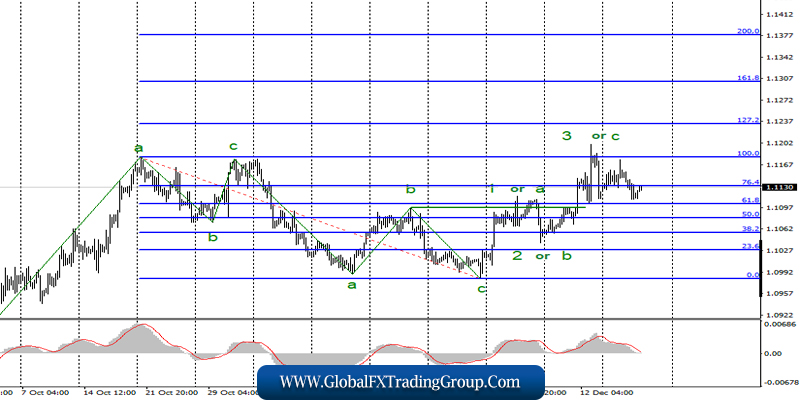

EUR / USD

On December 17, the EUR/USD pair completed lowering by 40 basis points, which is fully consistent with the current wave marking at the moment, and just involves the construction of a new bearish set of waves. Thus, I still believe that the pair is completely ready for a new decline, however, the level of 61.8% Fibonacci raises some doubts.

The euro-dollar instrument has already twice completed an unsuccessful breakout attempt, which suggests that the market is also ready for new purchases, which may complicate the trend section, which begins on November 29, and turn it into a 5-wave one.

Fundamental component:

On Wednesday, the news background for the euro-dollar instrument was not too strong. The news calendar put inflation report in the EU in the first place. However, the markets were somewhat disappointed with this report, as their expectations fully coincided with reality.

At the same time, it is rather difficult to interpret the inflation indicator as “positive” or “negative”. Inflation in November remained at 1.0% y / y. It seems that there is no decline – good. However, 1% is an extremely low value that makes the European Central Bank continue to puzzle over how to make inflation rise.

Thus, at the same time, this is a weak value. In any case, the markets did not have any moral right to buy the euro on the basis of 1% inflation. Today, the news calendar in the European Union is empty, and several not-so-interesting economic reports will be released in America, which markets are unlikely to turn their attention.

Today, there may be a decline in market activity and even a slight departure of quotes from previously reached lows. Moreover, the focus of attention can be shifted towards the pound-dollar instrument.

General conclusions and recommendations:

The euro-dollar pair presumably completed the construction of the upward trend section. Thus, I recommend buying an instrument with targets near the calculated levels 1.1233 and 1.1303, which equates to 127.2% and 161.8% Fibonacci, only in case of a successful attempt to break through the level of 100.0%.

In addition, I recommend selling the instrument after a successful attempt at a breakthrough of 1.1109, which will confirm the intentions of the markets to continue selling eurocurrencies.

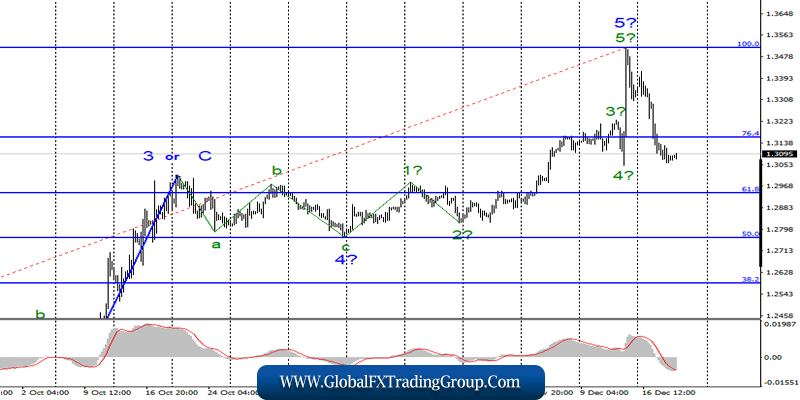

GBP / USD

On December 18, the GBP/USD pair lost another 50 basis points and, thus, continues to build the proposed bearish section of the trend and its wave 1 or a. If this is true, then the decline in quotations will continue with targets located at least around 1.2750.

At the same time, the MACD indicator signal “up” may indicate the readiness of markets to build an upward correctional wave as part of a new trend section. Moreover, the decline of the Pound / Dollar instrument should resume after the completion of the construction of this wave.

Fundamental component:

On Wednesday, the news background for the GBP / USD instrument also came down to the consumer price index, but only in the UK. This report showed the same dynamics as European inflation. To simply put it, no changes in inflation processes were recorded in November.

Inflation remained at 1.5%, which is also insufficient to allow the Bank of England to “breathe freely.” Today, by the way, the last meeting of the Bank of England this year will be held, and many analysts and economists disagree on what the results of this meeting will be.

In this regard, most of the questions come down to whether the number of board members voting for easing monetary policy will change, since there were two at the last meeting.

At the same time, economic reports in the UK have not improved over the past month and a half, but they just continued to deteriorate, that is, there is every reason to expect that someone else will join Michael Saunders and Jonathan Haskel and even plus one vote for lower rates will be a bear factor for the pound.

General conclusions and recommendations:

The pound/dollar instrument supposedly completed the construction of an upward trend. I recommend considering continuing to sell the instrument with targets located near the level of 1.2750, which approximately corresponds to the base of wave 4.

Meanwhile, the departure of quotes from the lows reached as part of the construction of correctional wave 2 can be considered for the possibility of new sales of the instrument.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom