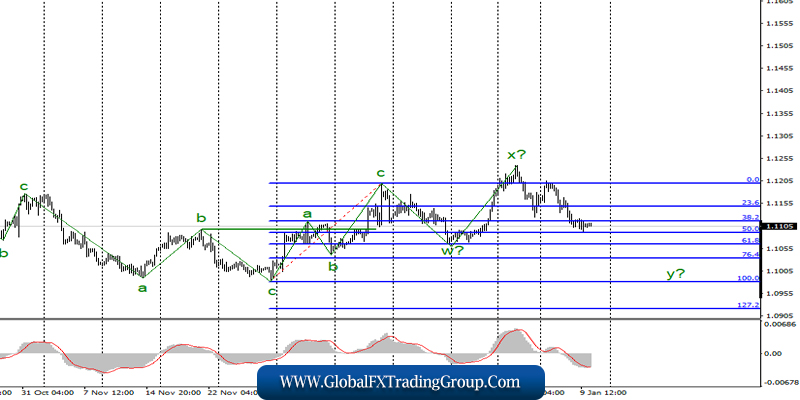

EUR / USD

On January 9, the EUR / USD pair did not lose or gain a single basis point. Thus, the instrument continues to remain within the framework of constructing the alleged downward wave y. If this assumption is true, then the decline in quotes will continue with targets located around the 10th figure.

On the contrary, an unsuccessful attempt to break through the 50.0% Fibonacci mark led to quotes moving away from the lows reached. However, I do not believe that the downward wave has completed its construction.

Fundamental component:

The news background for the euro-dollar instrument was rather weak on Thursday. Mostly, only one economic report really deserved attention. The change in industrial production in Germany in November was interesting not only in itself, but also in terms of determining the indicator of production in the European Union.

Moreover, production in Germany exceeded expectations which is unexpected for the currency exchange market, but still turned out to be negative. Compared to November 2018, the decrease was 2.6%. Thus, the fact of exceeding the forecast was not noted by the markets, and the euro remained in a downward direction.

Today, there will be much more important news, and all of them will be released in America. In the first place in importance, of course, is the Nonfarm Payrolls, which will show how many jobs were created in the non-agricultural sector in December. From which, market expectations range from 150K to 165K.

Thus, the dynamics of the instrument on Friday depends on whether the forecast is exceeded. The salary report for December will also be interesting, but markets will pay more attention to the report on Nonfarms. In case of strong data from America, the US dollar will receive support for the currency exchange market this afternoon and will be able to continue to build a downward wave y.

General conclusions and recommendations:

The euro-dollar pair allegedly completed the construction of the upward trend section. Thus, I would recommend continuing to sell the instrument with targets located around the levels of 1.1034 and 1.0982, which corresponds to 76.4% and 100.0% Fibonacci, since there is now a high probability of building a bearish wave. And perhaps, new sales of the instrument are best done after the new MACD signal “down”.

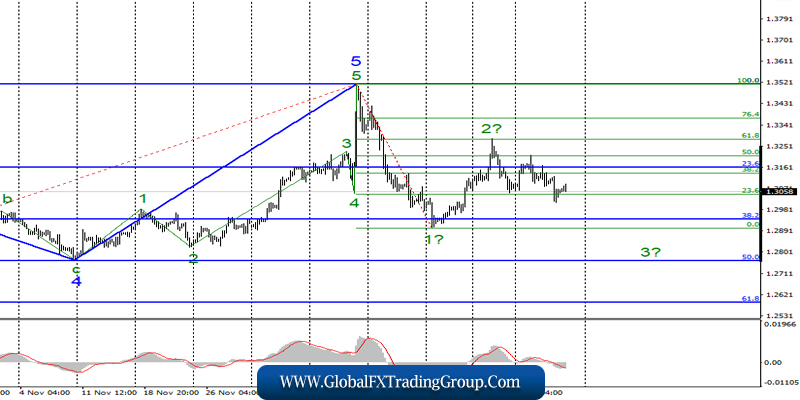

GBP / USD

On January 9, GBP / USD pair lost another 30 basis points. However, the construction of the bearish wave 3 continues, and even if the entire trend section beginning on December 13, acquires a 3-waveform, the instrument should still decline below the expected first wave of this trend section.

That is, below the level of 1.2890, which corresponds to 0.0% on the green grid of Fibonacci levels. Thus, I expect the resumption of the decline in quotes of the pound / dollar instrument.

Fundamental component:

There was no news background for the GBP / USD instrument on Thursday, but it was absent only at first glance. On the other hand, speech by Mark Carney, Chairman of the Bank of England, stirred up the markets and in the morning, the pound lost about 90 basis points. By the end of the day, it won back most of the losses, but still.

Mark Carney said that the Bank of England could lower the key rate, and this greatly upset buyers of the British pound. The markets have been waiting for such a statement from Carney for a long time. In turn, economic reports coming from the UK are upsetting and disappointing one by one.

The Central Bank would have to intervene sooner or later and it seems that it is approaching this time. Mark Carney also said that other monetary policy instruments could be applied to stabilize the economic situation.

General conclusions and recommendations:

The pound / dollar instrument continues to build a new downward trend. Thus, I recommend continuing to sell the instrument with targets near 1.2764, which corresponds to the Fibonacci level of 50.0%. Meanwhile, a new MACD signal “down” may indicate the next wave of sales of the instrument. Thus, I recommend placing Stop Loss orders above 1.3206.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom