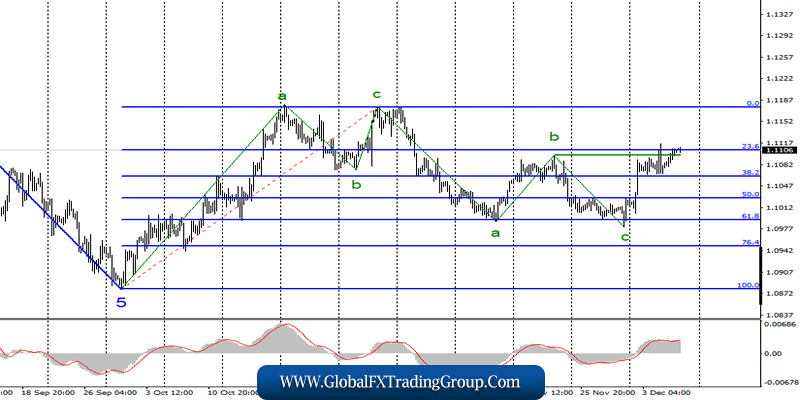

EUR / USD

On December 5, the EUR / USD pair completed with an increase of 25 basis points and exceeded the maximum of wave b for the second time. Thus, another unsuccessful attempt to break through the 23.6% Fibonacci level may lead to a departure of quotes from the reached highs again.

Until a breakthrough of the level of 1.1106 occurs, the option to build an upward wave and an upward trend section is not working, although the current wave marking suggests just such a development of events.

Fundamental component:

On Thursday, the news background for the euro-dollar instrument was quite interesting and strong. As I said yesterday, the euro needed strong figures for economic reports on GDP and retail sales in the eurozone. However, in reality, strong values were not needed.

Retail sales in October showed an increase of 1.4%, which means a strong slowdown in growth rates from 3.1% y / y, and GDP amounted to 1.2% y / y, which coincided with the expectations of the currency market. Thus, none of the released indicators exceeded the forecast At the same time, euro currency increased during the day, however, this movement can hardly be called strong.

Today, the chances of a really strong movement will be much greater, since several important economic reports will be released in America at once. Also today, markets are waiting for strong statistics from the United States. Recent business activity reports have been a little disappointing, and the US dollar has recently begun to lose ground.

Now, reports on the number of new jobs outside the agricultural sector and wages should be stronger than market expectations (+ 180K and + 3.0% y / y) to regain market confidence. However, exceeding the forecast of + 180K will be extremely difficult. In turn, nonfarm value for the last year exceeded 180K for only three times.

But if it happens for the fourth time today, the US dollar will certainly receive market support. However, this is bad for the current wave marking, which involves the construction of an upward trend section. Thus, for this scenario, it is necessary that statistics from America be weaker than market expectations.

General conclusions and recommendations:

The euro-dollar pair allegedly completed the downward trend. Thus, I recommend buying an instrument with targets near the calculated level of 1.1176, which equates to 0.0% Fibonacci. However, I also recommend waiting for a successful attempt to break through the peak of wave b before this and the level of 23.6% Fibonacci.

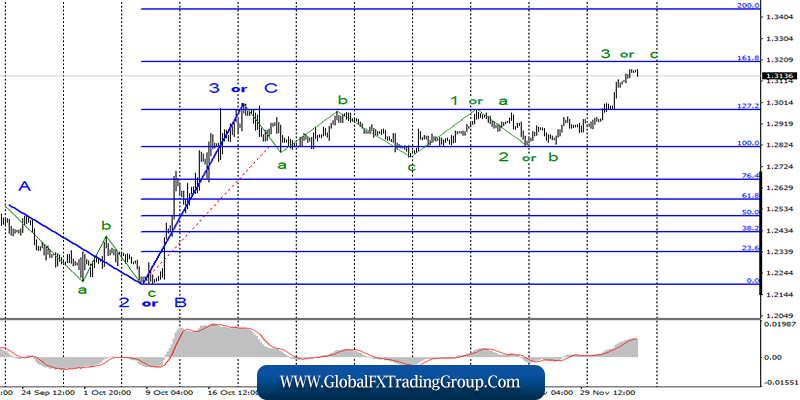

GBP / USD

On December 5, the GBP / USD pair gained about 55 basis points, and presumably remains within the framework of constructing the alleged wave 3 or C, an upward trend section, which may well now take the form of a 5-wave one and can be defined as wave 5 at the highest level. If the current wave counting is correct, then the increase in quotes will continue, and if not today, then on Monday.

However, much will also depend on the news background for December 6. In this regard, strong data from the USA can lead to quotes moving away from the reached highs. If it’s very strong – to the completion of wave 3 or c.

Fundamental component:

On Thursday, there was no news background for the GBP / USD instrument. However, the “Briton” is now not needed in order to be in demand in the currency market. Day by day, I observe an increase in quotes of the instrument, which is not the reactions of the market to strong economic reports from the UK or weak from the USA.

Moreover, markets continue to look favorably towards the pound, which was not a long time ago because of high hopes for the successful implementation of Brexit in late January. Thus, divorce proceedings between the UK and the European Union have already bothered everyone.

The period of uncertainty does not allow us to consider the future of the United Kingdom from any particular angle. Indeed, it is impossible to say for sure even now whether Brexit will take place at all. Laborites will unexpectedly win the election and there will be no Brexit on January 31, in the same way as it was not on October 31, and March 31.

The conservatives will not get enough votes – and the Parliament will not allow the adoption of an agreement between Boris Johnson and the EU again. Thus, now, the pound is growing, but the situation may change dramatically, as well as with the mood of the currency market after December 12.

General conclusions and recommendations:

The pound / dollar instrument continues to build an upward trend. I recommend that you should consider closing purchases on the way to the estimated level of 1.3201, which is equivalent to 161.8% Fibonacci. As today, the market may be on the dollar side, especially in the afternoon, when several important reports are released in the USA.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom