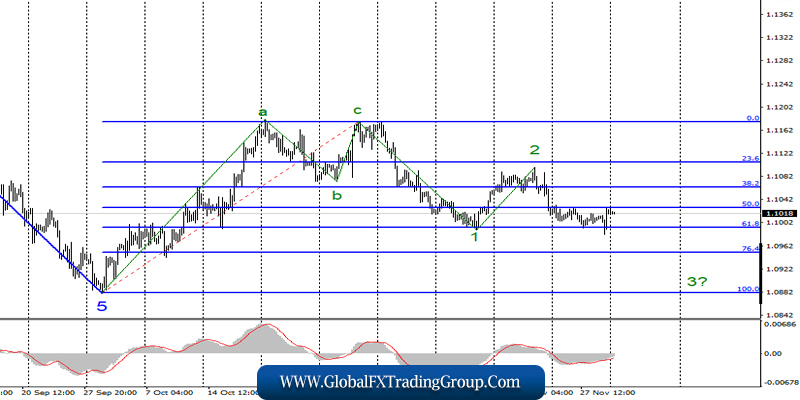

EUR / USD

On November 29, the EUR / USD pair completed with an increase of 10 basis points. Thus, the instrument made an unsuccessful attempt to break through the 61.8% Fibonacci level, but managed to update the minimum of wave 1. However, to continue building the proposed wave 3, the fact of overcoming the level of 61.8% is still necessary.

At the moment, the quotes of the pair have retreated from the lows reached, but above the Fibonacci level of 50.0%, they also failed to close. In general, the activity of the currency market remains not too high, to say the least. As can be clearly seen from the illustration, the euro-dollar pair continues to trade accurately between the levels of 50.0% and 61.8%.

Fundamental component:

The news background for the euro-dollar instrument was present on Friday and the most interesting indicator of the day – inflation in the European Union – unexpectedly pleased buyers of the euro currency. According to preliminary data, inflation in the EU will accelerate in November to 1.0% yoy.

Although this value remains quite weak and far from the target level of the ECB, this acceleration is immediately by 0.3%. Thus, the rise of the European currency was to happen at the end of last week. However, in general, so far, one inflation indicator does not change the overall picture of what is happening.

Most of the other indicators remain at extremely low values, and also continue to deteriorate from month to month. Today we can see this, since the index of business activity in November will be released in the European Union and only the French indicator can remain above 50.0. All other countries will remain below this level, which may cause a new decline in the euro.

It will also be interesting to know what dynamics business activity will show in different countries of the European Union. Nevertheless, an increase in indicators may be the first step towards overcoming a recession in industrial production sectors.

Even if there are no positive dynamics, Friday’s inflation may remain the only bright spot among all economic reports from the EU.

General conclusions and recommendations:

The euro-dollar pair presumably continues to build wave 3. Thus, I now recommend selling the instrument with targets near the calculated levels of 1.0951 and 1.0880 again, which equates to 76.4% and 100.0% Fibonacci, but only after a successful attempt to break through the 61.8% Fibonacci level.

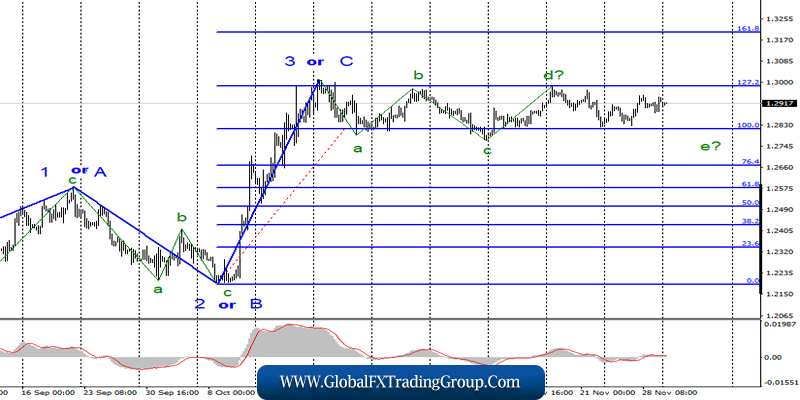

GBP / USD

On November 29, the GBP / USD pair gained about 20 basis points, and presumably continues to remain within the framework of constructing the proposed wave e, which takes on a noticeably more complex form than originally assumed.

There is also an option in which a new three-wave correction structure is being built starting from November 8 and if this option is correct, then it can end near the Fibonacci level of 127.2% one way or another, however, the pound-dollar instrument remains in the range between 100.0% and 127.2% and cannot leave it.

Fundamental component:

On Friday, the news background for the GBP / USD instrument was quite weak. The markets continue to closely monitor all the information related to the course of the election campaigns, because there is not much time left before the elections. However, there is practically no new information.

But the US-Chinese talks have been postponed once again, and this time, it is quite expected due to Trump’s signing of law on the Protection of Human Rights and Democracy in Hong Kong. Therefore, the Chinese side initially expressed strong protest and hinted that retaliatory measures would follow.

Now, some sources close to both the American side and the Chinese indicate that the “first phase” of the transaction, if it is concluded, not earlier than the end of 2019 and not in the near future. China also continues to insist on the complete abolition of duties on Chinese imports to the United States, but President Donald Trump, seems not ready to cancel all duties in one fell swoop.

Moreover, if the parties do not sign the agreement before December 15, then Trump will face the issue of introducing new duties, which he previously transferred to December 15. That is, theoretically on December 15, the conflict between America and China could erupt with even greater force, and instead of signing the “first phase” we can see new duties on both sides.

General conclusions and recommendations:

The pound-dollar instrument continues to build the correctional part of the trend. Thus, now, I still expect the pair to decline to 1.2770 after the MACD signal “down”. It is recommended to buy a pair not earlier than a successful attempt to break through the 127.2% Fibonacci level, which will indicate the willingness of markets to build a new impulsive ascending wave.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom