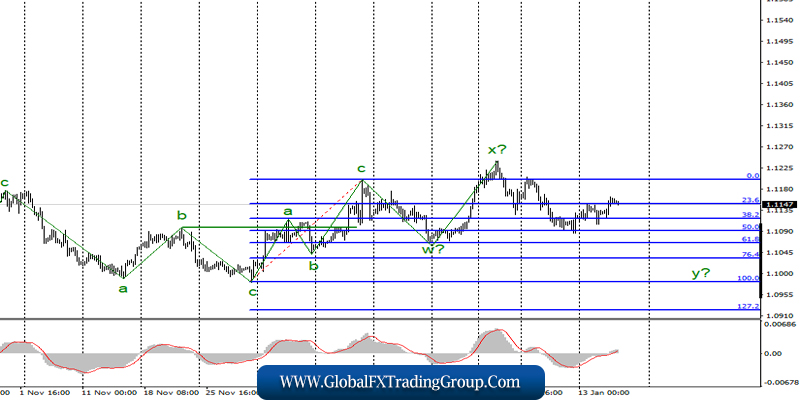

EUR / USD

On January 15, the EUR / USD pair gained about 20 basis points and continued to move away from previously reached lows after an unsuccessful attempt to break through the 50.0% Fibonacci level. At the same time, the alleged wave y still does not seem to be fully equipped. If this is true, then the decrease in quotes will resume with targets located near the 10th figure since I do not see any prerequisites for the resumption of the upward trend section.

Fundamental component:

The news background for the euro-dollar instrument was not strong, but interesting on Wednesday. The next economic report from the European Union was weaker than market expectations, weaker than forecasts. Industrial production in November declined by 1.5% yoy, a month earlier the decrease was 2.2% yoy. On a monthly basis, even an increase of 0.2% was observed, which is still worse than market expectations.

Thus, the euro was supposed to lose another part of demand, but did not. The increase in quotes continues after an unsuccessful attempt to break through the level of 1.1091. Meanwhile, there were no economic reports in America yesterday, so it cannot be said that American news blocked European news.

The euro added contrary to the news background. Today, markets have already witnessed German inflation for December, which turned out to be completely neutral, amounting to 1.5% y / y. This is exactly the figure that markets expected to see.

On the other hand, there will be an index of business activity in the manufacturing sector of the Federal Reserve Bank of Philadelphia, as well as applications for unemployment benefits and retail sales in several variations (retail sales, retail control group and retail sales excluding cars ) in America a little later.

The forecasts for US reports are higher than the values of the previous month, so improvement can be expected. I still continue to expect a resumption of the decline in the euro, believing that this option is now justified by both wave analysis and the news background. At the same time, the speech by Christine Lagarde this evening may have the greatest impact on the currency market.

General conclusions and recommendations:

The euro-dollar pair allegedly completed the construction of the upward trend section. Thus, I would recommend resuming sales of the instrument with targets located near the levels of 1.1034 and 1.0982, which corresponds to 76.4% and 100.0% Fibonacci, on the new MACD signal “down”, which indicates the readiness of the markets to build a new downward wave of y.

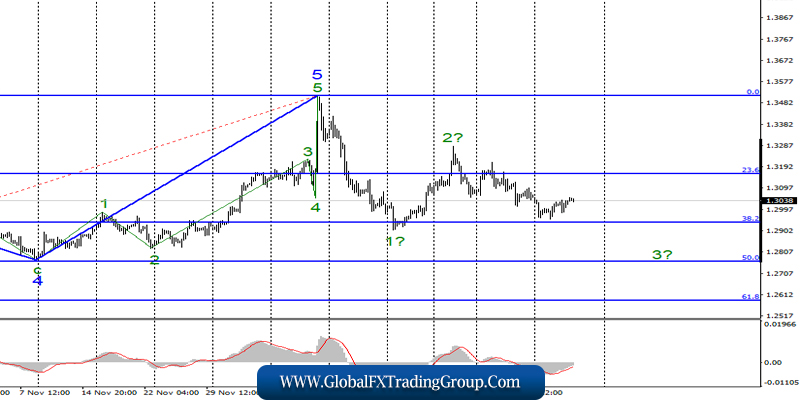

GBP / USD

On January 15, the GBP / USD pair increased by 20 basis points and also continues to move away from previously reached lows near the level of 38.2% Fibonacci. Wave 3 also does not appear to be completed, so I expect its construction to resume with targets below the 38.2% Fibonacci level. In addition, the wave structure of the trend section, originating on December 13, can take a 3, rather than a 5-wave form. But even in this case, the quotes of the instrument should still go below the 29th figure.

Fundamental component:

The news background for the GBP / USD instrument was negative again on Wednesday. The consumer price index in the UK continues to decline and stopped at around 1.3% y / y in December, although markets expected to see at least 1.5% y / y. However, the harsh reality now is that the pound is very difficult to count on supporting the news background. On a monthly basis, inflation was 0.0%.

The retail price index was also below forecasts – 2.2% y / y and 0.3% m / m. However, the British pound did not respond to these reports and continued a smooth increase. Given the discrepancy between the news background and the direction of movement of the pound / dollar instrument, I believe that wave 3 or c will still resume its construction and this should happen in the near future.

General conclusions and recommendations:

The pound / dollar instrument continues to build a new downward trend. I recommend selling the instrument with targets located near 1.2764 again, which corresponds to the Fibonacci level of 50.0%, with the new MACD signal “down”, as wave 3 does not yet look fully occupied.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom