EUR / USD

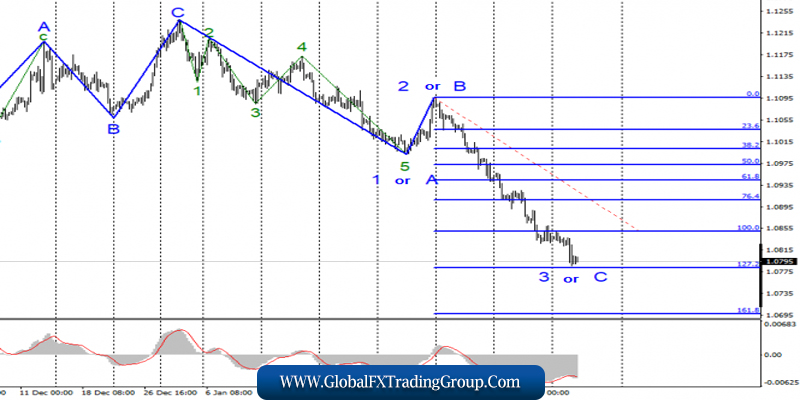

On February 18, the EUR / USD pair lost about 45 basis points and continues to build the proposed wave 3 or C, and inside of which, no correctional wave is visible. Quotes of the pair declined the day before to the level of 127.2% Fibonacci.

Thus, an unsuccessful attempt to break this level will indicate the readiness of the euro-dollar instrument to move away from the lows reached. On the other hand, a successful attempt to breakdown will indicate a willingness to further reduce quotes. At present, markets continue to get rid of the euro, but there are no signs of completion of this process yet.

Fundamental component:

There was no news background for the EUR / USD instrument on February 18 in the Eurozone and America. There were literally one or two weak economic reports that had absolutely no effect on the mood of the currency exchange market. Although, given that the reports were European turned out to be worse than the market expectations again, it can be assumed that they also “helped” the instrument continue to decline.

However, it is obvious to most that the euro would continue to decline without these reports, as it has been doing over the past two weeks. On Wednesday, there will be few news from the eurozone and America during the day. In America, there will be reports on producer prices. The number of started construction of houses received permission for new construction. In general, those reports that markets are likely to ignore.

In addition, statements by Fed representatives Neel Kashkari and Robert Kaplan are scheduled for today, and the minutes of the last meeting of the US Fed will be released late at night. Of course, the Fed’s minutes will be of the highest importance today, but since it will be released only in the evening, it will not affect the instrument during the day. Nevertheless, the minutes may cause additional demand for the dollar, because the US economy is clearly feeling good now, as Fed President Jerome Powell regularly recalls.

Accordingly, the nature of the minutes is likely to be positive. It will show a strong labor market and weakened risks for the economy. Thus, if no “dovish” notes were felt at the previous speeches of Powell, then they would not be in the minutes.

General conclusions and recommendations:

The euro-dollar pair continues to build a downward set of waves. Based on the current wave counting, I recommend that you stay in sales with targets located near the target 1.0699, which corresponds to 161.8% Fibonacci if an attempt to break through the level of 127.2% is successful. I don’t recommend thinking about purchases, since the downward trend is too strong.

GBP / USD

On February 18, GBP / USD pair lost only a few basis points and was unable to update previous local highs and remains likely to complete the construction of the proposed wave 2 in 3 or C of the downward trend section.

If the current wave marking is correct, then the decline in quotes will continue from current positions with targets located near the Fibonacci level of 50.0% and below. However, one cannot exclude the option with the complication of wave 2.

Fundamental component:

A news background for the GBP / USD instrument was present on Tuesday, but did not help the markets decide on the dynamics. During the day, quotes of the instrument first made a jump up, and then a jump down, ending the day with minimal price changes.

Most of all, the markets were disappointed by the salary report, which lost a few tenths of a point in growth rates. Today, important information is expected from the UK again, this time about inflation. In January, the consumer price index may rise to 1.6% y / y, which will be a very positive moment for the Briton.

However, if inflation really accelerates unexpectedly, it will also be an occasion for the purchase of the pound sterling. Thus, wave 2 may get complicated today with a strong inflation value. However, I believe that the forecast is too high and the real value will be lower than market expectations. This is a factor in favor of a new decline in the British currency.

General conclusions and recommendations:

The pound-dollar instrument construction continues downward wave 3 or C. Thus, I recommend selling the instrument with targets located around 1.2767, which corresponds to 50.0% Fibonacci. In case of complication of wave 2, new sales can be carried out around the level of 23.6% Fibonacci.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom