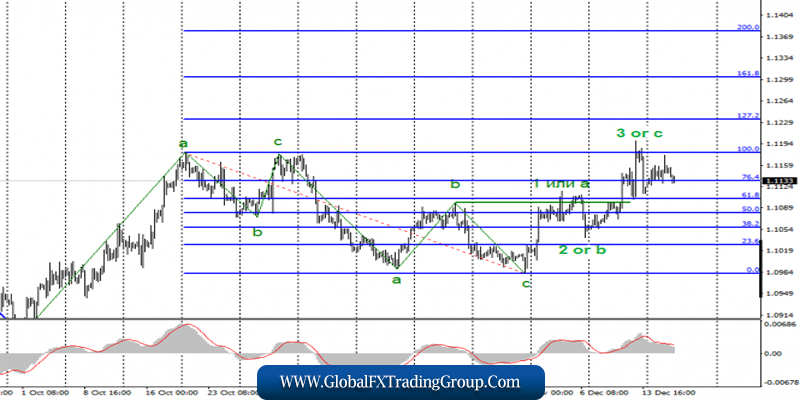

UR/USD

On December 17, the EUR / USD pair ended with an increase of 5 basis points. Such increase in the instrument, however, did not have any effect on the current wave marking, which still involves the completion of the construction of the expected wave 3 or C, and the transition to the construction of a new downward trend.

If this assumption is correct, the current positions will continue to reduce the quotes of the instrument with targets located near the 10th figure. The unsuccessful attempt to break the important and strong 100.0% Fibonacci level indirectly indicates the readiness of the currency market to sell the Euro-Dollar.

Fundamental component:

The news background for the Euro-Dollar instrument on Tuesday, although weak, is at the same time supporting the current wave marking, suggesting the construction of a downward wave. The report on industrial production in America for November showed a gain of as much as 1.1%, contrasting the market’s expectation of seeing only 0.8%.

Meanwhile, last month’s industrial production fell by 0.8%. Thus, although small, the increase in the US currency in the afternoon corresponds to the news background. Today though, there will be much more interesting data.

Inflation in the European Union has long been a concern for both the markets and the European Central Bank. According to the expectations of the Forex market, inflation in November will be 1.0% yoy and -0.3% m/m. These figures are quite low and are unlikely to cause an increase in the Euro currency.

However, I assume that the real values may come out even lower, as the overall state of the economy in the European Union is now extremely unstable and requires constant support and stimulation.

Given that business activity in the manufacturing sector continues to decline, it is quite possible to assume a decrease in inflation, which last month accelerated unexpectedly to 1.0% yoy. Thus, a weak inflation report may support the execution of the working option, which involves the construction of a downward set of waves.

General conclusions and recommendations:

The Euro-Dollar pair presumably completed the construction of an upward trend section. With this, I recommend that in the case of a successful attempt to break the level of 100.0%, buy a tool with estimated targets located near the levels of 1.1233 and 1.1303, which equates to 127.2% and 161.8% Fibonacci. Today though, it is possible to sell the instrument in small lots with a restrictive order above the maximum of the expected wave 3 or C.

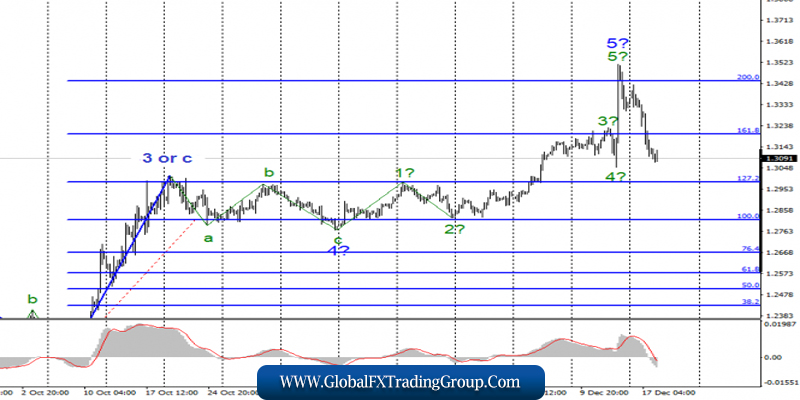

GBP/USD

The GBP / USD pair lost 200 basis points on December 17. With this, the construction of the upward section of the trend, which originates on August 12, may complete with a probability of 99%. If this is indeed the case, the decline in quotes will continue within at least a three-wave corrective section of the trend and, given the strength of the first wave, the targets may be located near the 1.2750 mark or possibly lower. Also, taking into account the news background, the tool can move to the construction of a full downward trend.

Fundamental component:

The news background for the GBP/USD instrument on Tuesday was the same as that of the EUR/USD instrument, with the same report on industrial production in the United States. The decrease in the quotes of the instrument by 200 points at once, however, clearly has other grounds than the increase in production in America.

Although in this matter, everything is obvious, the wave pattern of the instrument implies the completion of the upward trend. Parliamentary re-election in Britain took place and the fate of Brexit has a probability of 99%. Markets have lost a set of factors that allow them to push the instrument up for several months.

Now, the news background is reduced only to economic reports, which in the UK can only cause tears. Today, the UK will receive a report on inflation, with which, according to market expectations, will decline even more compared to the previous month’s contraction and will be 1.4% yoy and 0.2% m/m. If the figures turn out to be exactly the same, the pound can still continue the decline it has already begun. If inflation slows even more, then the fall of the pound may accelerate.

General conclusions and recommendations:

The Pound-Dollar instrument, presumably, has completed the construction of an upward trend. I recommend to continue selling the instrument with the targets located near the 1.2750 mark, which is approximately at the base of wave 4.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

If you have an interest in any area of Forex Trading, this is where you want to be.

Global Fx Trading Group is a world leader in providing Fx services to individual traders, including: Unmatched funding programs, on-line education, virtual trading rooms, automation tools, robot building, and personal coaching.

The company was first established by Jeff Wecker, former member of the Chicago Board of Trade, with 25 years in the industry. Jeff has a keen understanding of the needs of Forex traders and those needs are our focus.

Please join our VIP Group while is still

FREE …

https://t.me/joinchat/JqsXFBKpyj3YS4bLWzT_rg

Our mission is simple: To enhance as many lives as we can through education and empowerment.

#theforexarmy #forexsigns #forexsignals #forexfamily #forexgroup #forexhelp #forexcourse #forextrade #forexdaily #forexmoney #forexentourage #forextrading #forex #forexhelptrading #forexscalping #babypips #forexfactory #forexlife #forextrader #financialfreedom