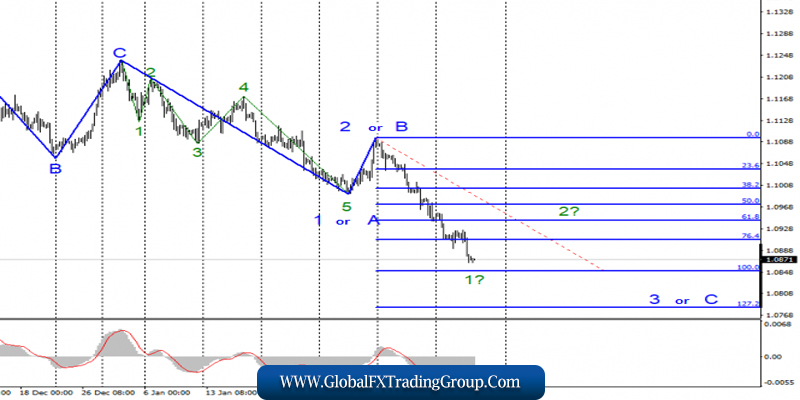

EUR / USD

On February 2, EUR / USD pair lost about 40 basis points and continued; thus, building supposed wave 1 in the next 3 or C. If the current wave marking is correct, then the whole wave 3 or C will turn out to be very extended if it takes the form of a 5-wave structure.

An unsuccessful attempt to break the level of 100.0% Fibonacci will indicate unavailability for further sales markets European currency and lead to a departure from the quotes reached minimum, as well as the construction of the intended wavelength 2 in the 3 or C.

Fundamental component:

Yesterday’s news background did not suggest another decline in the quotes of the Euro / Dollar instrument. Despite the fact that the next economic report from the European Union (industrial production) turned out to be much weaker again than market expectations, it is high time for the instrument to move on to building an upward wave 2.

However, the market does not want to increase demand for the European currency, and the decline continues. Today, the Euro will have another chance to stop the uncontrolled decline and begin to move away from the lows reached since at least two important economic reports will be available today to the markets.

First, a not-so-important inflation report in Germany will be released, and after lunch, an important inflation report in the USA. The second report is all the hope of the euro. In recent months, the consumer price index accelerated to 2.3% y / y, although a few months ago it was 1.7% y / y. Often, forecasts and market expectations are based on the general trend of the indicator. That is, if there has been an improvement in recent months, then, most likely, the picture will remain the same in this.

I believe that today’s inflation report may turn out to be slightly worse than market expectations, and amid disappointment, demand for the US dollar will decline. However, if the forecast is exceeded again, the decline in the instrument is likely to continue. The inflation report in Germany may slightly support the euro, but for this it is necessary that the forecast of + 1.7% y / y be exceeded.

General conclusions and recommendations:

The euro-dollar pair continues to build a downward set of waves. Thus, I recommend waiting for the construction of the correctional wave as part of 3 or C (as wave 1 is nearing completion), and then selling the instrument with targets located around 1.0908 and 1.0850, which equates to 76.4% and 100.0% Fibonacci.

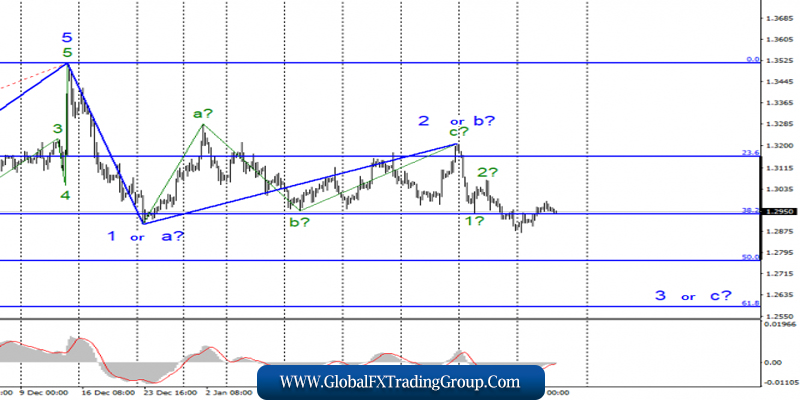

GBP / USD

On February 12, GBP / USD pair added a few basis points and is now preparing for the resumption of lowering the goals, situated near the level of 50.0% Fibonacci as a continuation of the construction of a prospective wave 3 or C. However, the wave structure of wave 3 or C can be either very complex and extended, or very shortened. In the second option, we already have four waves built in 3 or C, so the downward impulse can be temporary. But anyway, I expect the continuation of the decline in quotes of the instrument.

Fundamental component:

There was no news background for the GBP / USD instrument on Wednesday. Nevertheless, there were interesting events, and one of them was a speech by Fed President Jerome Powell in Congress. If Powell was optimistic in his speech on Tuesday, talking about the excellent state of the US economy, a strong labor market and low unemployment, the topics of the pneumonia virus in China were also raised yesterday.

Moreover, Jerome Powell said the Fed will closely monitor any changes in economic data to assess the impact of the Chinese coronavirus on them. The Fed president also believes that these changes will be visible in the near future. In this regard, China’s economy is slowing due to the effects of the virus, quarantines, and reduced business activity.

And since it is very closely connected with the American one, a slowdown can be observed in the USA as well. At the same time, Powell said that the Fed does not intend to lower the key rate in the near future. “Low rates are no longer our choice,” said the head of the Fed.

General conclusions and recommendations:

The pound / dollar instrument continues to build a downward wave of 3 or C. Thus, I recommend resuming sales of the instrument by the MACD signal “down” with targets located near the level of 1.2767, which corresponds to 50.0% Fibonacci.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom