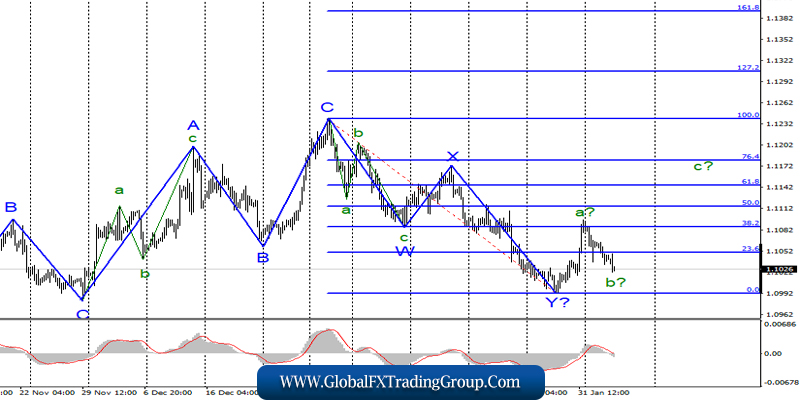

EUR/USD

On February 4, the EUR/USD pair fell by 15 basis points and thus continues to build the expected wave b as part of a new upward trend, most likely also a three-wave section of the trend. If this assumption is correct, then today or tomorrow, I expect the instrument’s quotes to resume rising within wave C. A successful attempt to break through the minimum of wave Y will show the market’s readiness to sell euro currencies further, and will also complicate the downward section of the trend that begins on December 31.

Fundamental component:

There was virtually no news background on Tuesday. At least for the euro/dollar instrument. There were only two or three completely uninteresting economic reports in the United States and the European Union, such as the producer price index or production orders. However, it is easy to guess that they did not cause changes in demand for a particular currency. The euro continues to lose positions, which still fits into the current wave markup. Today will be a more eventful day.

Several economic reports in the eurozone have already been released, which allow us to draw certain conclusions. First, the indices of business activity in the services sector in Germany, France, Spain, Italy, and the entire EU became known. In Germany, the index remained unchanged at 54.2, in France – it fell to 51.1, in Italy – it rose to 51.4, in Spain – it fell to 52.3, and in the European Union as a whole – it rose to 52.5. Given all the data, we can call them neutral, since some indices have increased, and some have declined.

Then came the report on retail sales in the European Union for December, which showed a slowdown to 1.3% y/y and a drop of 1.6% m/m. Market expectations were much higher, and it was because of this report that demand for the European currency fell even more in the first half of the day. If the nature of the reports coming out in Europe does not change, then instead of an upward trend, we may see a complication of the downward trend.

As of today, the news calendar also contains a report on the change in the number of ADP employees in the US, and the business activity indices in the US service sector ISM and Markit. All three indicators have very high forecasts, that is, the market does not expect any deterioration in these indicators. However, it is their deterioration that can lead to the construction of an upward wave with the instrument.

General conclusions and recommendations:

The euro-dollar pair has presumably started building an upward set of waves. Thus, before a successful attempt to break the minimum of the wave y, I recommend buying euros using the MACD “up” signals with targets located near the calculated marks of 1.1115 and 1.1144, which is equal to 50.0% and 61.8% for Fibonacci.

GBP/USD

On February 4, the GBP/USD pair gained about 30 basis points and made an unsuccessful attempt to break the 38.2% Fibonacci level, which led to the quotes moving away from the reached lows. However, the current wave markup has not changed due to the increase in the pound-dollar instrument. Wave 2 or b, although it looks very complicated, is considered completed at this time, so the tool remains within the framework of building wave 3 or C, which can also turn out to be very long.

Fundamental component:

The news background for the GBP/USD instrument on Tuesday was the same as for the EUR/USD instrument. All the last movements of the instrument were related to global events. First with the monetary policy of the Bank of England, then with Boris Johnson’s speeches on the negotiation process with the European Union.

Now there are no such messages or news, and the tool has calmed down a bit. The index of business activity in the UK services sector, released today, was higher than market expectations and caused additional demand for the pound. However, American reports will be more important today, and they may lead to a drop in demand for the British or to its strengthening.

Anyway, the wave markup implies the construction of a downward wave, so the news background should be in favor of the dollar, that is, I expect reports from America to exceed forecasts.

General conclusions and recommendations:

The pound-dollar instrument has presumably moved to build a downward wave 3 or C. Thus, I now recommend selling the pound with targets located around the mark of 1.2764, which is equal to 50.0% for Fibonacci, and below. At the moment, I recommend selling the instrument after a successful attempt to break the mark of 1.2939, which corresponds to 38.2% for Fibonacci, or the MACD signal “down”.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom