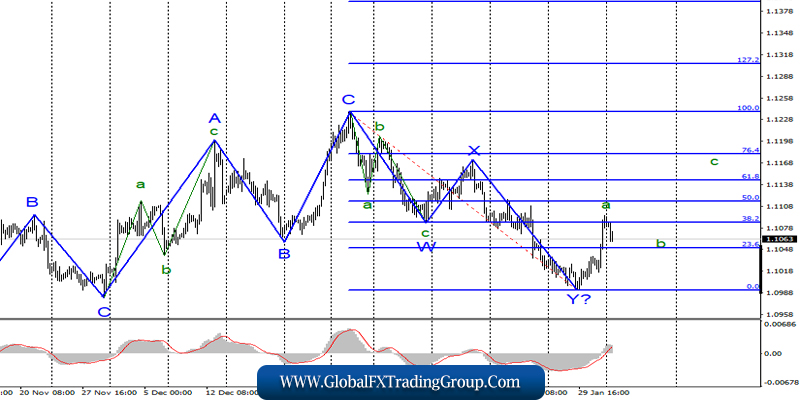

EUR/USD

On January 31, the EUR/USD pair added about 60 base points and continued, therefore, the quotes moved away from previously reached lows as part of building a new upward wave structure. The supposed wave Y is completed, as well as the entire bearish section of the trend, originating on December 31.

Thus, now the instrument can proceed to the construction of an upward trend section, which is likely to also take a 3-wave form and a zigzag shape. If this assumption is true, then the instrument may return to area 12 of the figure in the coming weeks.

Fundamental component:

The news background on Friday was again very strong for the euro-dollar instrument. The foreign exchange market worked out a large number of various economic reports, despite being illogical. Almost all European reports showed negative dynamics, some were very disappointing. Nevertheless, the euro was in demand last Friday. At first, the report on retail sales in Germany, which showed a decrease of 3.3% y/y, was disappointing.

A little later, the consumer price index in the eurozone was 1.4% y/y, as expected by the markets. Positive dynamics were not observed here. The most important indicator of GDP fell to +0.1% q/q and to 1.0% y/y, although the markets were already expecting a slowdown, but not as strong. Thus, the euro’s growth on Friday raised some questions. Economic data from the US was more neutral.

Personal income of Americans grew by 0.2%, and expenses – by 0.3%. Forecasts howled a little higher. Chicago’s PMI index unexpectedly crashed down to just 42.9 in January, but this figure reflects business activity in only three states — Illinois, Indiana, and Michigan. On the contrary, US consumer confidence index grew and reached 99.8.

Thus, the US continues to experience problems with business activity in the manufacturing sector, but there are much more problems in the eurozone, judging by economic statistics. Today, it seems, the time has come to repay debts and the euro has sharply dropped.

General conclusions and recommendations:

The euro-dollar pair has allegedly completed the construction of a downward set of waves. Thus, before a successful attempt to break through the low of wave Y, I recommend buying the euro using MACD signals “up” with targets located near the calculated marks of 1.1115 and 1.1144, which equates to 50.0% and 61.8% Fibonacci from the previous downward trend section.

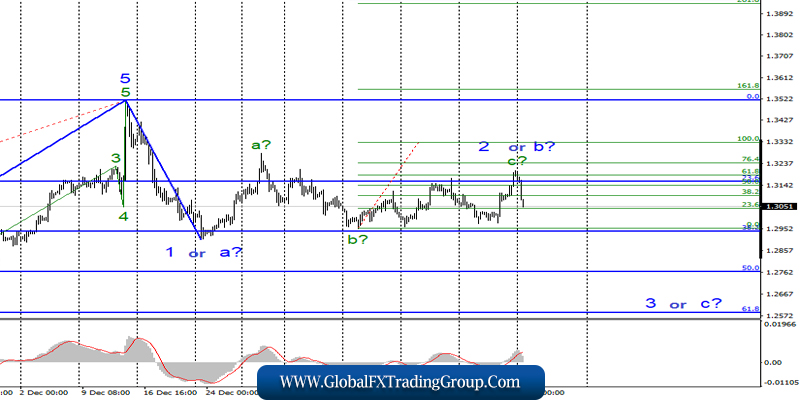

GBP/USD

The GBP/USD pair gained about 115 base points on January 31. Thus, the alleged wave 2 or b acquired a complex three-wave internal structure. If this is true, then a sharp decline in the instrument’s quotes today could mean the completion of the construction of the internal wave from 2 or b. If this assumption is true, then the tool is now moving on to building a descending wave of 3 or with targets located much lower than 1.2950.

Fundamental component:

The news background for the GBP/USD instrument on Friday was minimal. Markets were completely focused on Britain’s exit from the EU and in anticipation of this event, they bought the pound. However, not only did the pound sharply fall today, but it collapsed. Moreover, the decline in quotes began at night, so the reasons are not in the economic reports on Monday.

Economic reports from Europe and the UK just pleased. Business activity in the manufacturing sector of Britain grew to 50.0, in the EU – 47.9, in Germany – to 45.3. As you can see, relatively good data did not save the euro, and good data on Britain had absolutely no effect on the pound.

Data on business activity in the US manufacturing sector will be released today. Perhaps if the numbers are not very good, then the decline in both the euro and pound could stop, but I believe that the decline will continue, given its grounds, which are not the Monday news background.

General conclusions and recommendations:

The pound/dollar instrument supposedly moved to the construction of a downward wave of 3 or s. Thus, now I recommend selling the pound with targets located around 1.2764, which equates to 50.0% Fibonacci, and lower. The internal wave structure of wave 2 or b appears to be fully stocked.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom